- United States

- /

- Semiconductors

- /

- NYSE:MX

Spotlight On US Penny Stocks For January 2025

Reviewed by Simply Wall St

As 2024 drew to a close, U.S. markets experienced a mixed finish with major indices like the Dow Jones and S&P 500 posting their largest monthly losses in over two years, despite achieving significant gains throughout the year. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing investment area due to their potential for growth and value. This article will explore three such U.S. penny stocks that exhibit financial strength and resilience, presenting unique opportunities for those seeking under-the-radar investments with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $6.03M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.84B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.43M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $97.13M | ★★★★★☆ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $93.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $43.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $24.65M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Quince Therapeutics (NasdaqGS:QNCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quince Therapeutics, Inc. is a biopharmaceutical company that acquires, develops, and commercializes therapeutics for patients with debilitating and rare diseases, with a market cap of $81.40 million.

Operations: Quince Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $81.4M

Quince Therapeutics, Inc., with a market cap of US$81.40 million, is a pre-revenue biopharmaceutical company focused on developing treatments for rare diseases. Recent financials highlight a net loss of US$5.49 million for the third quarter of 2024 and increased shareholder dilution over the past year. Despite having more cash than debt and short-term assets covering liabilities, long-term liabilities remain uncovered by current assets. The company is engaged in promising clinical trials like the Phase 3 NEAT trial for its EryDex System but remains unprofitable with no immediate path to profitability forecasted within three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Quince Therapeutics.

- Examine Quince Therapeutics' earnings growth report to understand how analysts expect it to perform.

Seer (NasdaqGS:SEER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seer, Inc. is a life sciences company focused on developing and commercializing products to decode the biology of the proteome, with a market cap of approximately $133.85 million.

Operations: The company generates revenue from the Biotechnology (Startups) segment, amounting to $14.61 million.

Market Cap: $133.85M

Seer, Inc., with a market cap of US$133.85 million, is navigating challenges typical for penny stocks in the life sciences sector. The company reported third-quarter revenue of US$4.03 million, down from the previous year, and a net loss of US$21.33 million. Despite being unprofitable with increasing losses over five years, Seer maintains a robust financial position with short-term assets significantly exceeding liabilities and no debt burden. A strategic agreement with Thermo Fisher Scientific aims to enhance its Proteograph Product Suite's market reach and could drive future growth potential in proteomics technology adoption starting early 2025.

- Dive into the specifics of Seer here with our thorough balance sheet health report.

- Gain insights into Seer's outlook and expected performance with our report on the company's earnings estimates.

Magnachip Semiconductor (NYSE:MX)

Simply Wall St Financial Health Rating: ★★★★★★

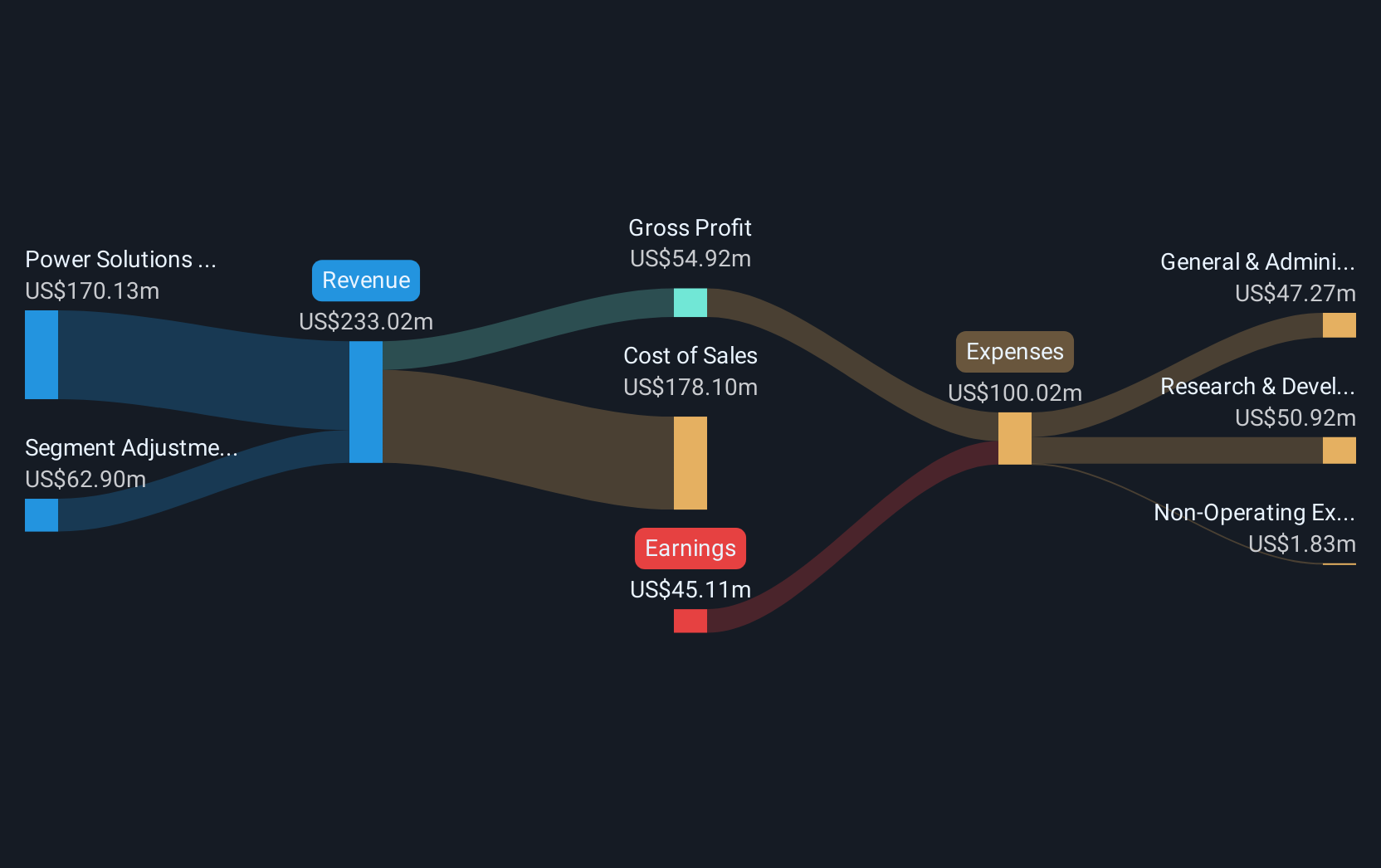

Overview: Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor solutions for various applications including communications, IoT, consumer electronics, computing, industrial, and automotive sectors with a market cap of approximately $149.18 million.

Operations: The company generates revenue from its Transitional Fab 3 Foundry Services segment, amounting to $17.94 million.

Market Cap: $149.18M

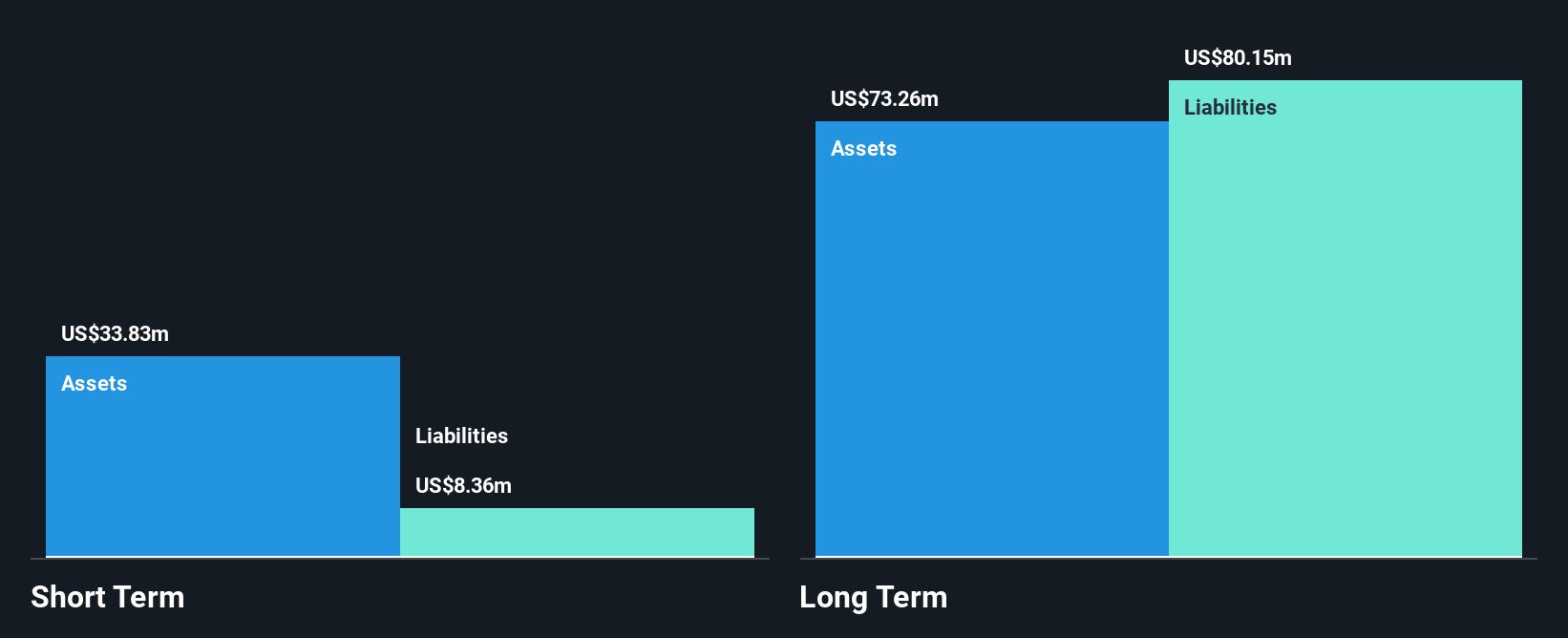

Magnachip Semiconductor, with a market cap of US$149.18 million, faces challenges common to penny stocks, including ongoing unprofitability and increasing losses over the past five years. Despite these hurdles, the company maintains a strong financial position with short-term assets of US$242 million exceeding liabilities and more cash than debt. Recent earnings reports show third-quarter revenue growth to US$66.46 million but also an increased net loss of US$9.62 million year-over-year. The company has actively repurchased shares under its buyback program while forecasting fourth-quarter revenue between US$59-64 million, indicating cautious optimism amidst financial restructuring efforts.

- Take a closer look at Magnachip Semiconductor's potential here in our financial health report.

- Learn about Magnachip Semiconductor's future growth trajectory here.

Make It Happen

- Dive into all 735 of the US Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MX

Magnachip Semiconductor

Designs, manufactures, and supplies analog and mixed-signal semiconductor platform solutions for communications, the Internet of Things, consumer, computing, industrial, and automotive applications.

Flawless balance sheet and fair value.