- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Is Semtech’s Recent 10% Rally Justified as Valuation Faces New Scrutiny?

Reviewed by Bailey Pemberton

If you have been tracking Semtech lately, you are likely wondering if the stock’s strong momentum signals a new chapter or a riskier phase. With a jump of 10% over the past week and a solid year-to-date gain of almost 10%, Semtech is capturing the attention of both growth seekers and more cautious investors. Over the past year, the stock has climbed an impressive 57.2%. Even looking back three years, Semtech has soared by 147.4%. The five-year return is 16.6%, reminding us that the journey has had its share of dips and turns.

What is driving all of this? Recent market excitement around the broader technology sector and the continued rollout of IoT solutions have played a role in bolstering sentiment toward semiconductors and related tech companies, like Semtech. Investors are actively weighing the potential for high future growth against the risks that come with market cycles and shifting expectations.

But price action is only one side of the story. Before making any decisions, it is smart to step back and ask whether the current stock price actually offers value or if optimism is outpacing the true fundamentals. Based on a standard value assessment, Semtech scores 1 out of 6 in key undervaluation checks, suggesting undervaluation in just a single area. In the next section, we will dig into these different valuation techniques. At the end, I will share an even smarter way to interpret Semtech’s valuation in today’s market.

Semtech scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Semtech Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting those cash flows back to their present value. This approach focuses on what the company is actually generating in cash, making it a popular method for assessing intrinsic value beyond quick market reactions.

Looking specifically at Semtech, the current Free Cash Flow stands at $110.53 Million. Analysts forecast that this figure will grow steadily, reaching $145.30 Million by 2026 and rising as high as $224.3 Million by 2028. Projections extend even further using automated models, with a possible Free Cash Flow of nearly $384.67 Million by 2035. This growth outlook underpins optimism, but rigorous discounting applies a present value lens to all future estimates.

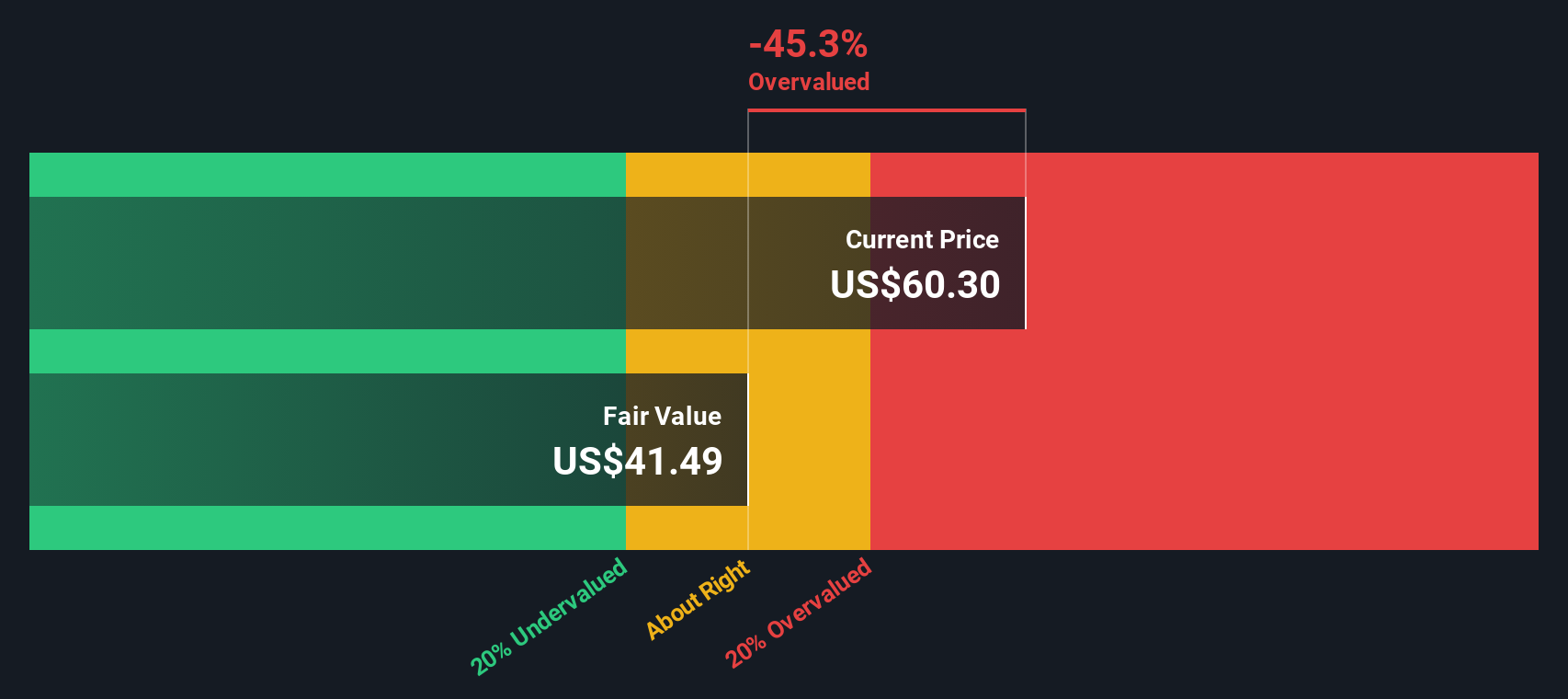

After weighing all projected cash flows, the estimated intrinsic value for Semtech shares is $41.16. However, compared to the current share price, the DCF analysis calculates that the stock is about 65.6% overvalued. This significant gap suggests current market enthusiasm may be running well ahead of underlying business performance based on fundamental analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Semtech may be overvalued by 65.6%. Find undervalued stocks or create your own screener to find better value opportunities.

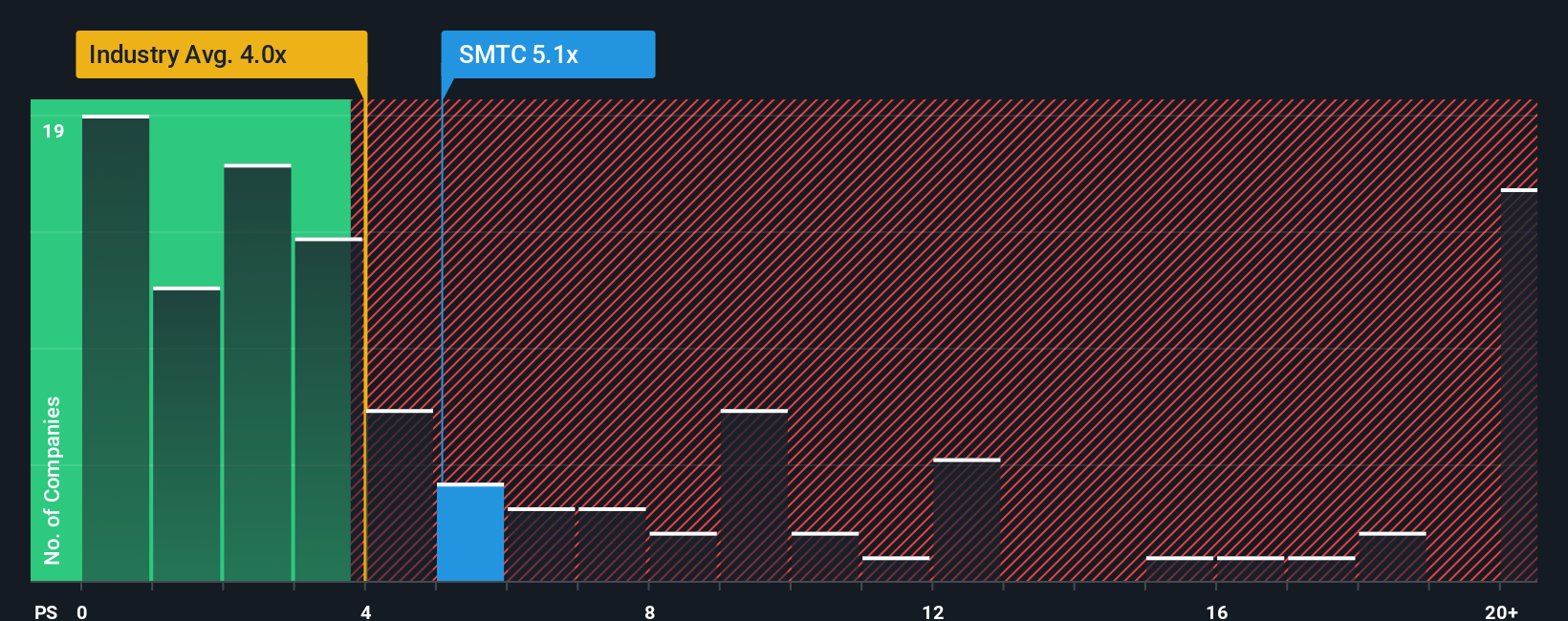

Approach 2: Semtech Price vs Sales

For companies like Semtech, which are profitable but may experience shifting earnings due to the cyclical nature of semiconductors, the Price-to-Sales (PS) ratio is often a reliable way to compare valuation. The PS ratio helps investors understand how much they are paying for each dollar of the company’s revenue, smoothing out the volatility that can affect earnings in rapidly evolving industries.

Growth prospects and perceived risks play a big role in what constitutes a “normal” or “fair” multiple. Companies with higher growth and lower risk typically command higher PS ratios, while those facing headwinds tend to trade at lower multiples. With Semtech currently trading at a PS ratio of 5.9x, it sits above the semiconductor industry average of 4.9x but below the peer average of 10.2x.

Rather than just looking at industry averages or peer comparisons, Simply Wall St’s proprietary Fair Ratio incorporates a broader set of metrics including Semtech’s profit margins, growth expectations, industry, and market cap. This Fair Ratio for Semtech is calculated at 5.7x. It provides a more tailored benchmark for this company’s unique situation. By accounting for both upside potential and inherent risks, the Fair Ratio offers a more intelligent guide for investors.

Comparing these numbers, Semtech’s actual PS ratio of 5.9x is only slightly higher than the Fair Ratio of 5.7x. This close alignment suggests the stock’s valuation is about right based on its fundamentals and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Semtech Narrative

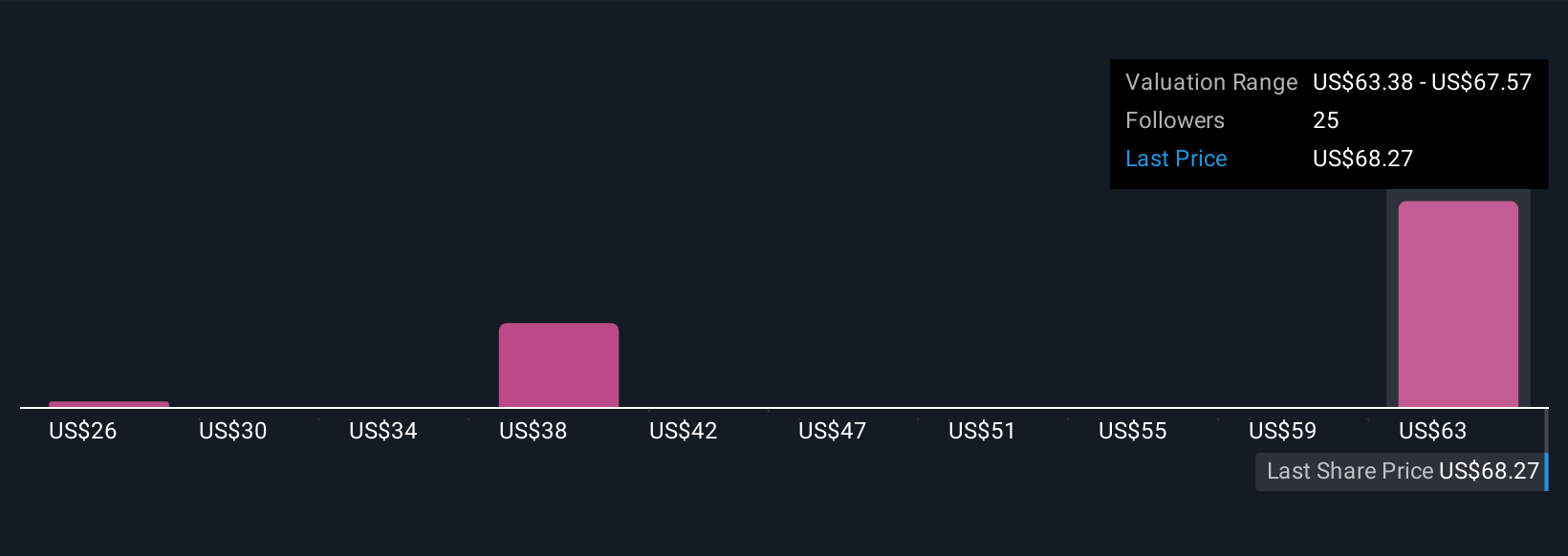

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple but powerful investing tool that lets you combine your viewpoint about a company—how you see its business trends, competitive strengths, and future prospects—with a financial forecast and a resulting fair value. Rather than relying solely on historical data or broad ratios, Narratives allow you to give shape to the story behind the numbers. You can set your expectations for Semtech’s future revenue, profit margins, and other assumptions and instantly see how those inputs change what the stock is worth right now.

Available to all investors directly on the Simply Wall St Community page, Narratives are easy to use and updated dynamically as new data, news, or results are released. With millions of investors sharing their perspectives, you can explore a range of possible outcomes and see exactly why a bull, bear, or consensus target for Semtech exists. You can also see how each maps to projected fair value compared to today’s price to help decide if it is time to buy, hold, or sell.

For example, analysts currently see Semtech’s fair value ranging from $53.00 (cautious outlook) to $70.00 (most bullish scenario), depending on their individual forecasts for growth, earnings quality, and risk.

Do you think there's more to the story for Semtech? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives