- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (NasdaqCM:RGTI) Soars 33% Despite US$153 Million Net Loss

Reviewed by Simply Wall St

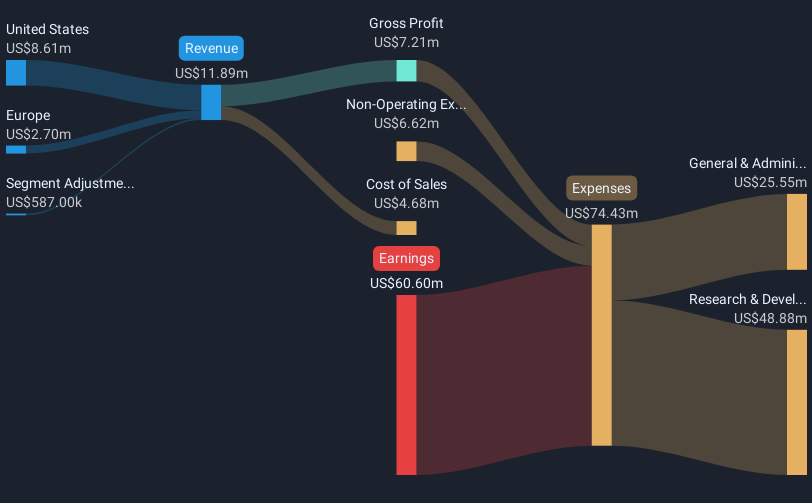

Rigetti Computing (NasdaqCM:RGTI) recently reported challenging financial results, with sales and earnings on a declining trend, highlighted by a $153 million net loss in Q4 2024. Concurrently, the company announced a private placement raising $35 million, featuring investment from Quanta Computer Inc., which could fuel future growth and innovation, like the launch of their 84-qubit Ankaa-3 quantum system. Amid these developments, Cathy McCarthy's decision to exit the board may bring staffing and strategic shifts. The company's stock rose 32.6% over the past quarter, reflective of a broader tech landscape facing mixed investor sentiment. While mega-cap tech names showed volatility, Rigetti's advancements in quantum computing, investor confidence from private placements, and broader market movements within the tech sector appear to have buoyed its stock, aligning with Nasdaq's efforts to break free from tariff and economic worries that previously pressured markets.

Over the last year, Rigetti Computing delivered a very large total shareholder return of 479.24%. This remarkable performance outpaced both the broader US market, which returned 8.1%, and the US Semiconductor industry with a 12.2% return. Several events contributed to Rigetti's significant return over this period. Notably, the company completed a $100 million follow-on equity offering in November 2024, strengthening its financial position for future developments. Additionally, Rigetti's initiatives in launching the 84-qubit Ankaa-3 system in December 2024 signaled advancements in quantum computing technology.

The company's inclusion in various notable indexes, including the S&P Semiconductors Select Industry Index in December 2024 and the Russell Indexes in July 2024, likely amplified investor interest and visibility. Rigetti's entry into the Singapore market with the sale of a Novera QPU in April 2024 further underscored its global reach and availability. While the company faced ongoing challenges with profitability, these strategic moves and product launches bolstered investor confidence, reflected in the impressive stock performance over the year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors.

Flawless balance sheet slight.