- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

What Synaptics (SYNA)'s AI-Enabled Media Device Launch at IBC 2025 Means for Shareholders

Reviewed by Simply Wall St

- Earlier this month, Synaptics Incorporated showcased its latest AI-enabled solutions for set-top boxes and OTT streaming devices at IBC 2025, featuring Astra™ Arm-based processors for enhanced video, audio, and personalized user experiences.

- One distinctive highlight was Synaptics’ demonstration of its AI-powered voice biometrics, enabling seamless, secure, and profile-free personalization for multi-user households.

- We’ll now explore how Synaptics’ focus on embedded AI for media devices strengthens its investment narrative around Edge AI growth.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Synaptics Investment Narrative Recap

Owning Synaptics stock today means believing in the company’s ability to capitalize on the growing demand for Edge AI and IoT device integration, while managing near-term profitability pressures and execution risks around its transition toward solutions-based Core IoT. The recent IBC 2025 showcase highlights Synaptics' pace of innovation in embedded AI for media devices, though the event does not materially alter the biggest near-term catalysts, Core IoT expansion and product pipeline ramp, or address the ongoing risk of lagging channel presence and customer scaling.

Among recent announcements, the launch of the Astra™ Arm-based processors takes center stage at IBC 2025. By focusing on contextually aware AI and multi-modal capabilities in set-top boxes and streaming devices, Synaptics is reinforcing one of its central growth drivers: expanding silicon content per device and strengthening its differentiation in next-generation IoT designs.

However, it is important for investors to be aware that, in contrast, Synaptics still faces significant risk if it cannot efficiently build out channel relationships and scale its customer base beyond early adopters...

Read the full narrative on Synaptics (it's free!)

Synaptics' outlook projects $1.4 billion in revenue and $199.2 million in earnings by 2028. This requires 9.6% annual revenue growth and a $247 million increase in earnings from the current level of -$47.8 million.

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

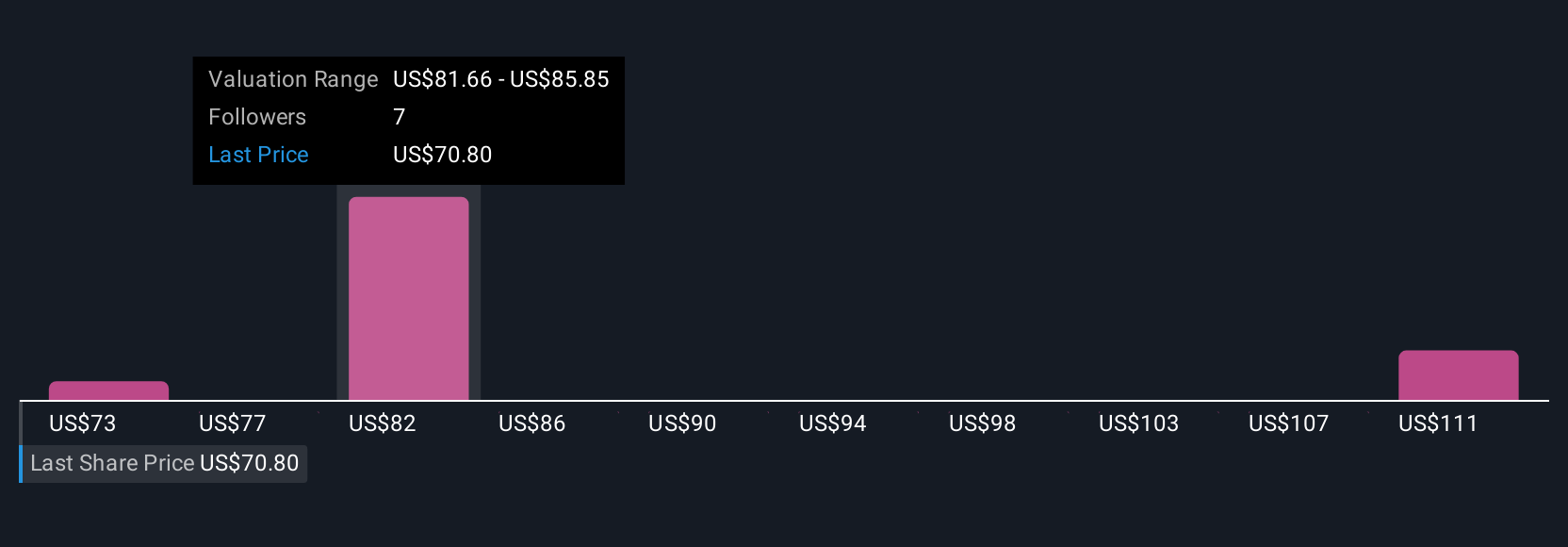

Three members of the Simply Wall St Community estimate Synaptics' fair value between US$73.28 and US$117.99 per share. While Edge AI product launches create opportunity, execution on customer growth will likely remain a key performance challenge, be sure to explore the range of opinions from different investors.

Explore 3 other fair value estimates on Synaptics - why the stock might be worth as much as 63% more than the current price!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

No Opportunity In Synaptics?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives