- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Valuation in Focus After First Global Shipments and Nexis Launch

Reviewed by Kshitija Bhandaru

If you're following SolarEdge Technologies (SEDG), you might be wondering what all the buzz is about this week. The company has just kicked off its first-ever international shipments of American-made residential solar products, landing in Australia with plans for even broader global reach before year-end. Not only is this a pivotal step in its global expansion playbook, but SolarEdge also just unveiled Nexis, an all-in-one solar and modular battery system. That combination of manufacturing scale and product innovation could have ripple effects for investors sizing up the company’s longer-term prospects.

SolarEdge’s shares have responded, climbing steadily year to date and accelerating in recent weeks. This momentum picked up after news of international shipments and the Nexis launch. The stock has gained 87% over the past year, defying some of the headwinds that have weighed on the sector and showing signs that sentiment could be shifting. Between new product launches and its global manufacturing strategy, SolarEdge seems to be positioning itself more aggressively both at home and abroad, raising important questions around future growth and valuation.

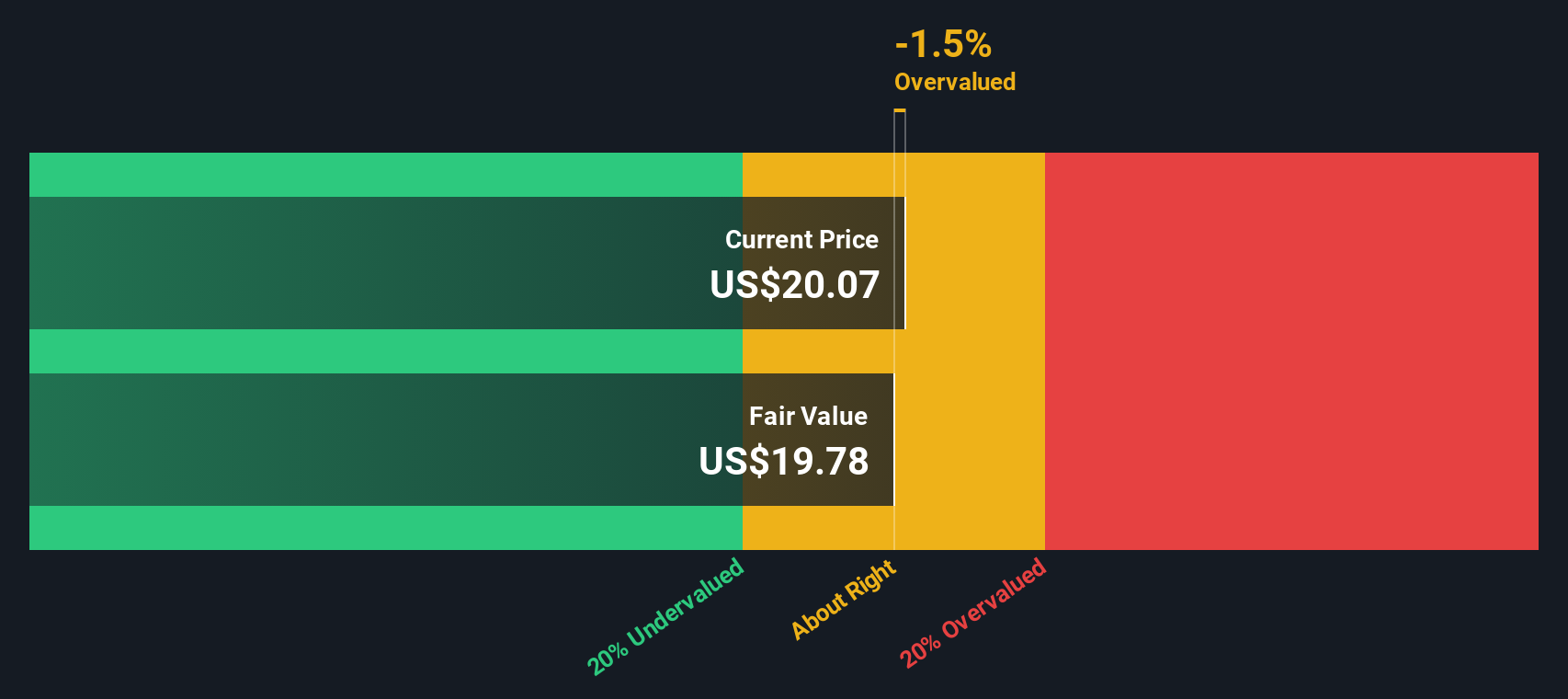

With this latest surge and a pipeline of international expansion, is SolarEdge a bargain for value-focused investors, or is the market already baking future growth into today’s price?

Most Popular Narrative: 74.2% Overvalued

According to the most widely followed narrative, SolarEdge Technologies is currently viewed as significantly overvalued relative to its fair value. Analysts believe the market may be pricing in overly optimistic assumptions about future growth and profitability.

"Forecasts for a meaningful boost from commercial and battery storage attach rates may be too aggressive. Adoption cycles could be hampered by macro uncertainties, weaker policy continuity, and the risk that competing integrated solutions outpace SolarEdge's offering, impacting future revenue streams."

Want to know which bold profit leaps and market shifts underpin this eye-catching valuation? The road to that fair value hinges on critical growth bets and ambitious forecasts that leave even seasoned investors guessing. What surprising assumptions power the consensus? Explore the hidden drivers and big financial leaps at the core of this valuation story.

Result: Fair Value of $22.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supportive U.S. policies or a faster than expected rebound in battery storage adoption could quickly shift SolarEdge’s valuation outlook in a positive direction.

Find out about the key risks to this SolarEdge Technologies narrative.Another View: Discounted Cash Flow Suggests Upside

While most see SolarEdge as overvalued based on analyst expectations, our DCF model presents a different perspective. This approach estimates fair value using projected cash flows and suggests the current price may actually be below intrinsic value. Could the SWS DCF model be identifying an opportunity others overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SolarEdge Technologies Narrative

If you see things differently or want to dig into the data on your own terms, it only takes a few minutes to create your personal view and test your assumptions. Do it your way

A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Unique Investment Opportunities?

Smart investors never stick to just one idea. The market is brimming with fresh possibilities that could match your risk appetite or spark a new strategy. Make your next move by exploring these specialized investment themes. Miss them and you might be leaving potential gains on the table.

- Track hidden potential with penny stocks with strong financials and uncover established companies quietly building impressive balance sheets and surprising growth stories.

- Capture tomorrow's technology boom by checking out AI penny stocks, where artificial intelligence pioneers are pushing boundaries no one else dares to approach right now.

- Supercharge your portfolio’s income with dividend stocks with yields > 3% to find businesses delivering dependable yields above 3% and rewarding shareholders every quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives