- United States

- /

- Semiconductors

- /

- NYSE:ONTO

The 6.2% return this week takes Onto Innovation's (NYSE:ONTO) shareholders three-year gains to 264%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For example, the Onto Innovation Inc. (NYSE:ONTO) share price has soared 264% in the last three years. How nice for those who held the stock! On top of that, the share price is up 14% in about a quarter. But this could be related to the strong market, which is up 7.1% in the last three months.

Since the stock has added US$338m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Onto Innovation

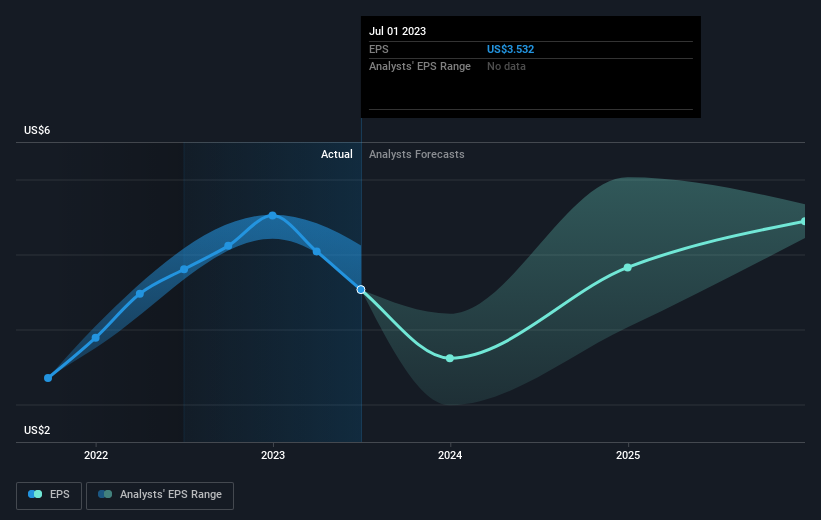

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Onto Innovation moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Onto Innovation has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Onto Innovation shareholders have gained 53% (in total) over the last year. That falls short of the 54% it has made, for shareholders, each year, over three years. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Onto Innovation is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives