- United States

- /

- Semiconductors

- /

- NasdaqGS:TSEM

Assessing Tower Semiconductor (NasdaqGS:TSEM) Valuation After Earnings Anticipation AI Chip Optimism And LightIC Partnership

Tower Semiconductor (TSEM) is back in focus after a 4.7% daily gain, as traders weigh the upcoming February 11 earnings release, fresh guidance, and its silicon photonics partnership with LightIC Technologies against broader AI driven chip sector momentum.

See our latest analysis for Tower Semiconductor.

That 3.43% 1 day share price return and 78.06% 90 day share price return at US$133.42 sit alongside a 1 year total shareholder return of 146.37% and 5 year total shareholder return of 368.96%. This suggests momentum has been building as investors react to the upcoming earnings release, guidance and the LightIC silicon photonics partnership, in the context of an AI focused chip sector backdrop.

If Tower’s recent move has you looking at the wider chip story, this could be a good moment to scan other high growth tech and AI stocks that might fit your watchlist.

With Tower trading close to its latest analyst price target after a strong run and with recent revenue and net income growth on the record, you have to ask: is there still a buying opportunity here, or is the market already pricing in the future?

Price to Earnings of 76.8x: Is It Justified?

On a P/E of 76.8x at a last close of US$133.42, Tower Semiconductor screens as expensive compared with both its own estimated fair multiple and its peers.

The P/E ratio compares the current share price with earnings per share, so a higher figure usually reflects strong earnings expectations or a willingness to pay up for growth. For a foundry business like Tower, investors often watch this closely because earnings can be sensitive to utilization, mix and long term capacity commitments.

Here, the market P/E of 76.8x stands well above the US Semiconductor industry average of 42.2x and also above a peer average of 47.9x. It is even higher than the estimated fair P/E of 46.6x, a level the market could move toward if sentiment or growth expectations cool off from current levels.

Explore the SWS fair ratio for Tower Semiconductor

Result: Price to Earnings of 76.8x (OVERVALUED)

However, the current P/E premium could come under pressure if upcoming guidance, AI optimism, or the LightIC partnership fail to match existing expectations.

Find out about the key risks to this Tower Semiconductor narrative.

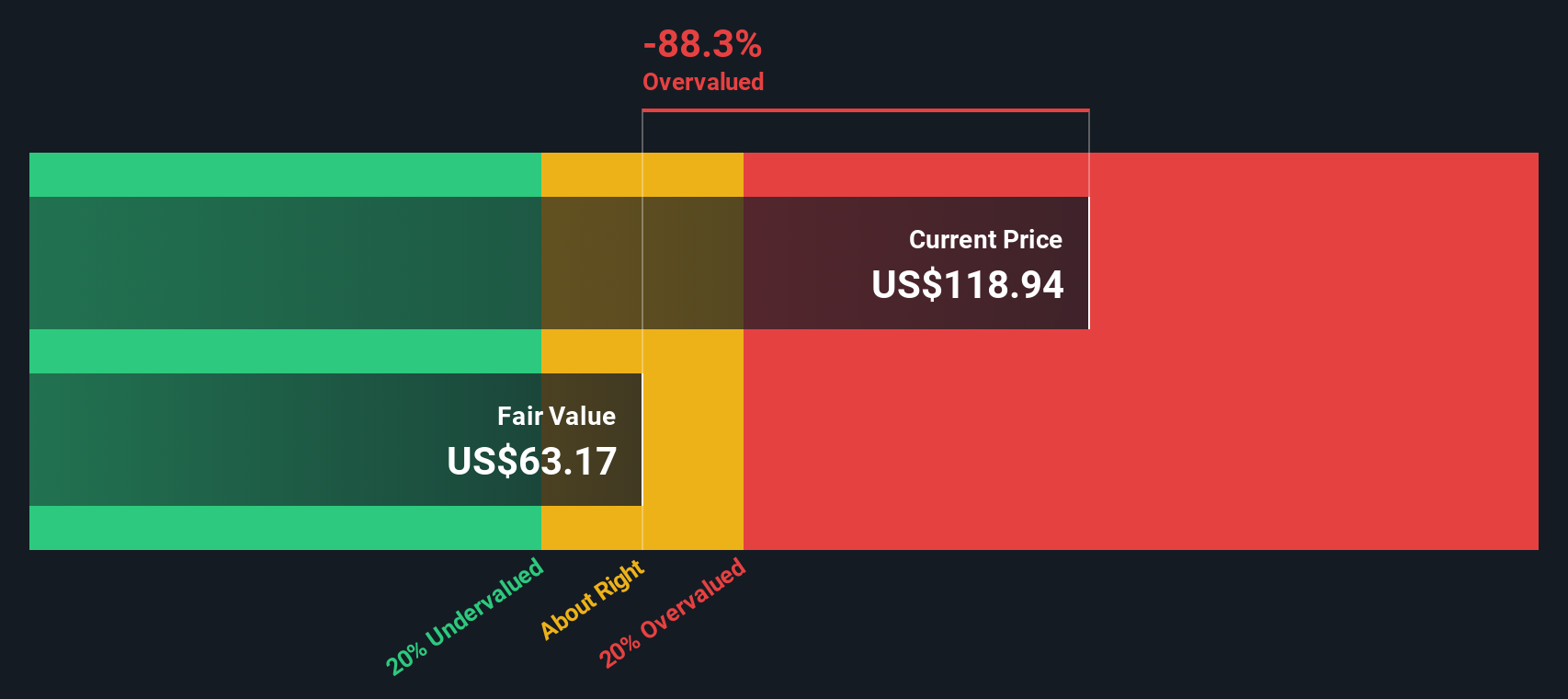

Another View: Our DCF Model Flags Rich Pricing

Our DCF model takes a different path from the earnings multiple and suggests Tower Semiconductor, at US$133.42, is trading above an estimated future cash flow value of US$62.40. That points to an overvalued signal on cash flows. How comfortable are you paying this kind of premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tower Semiconductor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tower Semiconductor Narrative

If you look at these numbers and reach a different conclusion, or simply want to stress test the assumptions yourself, you can build a personalised view in just a few minutes and Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tower Semiconductor.

Looking for more investment ideas?

If Tower has your attention but you do not want to stop at one name, now is the time to widen your net and pressure test your watchlist.

- Spot potential mispricing early by checking out these 880 undervalued stocks based on cash flows that might not yet be front of mind for most investors.

- Back the AI trend with focus by reviewing these 23 AI penny stocks that are tied directly to data, compute, and model development.

- Balance your growth ideas with income by scanning these 13 dividend stocks with yields > 3% that could add steady cash returns to your portfolio mix.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tower Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSEM

Tower Semiconductor

An independent semiconductor foundry, provides technology, development, and process platforms for integrated circuits in the United States, Japan, rest of Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion