- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

3 Growth Companies With High Insider Ownership And 81% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with major indices reacting to recent earnings reports and tariff announcements, investors are closely monitoring economic indicators that could influence future interest rate decisions. In this environment, growth companies with high insider ownership can offer a compelling opportunity, as strong insider stakes often indicate confidence in the company's potential amidst uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 17.7% | 24.9% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.7% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

We'll examine a selection from our screener results.

SkyWater Technology (NasdaqCM:SKYT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SkyWater Technology, Inc. operates as a pure-play technology foundry in the United States, specializing in semiconductor development, manufacturing, and packaging services with a market capitalization of approximately $421.28 million.

Operations: SkyWater Technology generates revenue through its specialized services in semiconductor development, manufacturing, and packaging within the United States.

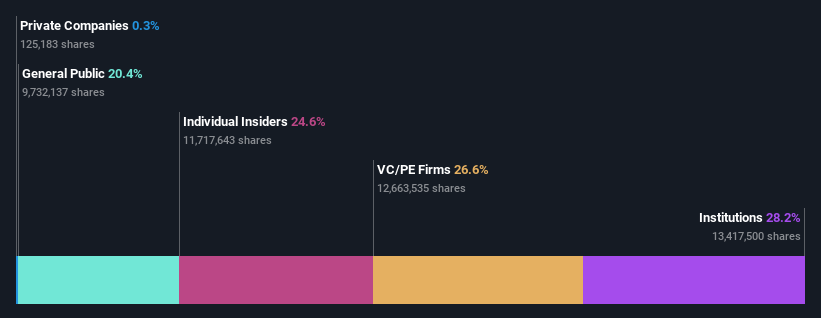

Insider Ownership: 24.6%

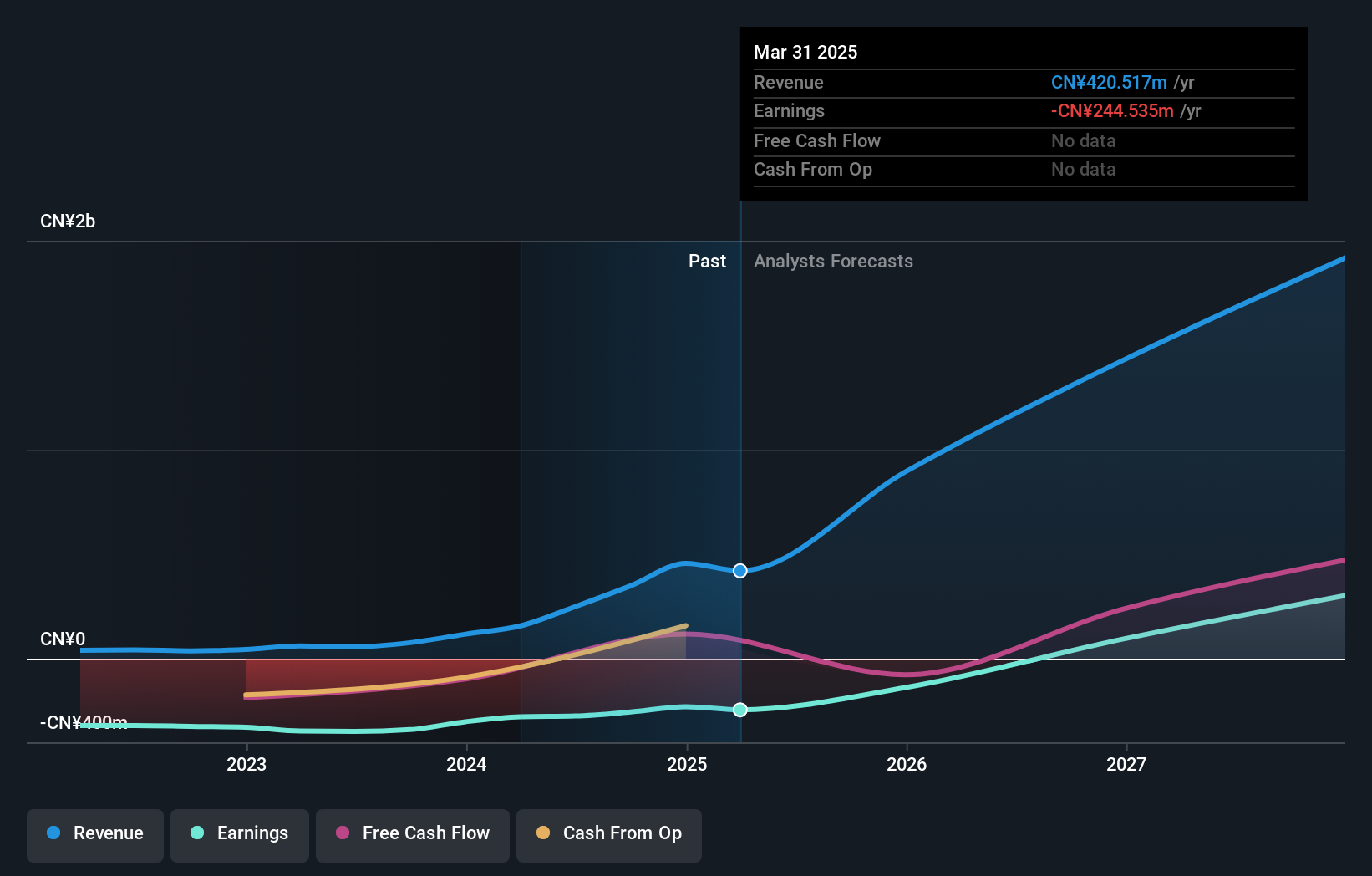

Earnings Growth Forecast: 31.4% p.a.

SkyWater Technology's growth prospects are underscored by its strategic initiatives and financial performance. The company reported a significant reduction in net loss, from US$30.76 million to US$6.79 million, alongside revenue growth to US$342.27 million in 2024. Despite high insider selling recently, SkyWater's focus on innovation is evident with the launch of ThermaView Solutions for thermal imaging systems and potential CHIPS Act funding to boost production capabilities, aligning with its role as a key U.S. defense supplier.

- Dive into the specifics of SkyWater Technology here with our thorough growth forecast report.

- The valuation report we've compiled suggests that SkyWater Technology's current price could be inflated.

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in China and internationally, with a market cap of $1.49 billion.

Operations: The company's revenue segment is Aerospace & Defense, generating CN¥348.48 million.

Insider Ownership: 31.4%

Earnings Growth Forecast: 81.1% p.a.

EHang Holdings is positioned for significant growth with its strategic alliances and technological advancements in the eVTOL sector. The company forecasts robust revenue growth of 38.1% annually, outpacing the market average. Recent partnerships, including a joint venture with Anhui Jianghuai Automobile Group and Hefei Guoxian Holdings, aim to enhance production capabilities for pilotless aircraft. EHang's collaborations focus on integrating advanced technologies to accelerate commercialization in China's burgeoning low-altitude economy, despite a forecasted low return on equity of 12.3%.

- Delve into the full analysis future growth report here for a deeper understanding of EHang Holdings.

- Our expertly prepared valuation report EHang Holdings implies its share price may be too high.

monday.com (NasdaqGS:MNDY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications globally and has a market cap of approximately $14.82 billion.

Operations: The company generates its revenue primarily from its Internet Software & Services segment, totaling $972.00 million.

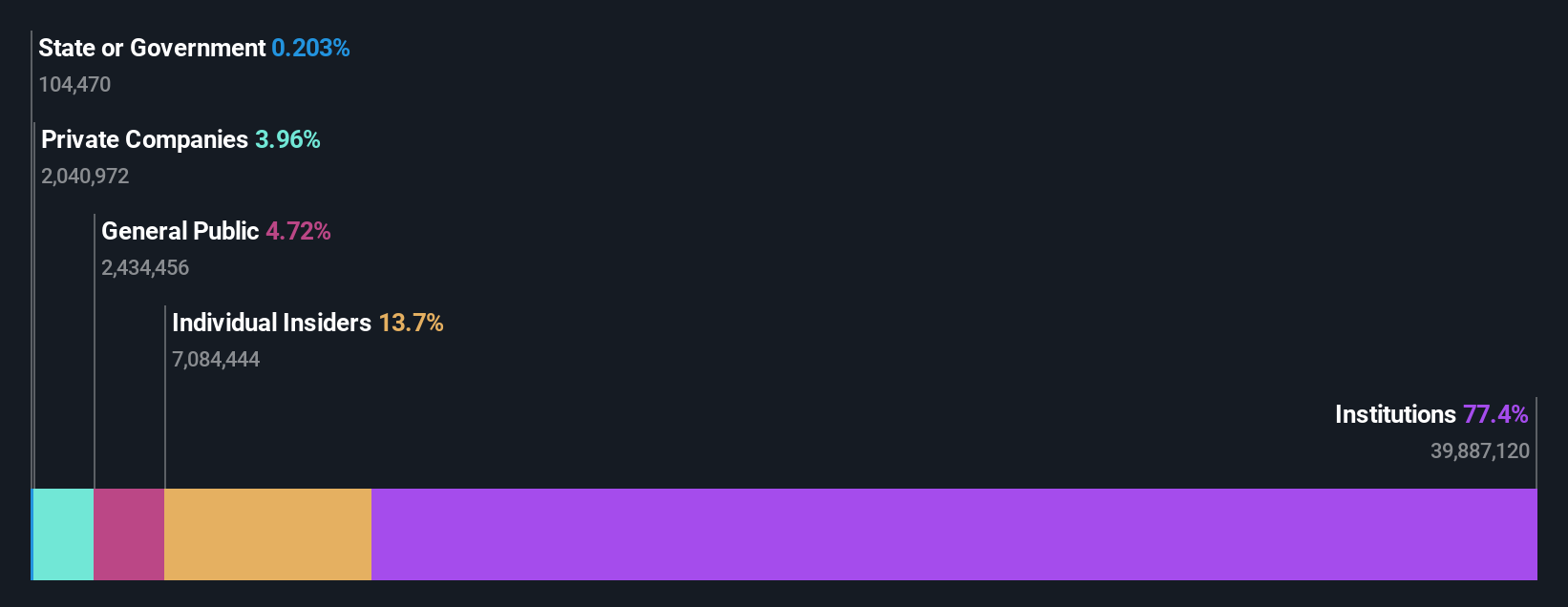

Insider Ownership: 15.4%

Earnings Growth Forecast: 35.5% p.a.

monday.com demonstrates strong growth potential with high insider ownership, underpinned by strategic partnerships and innovative product offerings. Recent collaborations with Rewind and Trundl enhance data protection and cloud infrastructure capabilities, respectively. The launch of monday service has already shown significant impact by resolving over 215,000 tickets since January 2024. Financially, the company reported a substantial increase in net income to US$32.37 million for 2024 and forecasts revenue growth exceeding market averages for the coming years.

- Navigate through the intricacies of monday.com with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of monday.com shares in the market.

Where To Now?

- Click here to access our complete index of 197 Fast Growing US Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade SkyWater Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives