- United States

- /

- Semiconductors

- /

- NYSE:ONTO

Onto Innovation (ONTO) Is Up 7.3% After Raising Revenue Guidance on Semilab Integration—What’s Changed

Reviewed by Sasha Jovanovic

- Onto Innovation recently updated its fourth quarter revenue guidance to a range of US$258 million to US$275 million, with an expected US$8 million to US$10 million contribution from the newly acquired product lines of Semilab International through early January 2026.

- This integration of new product offerings into Onto Innovation’s portfolio highlights how recent acquisitions may begin delivering immediate top-line benefits.

- We'll explore how the contribution from Semilab’s product lines could reshape Onto Innovation’s investment narrative and growth prospects.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Onto Innovation Investment Narrative Recap

To be an Onto Innovation shareholder, you need confidence in its ability to capture semiconductor industry trends, especially AI packaging and advanced node spending, by expanding its leading product portfolio. The recent shelf registration filing does not appear to materially influence the crucial short-term catalyst, which remains a successful rebound in customer demand for advanced logic and packaging; the biggest risk continues to be prolonged softness in this demand or a cyclical downturn.

Among recent company announcements, the updated fourth quarter revenue guidance, which integrates $8 million to $10 million contributions from the Semilab acquisition, stands out for its relevance. This guidance suggests the new product lines could help mitigate near-term revenue pressure, linking Onto Innovation’s acquisition strategy directly to its efforts to address demand recovery as the primary catalyst for performance in the near future.

In contrast, investors should also be aware of concentration risks tied to a small number of customers, because...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.4 billion revenue and $311.2 million earnings by 2028. This requires 11.0% yearly revenue growth and a $111.3 million earnings increase from $199.9 million today.

Uncover how Onto Innovation's forecasts yield a $157.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

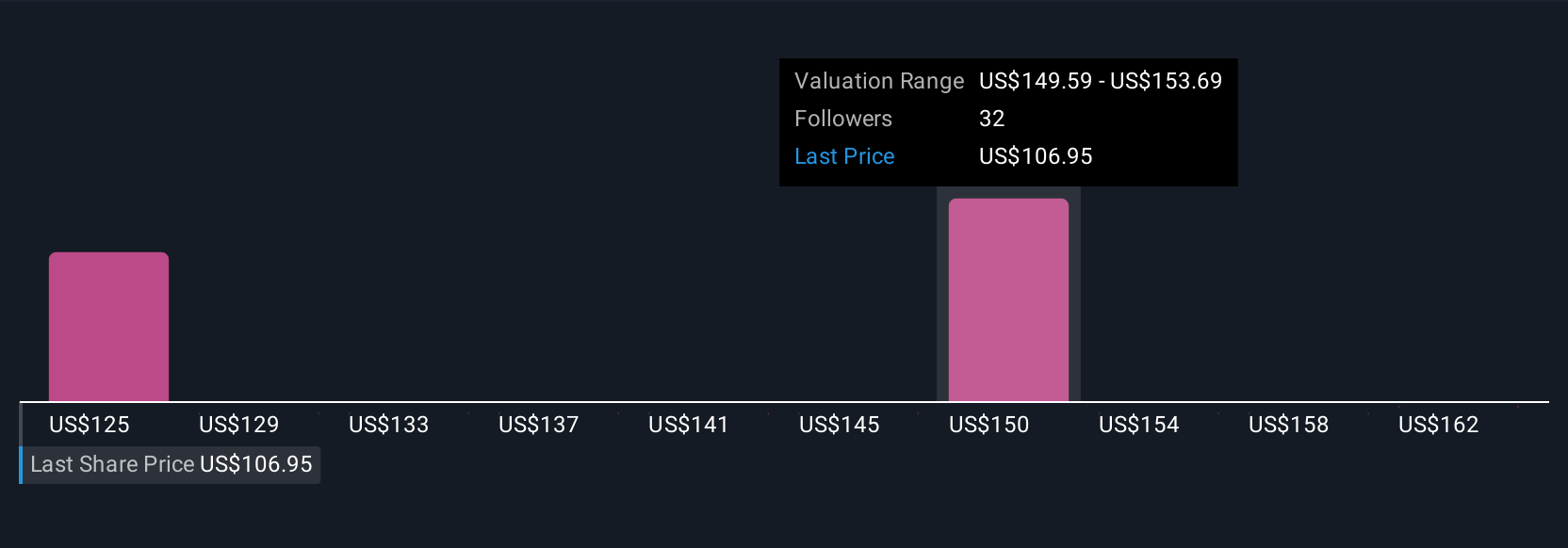

Simply Wall St Community members provided two fair value estimates for Onto Innovation between US$157 and US$168.10. With customer demand for AI packaging and advanced nodes still critical, it’s worth exploring how your view compares to these diverse opinions.

Explore 2 other fair value estimates on Onto Innovation - why the stock might be worth as much as 20% more than the current price!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology and inspection worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success