- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Teradyne (NasdaqGS:TER) Announces Shannon Poulin as New President of Semiconductor Test Division

Reviewed by Simply Wall St

Teradyne (NasdaqGS:TER) announced the appointment of Shannon Poulin as the new President of the Semiconductor Test Division, signaling a key leadership change that might influence its strategic outlook. Over the last month, Teradyne’s stock saw a minor 0.8% decline. This decrease coincided with a broader sell-off in tech stocks, driven by ongoing tariff concerns that rattled Wall Street sentiment. The Nasdaq, where Teradyne is listed, experienced similar downward pressure, with a noted 1% decline amid heightened volatility. Tariff uncertainties and the general downturn in tech stocks may have contributed to Teradyne's modest price move. Despite the leadership change potentially positioning Teradyne for focused growth, market jitters surrounding tariffs and tech valuation adjustments created a backdrop that negatively impacted tech equities, including Teradyne. The company’s performance reflects not solely its internal developments, but also broader market trends affecting the sector.

See the full analysis report here for a deeper understanding of Teradyne.

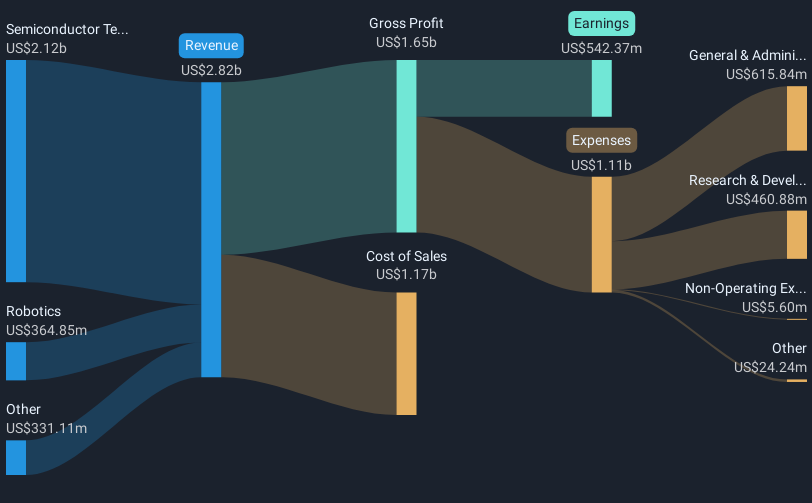

Over the five-year stretch, Teradyne's total shareholder returns reached an impressive 105.00%. This performance was shaped by a mix of consistent earnings announcements and strategic actions. For instance, Teradyne's earnings growth rebounded significantly over the past year, showcasing a 20.9% rise, surpassing the US Semiconductor industry growth. Furthermore, the company's active share buyback program, completed with over 5.65 million shares repurchased totaling US$600.52 million, contributed to enhancing shareholder value.

Additionally, Teradyne's earnings, despite some declines over the longer term, have shown positive momentum, with recent profit margins improving to 19.2%. The company's performance lagged behind the US Semiconductor industry's 10.3% return in the past year, yet its strategic guidance announcements, consistent earnings growth expectations, and ongoing dividend distributions underscore its focused efforts on sustaining shareholder returns. While tariffs and market volatility did pose challenges, Teradyne has maintained its shareholder value through internal initiatives and market positioning.

- See how Teradyne measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting Teradyne's growth trajectory—explore our risk evaluation report.

- Have a stake in Teradyne? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Teradyne, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.