- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Unveils Cutting-Edge Power-Management Chips For Data Centers At APEC 2025

Reviewed by Simply Wall St

Texas Instruments (NasdaqGS:TXN) recently launched new power-management chips, broadening its product portfolio to address the growing demands of high-performance computing and AI in data centers. Despite this innovation, the company's share price dipped 1.66% over the past month. This move comes amid a broader selloff in the technology sector, as reflected by major indices such as the Nasdaq Composite, which slid 1.5% amid economic concerns and market volatility. While showcasing its power-management technologies at significant industry events like APEC 2025, the market climate proved challenging, with investor sentiment rattled by geopolitical uncertainties and potential economic headwinds. The company's presence at technological showcases did not immediately sway investor confidence, perhaps overshadowed by larger market trends. As a result, this minor decline aligns with trends affecting other tech giants, despite TI's strategic advances and innovative breakthroughs in power technology.

Over the last five years, Texas Instruments has delivered a total shareholder return of 110.17%. This substantial appreciation reflects a combination of share price growth and dividends, positioning the company favorably relative to many peers. Among the key developments, Texas Instruments enhanced its U.S. semiconductor production capacity with government support worth up to US$1.6 billion, reflecting its investment in future growth. Furthermore, the company significantly expanded its share repurchase program, culminating in the repurchase of 44.58 million shares for US$6.75 billion, thus returning considerable capital to shareholders.

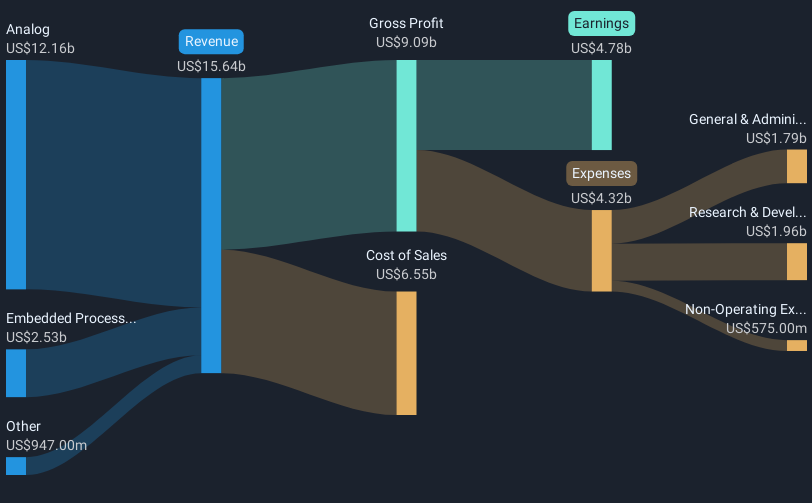

Diversification efforts included announcing new power management chips and opening a new distribution center in Germany to improve logistics across Europe. Although recent quarterly results showed declines in earnings and net income, a steady rise in dividends provided a counterbalance, with a 5% increase announced in late 2024. Despite these mixed results, the company has maintained a high return on equity, underscoring its robust operational efficiency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Texas Instruments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Excellent balance sheet with moderate growth potential.