- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

Is SiTime's (SITM) Insider Selling Wave Revealing Tensions in Its Disruptive Growth Narrative?

Reviewed by Sasha Jovanovic

- SiTime recently saw its CFO, Elizabeth Howe, execute a large insider sale raising about US$1.63 million, amid 18 insider selling transactions over the past three months without any insider buying.

- This activity comes as SiTime continues to challenge traditional timing device markets with its smaller, more precise semiconductor solutions for demanding infrastructure.

- We'll explore how increased insider selling during a period of revenue challenges could alter SiTime's investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SiTime Investment Narrative Recap

SiTime’s investment case rests on the belief that AI-driven growth in data centers and infrastructure will fuel outsized demand for its next-generation silicon timing solutions, with risks centered on high customer concentration and volatile revenue trends. The recent wave of insider selling, including CFO Elizabeth Howe’s US$1.63 million transaction, has added short-term uncertainty but has not directly impacted the company’s immediate catalyst: surging infrastructure demand. The most relevant recent announcement is SiTime’s launch of its Titan MEMS platform, which aims to expand the addressable market by targeting industrial IoT and medical applications, key areas that could support revenue growth as the company navigates periods of sector-specific weakness. In contrast, investors should be aware of the sharp volatility that could arise if ...

Read the full narrative on SiTime (it's free!)

SiTime's narrative projects $600.4 million revenue and $15.9 million earnings by 2028. This requires 32.9% yearly revenue growth and a $98.1 million earnings increase from the current earnings of -$82.2 million.

Uncover how SiTime's forecasts yield a $260.71 fair value, a 6% downside to its current price.

Exploring Other Perspectives

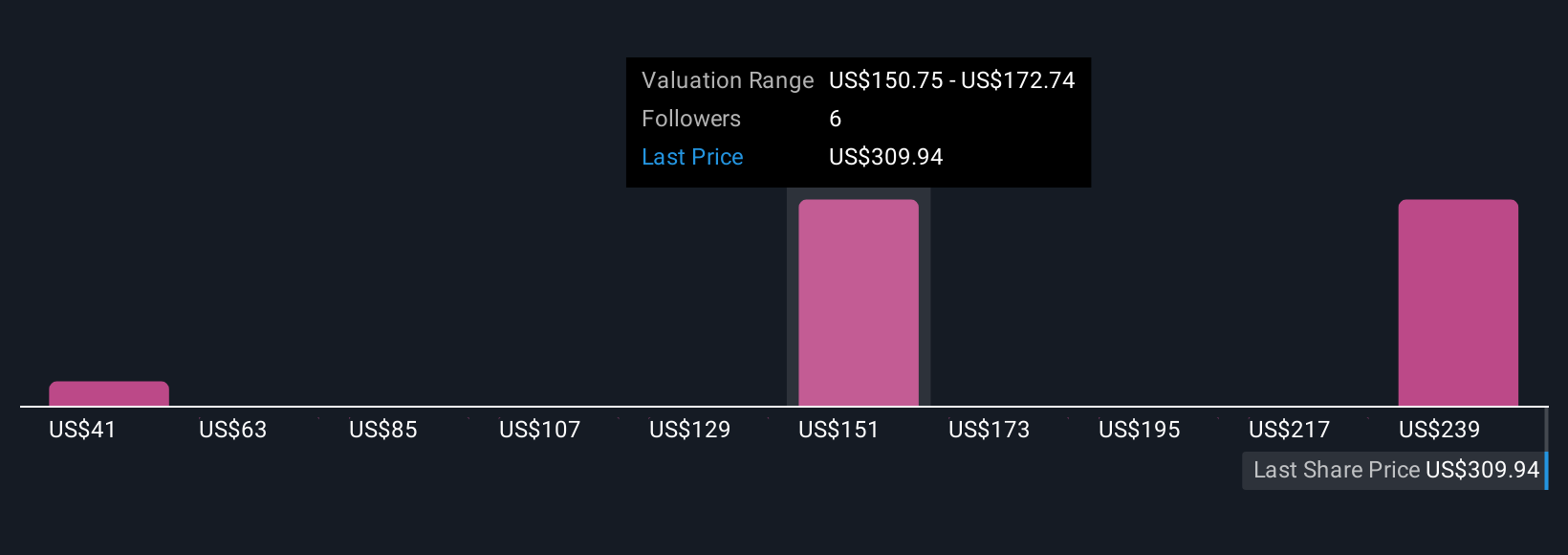

Three members of the Simply Wall St Community provided fair value estimates for SiTime, ranging widely from US$40.78 to US$260.71 per share. While opinions span the extremes, many continue to focus on SiTime's significant exposure to AI data center trends as both a driver and a risk for future performance.

Explore 3 other fair value estimates on SiTime - why the stock might be worth less than half the current price!

Build Your Own SiTime Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiTime research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SiTime research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiTime's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives