- United States

- /

- Semiconductors

- /

- NYSE:MX

Magnachip Semiconductor Corporation's (NYSE:MX) Prospects Need A Boost To Lift Shares

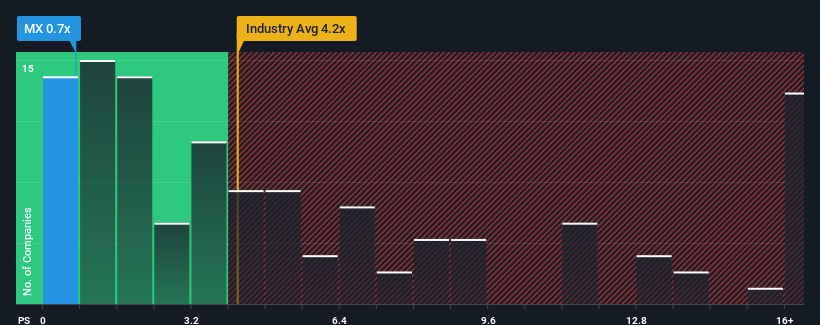

You may think that with a price-to-sales (or "P/S") ratio of 0.7x Magnachip Semiconductor Corporation (NYSE:MX) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in the United States have P/S ratios greater than 4x and even P/S above 9x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Magnachip Semiconductor

What Does Magnachip Semiconductor's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Magnachip Semiconductor's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Magnachip Semiconductor will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Magnachip Semiconductor?

Magnachip Semiconductor's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 40% growth forecast for the broader industry.

With this in consideration, its clear as to why Magnachip Semiconductor's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Magnachip Semiconductor maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Magnachip Semiconductor (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Magnachip Semiconductor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MX

Magnachip Semiconductor

Designs, manufactures, and supplies analog and mixed-signal semiconductor platform solutions for communications, the Internet of Things, consumer, computing, industrial, and automotive applications.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026