- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Possible bearish signals as Synaptics Incorporated (NASDAQ:SYNA) insiders disposed of US$17m worth of stock

Many Synaptics Incorporated (NASDAQ:SYNA) insiders ditched their stock over the past year, which may be of interest to the company's shareholders. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Synaptics

Synaptics Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Senior VP, John McFarland, sold US$4.0m worth of shares at a price of US$250 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The silver lining is that this sell-down took place above the latest price (US$224). So it is hard to draw any strong conclusion from it.

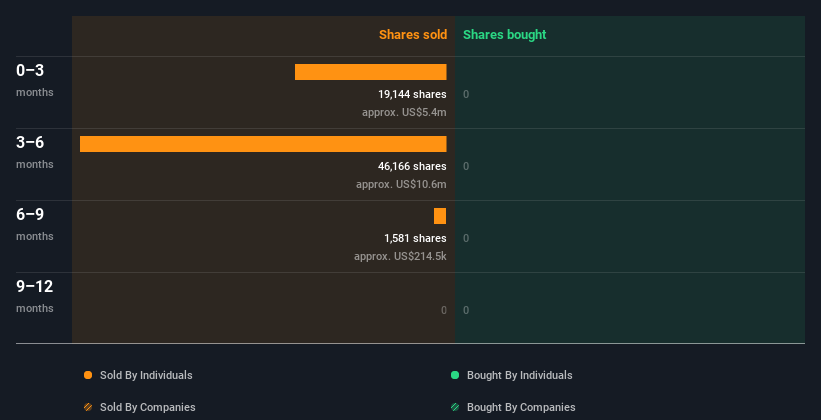

Synaptics insiders didn't buy any shares over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders at Synaptics Have Sold Stock Recently

The last quarter saw substantial insider selling of Synaptics shares. In total, insiders sold US$5.5m worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Does Synaptics Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 0.9% of Synaptics shares, worth about US$82m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Synaptics Tell Us?

Insiders sold Synaptics shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. Insiders own shares, but we're still pretty cautious, given the history of sales. So we'd only buy after careful consideration. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For example - Synaptics has 3 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SYNA

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026