- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Reports Q1 Earnings Rise With Sales Reaching US$4,069 Million

Reviewed by Simply Wall St

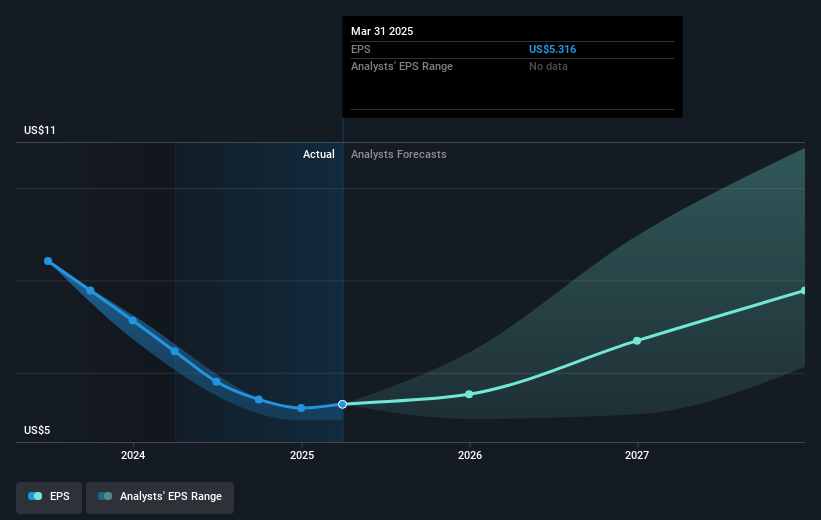

Texas Instruments (NasdaqGS:TXN) recently announced its first-quarter earnings on April 23, 2025, with sales and net income rising to $4,069 million and $1,179 million, respectively. The company saw further positive momentum with its guidance for the second quarter, projecting revenues between $4.17 billion and $4.53 billion. This optimism was echoed in the broader 3.9% market rise over the past week. Texas Instruments declared a $1.36 dividend per share and updated its share buyback progress, adding weight to its 28% price move in the last month.

The recent announcement of Texas Instruments’ Q1 earnings along with an optimistic outlook for Q2 may have a considerable impact on the company's narrative. While sales and net income rose, the projected revenues of $4.17 billion to $4.53 billion indicate potential growth despite geopolitical and tariff challenges. This aligns with the strong revenue growth seen over the past year and could influence future earnings forecasts positively. The 28% monthly price increase might reflect market optimism, although it's essential to consider that current share prices are above consensus price targets, with the fair value discounted by over 5%.

Over the past five years, Texas Instruments delivered a 92.12% total shareholder return, including share price appreciation and dividends, indicating robust long-term performance. When comparing recent performance to the industry, the company underperformed the US Semiconductor industry and the broader US market in the past year. This context provides a broader view of its competitive stance and market perception. The company's initiatives, including its dividend declaration and buyback program, could have contributed to both past performance and current investor sentiment.

Moreover, the price movement should be considered against the analyst consensus, which set a price target of approximately US$177.42. Trading below this target suggests varying market expectations on its future growth compared to the consensus estimates. Texas Instruments faces revenue growth challenges, with tariff impacts and the semiconductor cycle at play, but also holds potential due to rising demand in key sectors like automotive and industrial. The guidance in this period reflects these broader dynamics and could serve as a key indicator of how the company intends to manage upcoming challenges and opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Texas Instruments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives