- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG) Faces Shifting Policy Winds—How Does Uncertainty Shape Its Competitive Edge?

Reviewed by Simply Wall St

- In the past week, President Donald Trump announced that his administration would no longer approve new U.S. solar or wind projects, presenting a significant policy shift for the renewable energy sector, while Schaeffler disclosed a partnership with SolarEdge Technologies for developing electric vehicle charging infrastructure.

- This development highlights how sudden regulatory changes can alter the risk profile and outlook for companies operating in the clean energy industry.

- We'll examine how U.S. policy uncertainty and future project restrictions are altering SolarEdge's near-term investment narrative and growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, you need to believe in the lasting demand for clean energy solutions and the company’s ability to weather regulatory uncertainty. The recent U.S. policy announcement is a concern for near-term solar project approvals, but the key risk for SolarEdge right now remains the unpredictability of government support, while margin recovery and U.S. residential demand shifts are still the primary catalysts. If policy restrictions persist, the impact could become more material. Among the recent company announcements, SolarEdge’s new partnership with Schaeffler to deploy 2,300 EV charging points across Europe stands out. This move is relevant as it signals a push into diversified markets, potentially offsetting some of the near-term U.S. policy headwinds, and highlights their wider focus on integrated energy management and storage solutions. But for investors, what really stands out, particularly when politics disrupt established catalysts, is...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' narrative projects $1.7 billion in revenue and $13.2 million in earnings by 2028. This requires 20.7% yearly revenue growth and an earnings increase of about $1.71 billion from current earnings of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $19.64 fair value, a 43% downside to its current price.

Exploring Other Perspectives

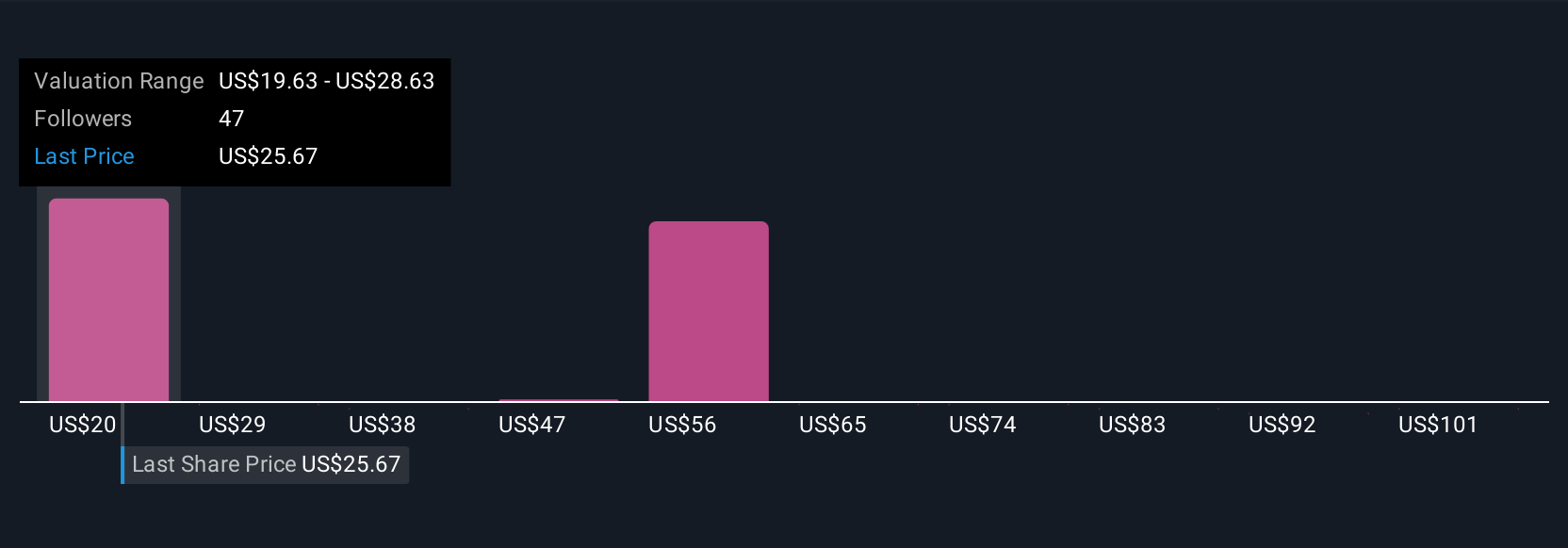

Simply Wall St Community members offered 19 unique fair value estimates for SolarEdge between US$19.63 and US$109.67 per share. While this sharp range shows just how much investor opinions can differ, the risk of shifting U.S. policy complicates growth expectations and could influence how the market weighs the company’s prospects.

Explore 19 other fair value estimates on SolarEdge Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives