- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Evaluating Wolfspeed After Shares Surge 18% Amid Chip Sector Momentum

Reviewed by Bailey Pemberton

If you have been watching Wolfspeed stock recently, you have likely noticed some eye-catching movement. After a period of relative calm, shares have surged by 18.4% in the last week alone. For anyone weighing an investment decision, that kind of action can signal renewed optimism in the company or a shift in how the market is assessing risk and reward in this situation.

So what is driving all this buzz? Part of it may be broader developments in the semiconductor industry, where Wolfspeed is a key player in advanced materials for next-generation chips. As the global push for electric vehicles and efficient power systems continues, demand for Wolfspeed’s silicon carbide technology has been a frequent talking point among analysts and industry followers alike. Even if there have not been headline-grabbing news events in the past month, there seems to be a sense of change moving through the sector.

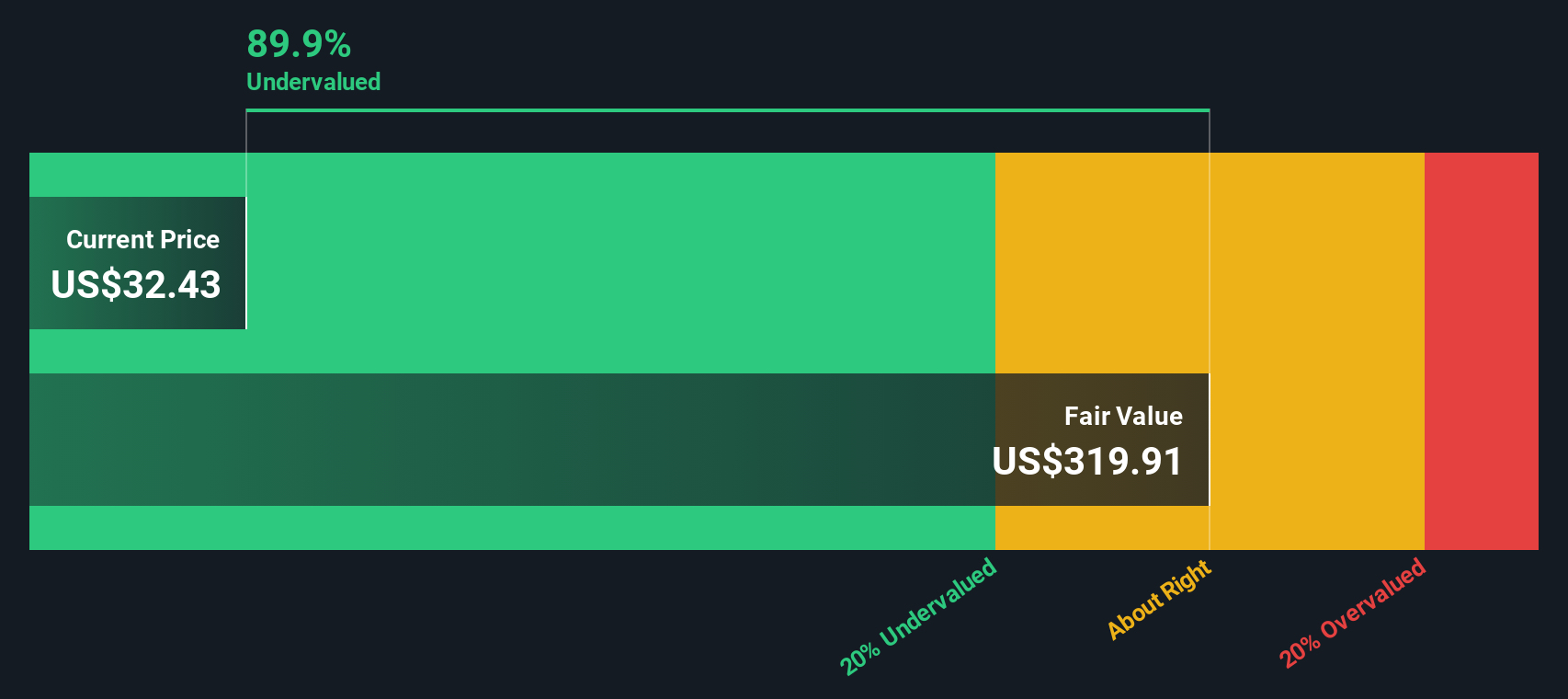

But let’s get to the big question weighing on investors’ minds: is the stock currently undervalued, overvalued, or right where it should be? According to our value score, Wolfspeed gets a 2 out of 6, which means it passes two of the common checks for being undervalued. While that does not indicate a bargain, it also does not rule out the possibility of upside, especially if perception shifts or long-term trends accelerate.

Next, we will take a closer look at the specific valuation approaches behind that score. After breaking down these methods, stay tuned for a more nuanced take on what “fair value” really means for Wolfspeed in the real world.

Wolfspeed scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wolfspeed Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. This approach helps investors assess what those future streams of money are truly worth in the present, providing a reference for decision-making.

For Wolfspeed, the DCF analysis begins with the company’s recent free cash flow, which is negative at -$2.19 billion. However, the forecast points to a significant turnaround. By 2026, analyst projections have free cash flow rising to $224 million. Looking further out, Simply Wall St extrapolates that annual free cash flow could continue to grow robustly, reaching over $1.27 billion by 2035. These projections assume strong demand in the semiconductor sector and improvement in profitability over time.

Using this set of projected cash flows and discounting them back with an appropriate risk factor, the model arrives at an estimated intrinsic value of $7,003.77 per share. Based on this, the intrinsic discount is calculated at 99.6%, indicating the current share price is far below this estimate. This represents an extremely wide gap by any valuation standard.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wolfspeed is undervalued by 99.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Wolfspeed Price vs Book

The price-to-book (P/B) ratio is often a valuable tool for evaluating companies like Wolfspeed, especially when profits fluctuate or earnings are negative, making metrics like price-to-earnings (P/E) less reliable. The P/B ratio looks at the company's market value compared to its net assets, offering a clearer perspective for high-growth industries or emerging technology firms where tangible assets matter.

What counts as a “normal” or “fair” P/B ratio depends on factors such as growth potential, risk profile, and the competitiveness of a company’s industry. Higher growth and lower risk can justify higher multiples, while weaker prospects typically pull them down. For Wolfspeed, the company’s current P/B ratio can be stacked up against industry standards. The broad semiconductor industry average is 3.63x, while the peer average is notably higher at 6.75x.

This brings us to Simply Wall St’s proprietary “Fair Ratio,” which goes beyond a basic industry comparison. The Fair Ratio blends Wolfspeed’s unique characteristics, including its expected growth, risk profile, profit margins, and market capitalization, offering a more custom benchmark. This allows investors to avoid oversimplifying by relying solely on industry or peer numbers, which might miss crucial company-specific dynamics. Comparing Wolfspeed’s actual P/B ratio with its Fair Ratio reveals only a minor difference, indicating that the stock’s pricing is closely aligned with its fundamental prospects and risks.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wolfspeed Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple way to tell your personal story about a company and connect it directly to numbers such as fair value, forecasts for revenue, earnings, and margins. Rather than just looking at static ratios or discounted cash flows, Narratives let you link the company’s potential, risks, and big-picture vision to a financial outcome and your own fair value estimate.

Narratives are available right inside the Simply Wall St Community page, making it easy for millions of investors to craft and share their perspectives with just a few clicks. They help you make confident, well-informed decisions about when to buy or sell by comparing your Fair Value against the latest share price. Narratives update automatically whenever new information or news comes in, so your story stays current with the market.

For example, one investor’s Narrative may see Wolfspeed’s future value as much higher based on aggressive growth assumptions, while another could be far more cautious if they expect headwinds to persist.

Do you think there's more to the story for Wolfspeed? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOLF

Wolfspeed

A semiconductor company, focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia Pacific, the United States, and internationally.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives