- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (NasdaqCM:RGTI) Shares Drop 10% In A Week After US$11 Million Sales Dip

Reviewed by Simply Wall St

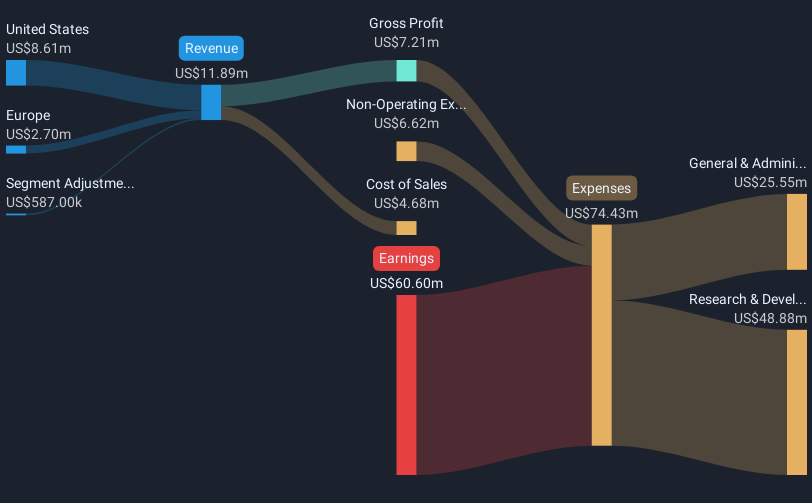

Rigetti Computing (NasdaqCM:RGTI) experienced a 10% share price decline over the past week amid a turbulent market and alongside several significant developments within the company. The announcement of a substantial net loss for the full year 2024, with sales falling to $10.79 million, contrasted sharply with rising losses from the previous year, which likely weighed on investor confidence. Additionally, news of executive changes with Cathy McCarthy deciding not to stand for re-election and the completion of a private placement with Quanta Computer Inc. attracted attention but failed to offset the cumulative market pressures, which generally declined by 1.8% during the same period.

Find companies with promising cash flow potential yet trading below their fair value.

Over the last year, Rigetti Computing's total shareholder return was very large, reflecting a positive trajectory despite operational challenges. This performance significantly outpaced both the US Market's 5.5% return and the US Semiconductor industry's 2.5% return, showcasing investor optimism amidst broader industry pressures.

A key driver of this impressive return was the anticipation surrounding the launch of the advanced 84-qubit Ankaa-3 system, announced on December 23, 2024, expected to enhance computing abilities on major platforms like Amazon Braket and Microsoft Azure. Additionally, the December 9, 2024 decision to pay off a US$10.5 million loan signified a strategic move to streamline financial liabilities. The company's successful follow-on equity offering on November 25, 2024, which raised US$100 million, further fortified its capital structure. However, investor sentiment has been tested with developments such as the Nasdaq delisting notice on September 17, 2024, which introduced regulatory compliance challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives