- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

Is SkyWater (SKYT) Using Quantum Partnerships to Redefine Its Secure Compute Moat?

Reviewed by Sasha Jovanovic

- In November 2025, Silicon Quantum Computing and SkyWater Technology announced a joint program to commercialize hybrid quantum-classical computing, combining SQC’s atomically engineered quantum processors with SkyWater’s secure U.S. semiconductor manufacturing, superconducting resonators, and tailored silicon wafers.

- This collaboration highlights SkyWater’s role in enabling the “future compute” stack, where tightly integrated quantum and classical components could reshape high-performance and security-focused computing architectures.

- We’ll now examine how this quantum collaboration, centered on integrating SQC’s quantum processors with SkyWater’s secure manufacturing, may influence SkyWater’s broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

SkyWater Technology Investment Narrative Recap

To own SkyWater, you need to believe its secure, specialty fabs and Technology-as-a-Service model can turn capacity expansion and quantum partnerships into durable, profitable demand, despite leverage and margin pressure from Fab 25. The SQC collaboration supports the quantum and advanced packaging catalyst, but does not materially change the near term focus on integrating Fab 25 or the key risk around high debt and cash demands.

The SQC program builds directly on SkyWater’s push into quantum computing and superconducting platforms, following its earlier QuamCore SFQ collaboration. Together, these agreements reinforce the quantum and “future compute” catalyst, but they sit alongside more immediate drivers such as the Infineon backed Fab 25 ramp and government supported reshoring, which are likely to matter more for near term earnings and balance sheet resilience.

Yet behind the quantum excitement, investors should still be aware of the elevated leverage and Fab 25 related margin pressure that...

Read the full narrative on SkyWater Technology (it's free!)

SkyWater Technology's narrative projects $804.6 million revenue and $113.6 million earnings by 2028.

Uncover how SkyWater Technology's forecasts yield a $21.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

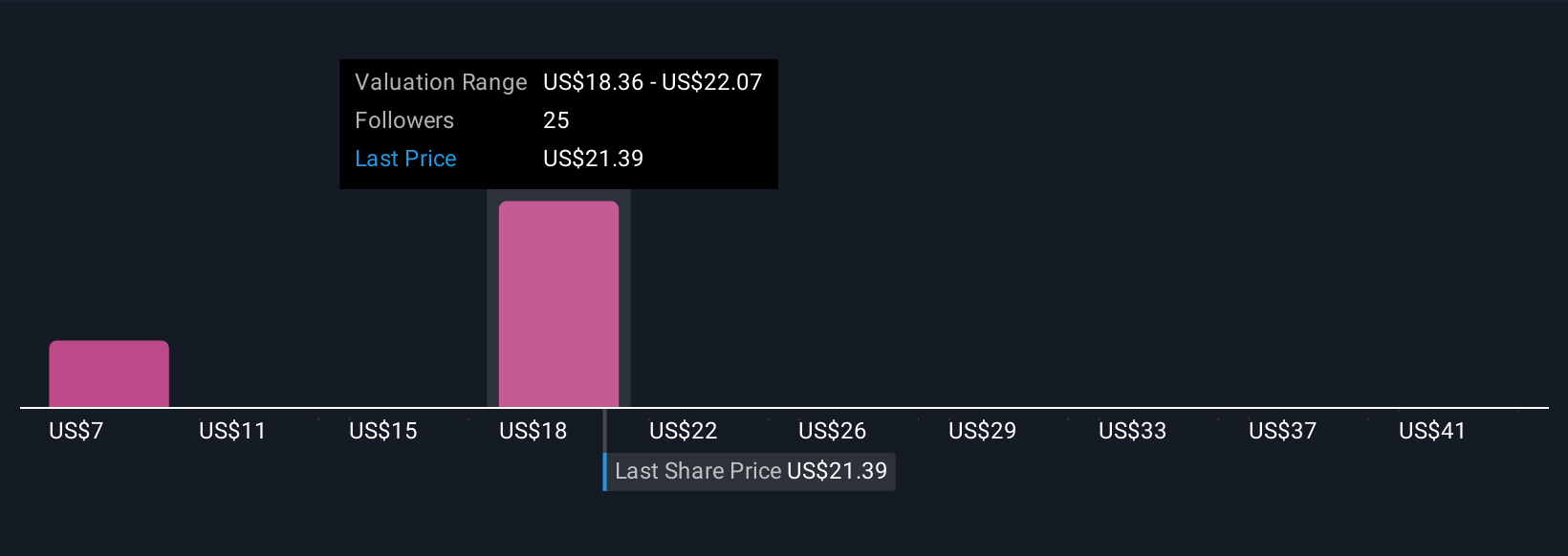

Five Simply Wall St Community fair value estimates for SkyWater span a wide range, from US$4.43 to US$44.30, showing sharply different expectations. When you set those views against the Fab 25 related leverage and margin risks, it underlines why many readers may want to compare several perspectives before deciding how this story could affect future performance.

Explore 5 other fair value estimates on SkyWater Technology - why the stock might be worth over 2x more than the current price!

Build Your Own SkyWater Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWater Technology research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free SkyWater Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWater Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026