- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Semtech (SMTC): Reassessing Valuation After Solid Q3 Results and Record Data Center Growth

Reviewed by Simply Wall St

Semtech (SMTC) just delivered a quarter that largely did what investors wanted: steady execution, record data center sales, and clear guidance pointing to more growth ahead even as margins feel some mix pressure.

See our latest analysis for Semtech.

That narrative seems to be feeding into the stock’s momentum, with a roughly 22.6% 3 month share price return and a powerful 3 year total shareholder return of about 156%, even though the latest close is $73.46.

If Semtech’s trajectory has you thinking about what else might be building momentum in chips and connectivity, now could be a good time to explore high growth tech and AI stocks.

Yet with shares hovering just below analyst targets after a huge three year run, is Semtech still trading at a discount to its true earnings power, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 8.4% Undervalued

With Semtech last closing at $73.46 against a narrative fair value of about $80.21, the story leans toward upside driven by earnings power and margins.

Analysts expect earnings to reach $253.1 million (and earnings per share of $2.05) by about September 2028, up from $23.8 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.8x on those 2028 earnings, down from 210.9x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

Curious what kind of revenue ramp and margin lift could turn today’s modest profits into that future earnings engine and premium multiple story? The full narrative lays out the step by step financial path behind that valuation call.

Result: Fair Value of $80.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent margin pressure from a lower quality mix and the goodwill impairment in connected services show how quickly this upbeat narrative could be challenged.

Find out about the key risks to this Semtech narrative.

Another Lens on Valuation

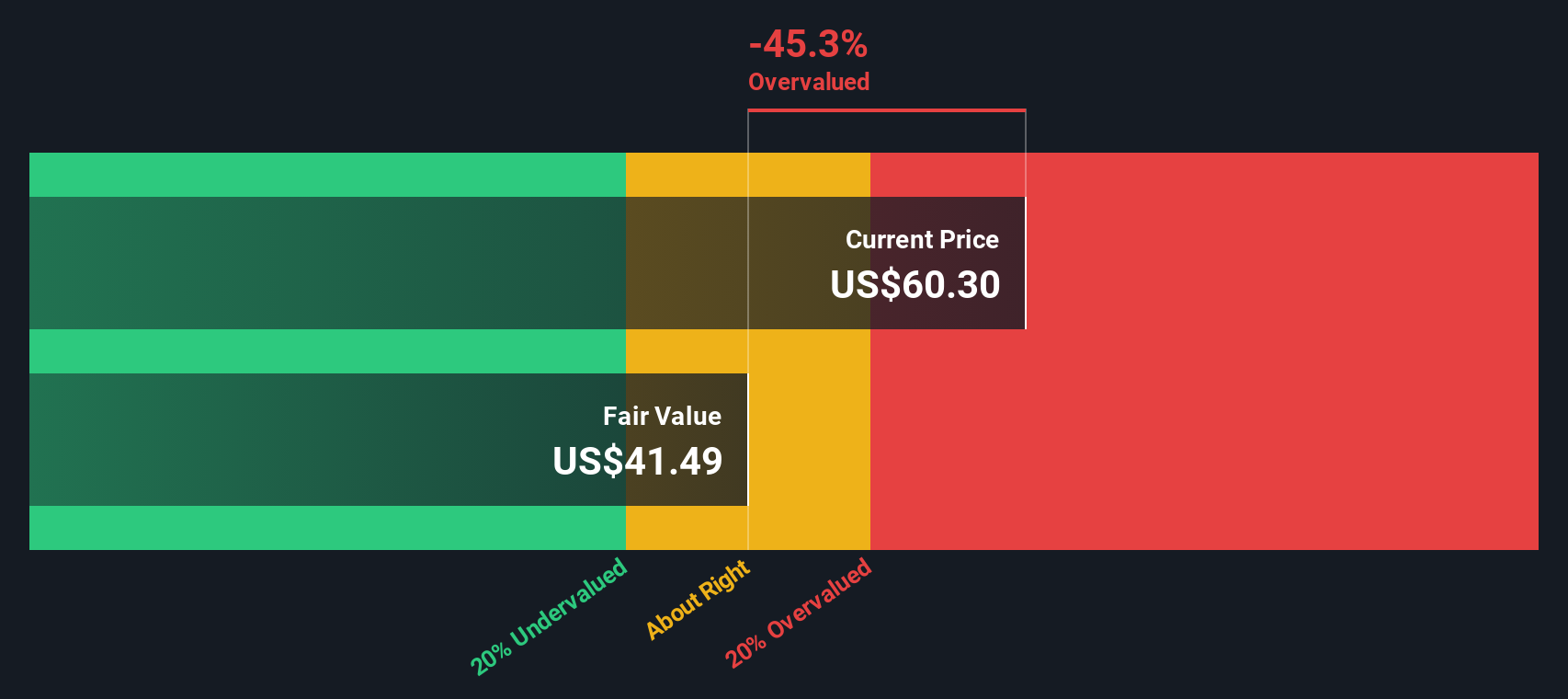

While the narrative fair value suggests Semtech is 8.4% undervalued, our DCF model points the other way. It puts fair value closer to $47.26. On that view, today’s $73.46 price bakes in a lot of growth already and leaves less room for error if margins slip.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Semtech Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story; broaden your opportunities now with targeted stock ideas from the Simply Wall St Screener before the market moves without you.

- Capitalize on early stage momentum by scanning these 3571 penny stocks with strong financials that pair tiny share prices with surprisingly solid financial underpinnings.

- Ride structural growth in automation and data by zeroing in on these 25 AI penny stocks positioned at the heart of machine learning and intelligent software demand.

- Focus on these 14 dividend stocks with yields > 3% that combine attractive yields with balance sheets designed to support ongoing cash flows through a range of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026