- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Expands Automotive Safety Portfolio With New Lidar And Radar Chips

Reviewed by Simply Wall St

Texas Instruments (NasdaqGS:TXN) introduced a new suite of automotive components, enhancing vehicle safety and boosting automation capabilities. Despite these promising product launches, TI shares saw a 2% decline last week, contrasting the broader market's upward trend. While the new products could bolster the company's position in the automotive tech sector, external pressures, such as ongoing U.S.-China tariff tensions and mixed performance from tech giants, may have overshadowed these developments. Overall, TI's tech advancements might support future growth, but current events exerted contrary influences on its recent share performance.

We've identified 1 weakness for Texas Instruments that you should be aware of.

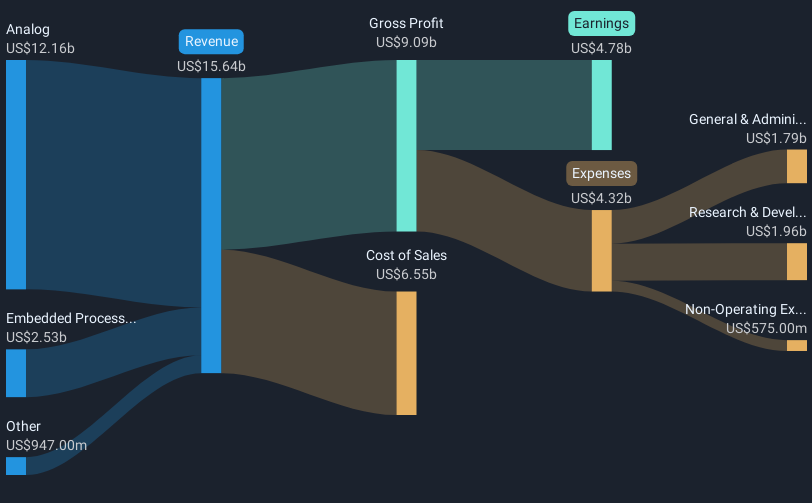

Although Texas Instruments' recent automotive component launch failed to immediately enhance its share price, the new products may significantly influence long-term revenue and earnings projections. With revenue forecasted to grow, albeit under market expectations, the company's focus on automotive and industrial markets could eventually bolster its market standing despite short-term pressures. Texas Instruments' shares have seen a total return of 55.60% over the last five years, reflecting a solid long-term performance, though the shares have underperformed relative to industry standards over the past year.

Despite a recent share price of US$169.50, current valuations reflect a slight discount compared to the bearish price target of US$168.57, which signals limited downside from a pessimistic standpoint. The integration of newly launched products could spur revenue growth, contingent upon successful execution and market adoption. However, increased depreciation and underutilization remain challenges, potentially impacting future earnings capacity. Considering the consensus analyst price target of US$202.29, recent price movements indicate investor caution amidst broader market variances and industry-specific hurdles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives