- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (NASDAQ:QCOM) is Positioned in an Expanding Industry with High-Quality Fundamentals

QUALCOMM Incorporated (NASDAQ:QCOM) is a wireless chipmaker, currently focused on the 5G landscape. The company is highly appealing based on the fundamentals, which is what we are evaluating today.

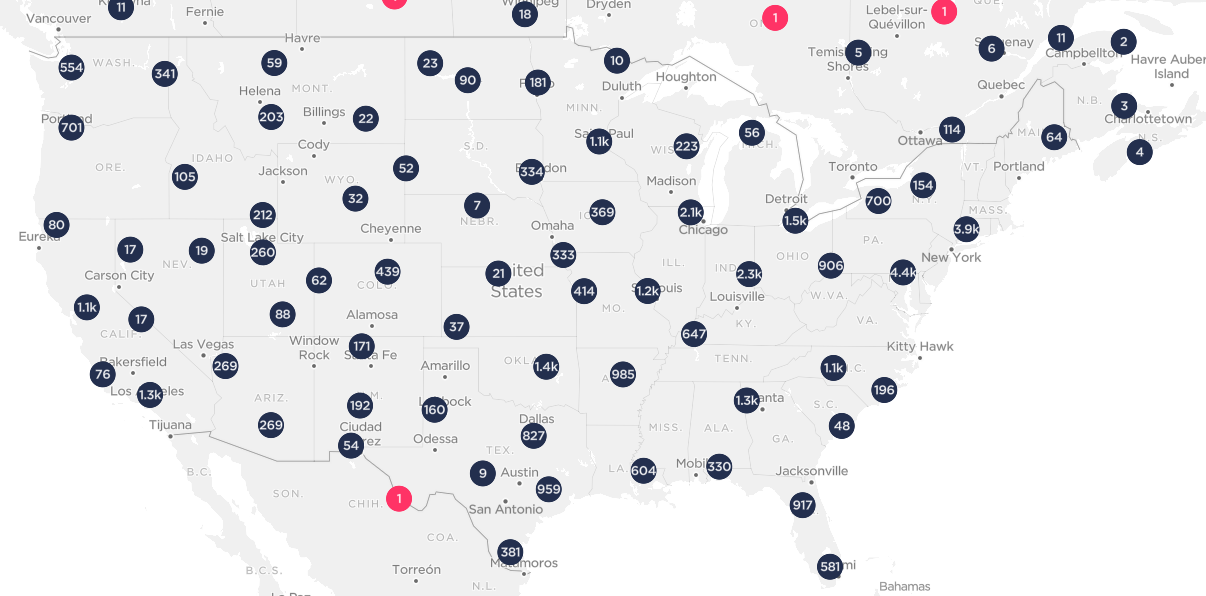

5G is coming at a quicker pace than some analysts have predicted, and many companies are tied to the development of this technology, including Qualcomm. This map of commercially available 5G locations shows the scale of the expansion:

Considering this, we want to see to what extent can Qualcomm gauge this growth, and how profitable will this endeavor be.

Fundamentals

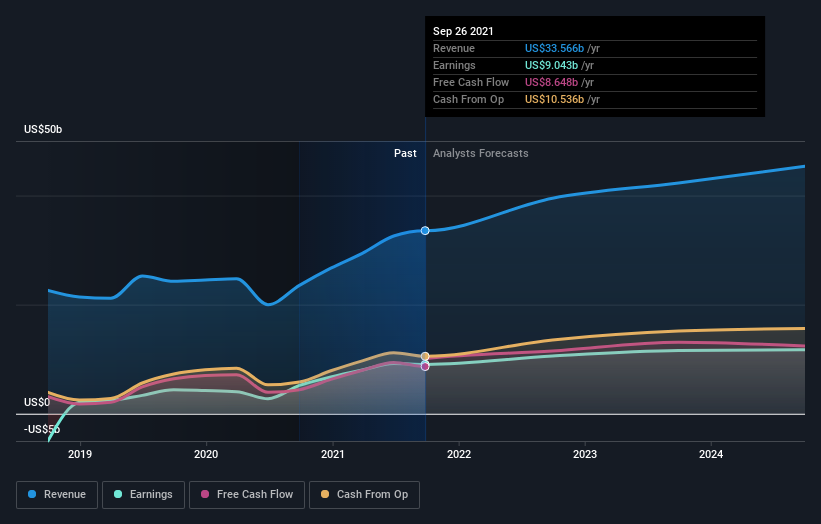

QUALCOMM reported US$34b in revenue, a growth of 43% vs the year before - roughly in line with analyst forecasts. Earnings per share (EPS) of US$7.87 beat expectations, being 7.3% higher than what the analysts expected.

The chart below shows that the company has grown and is also expected to continue that growth in the future. We can also see that Qualcomm has a 27% profit margin and is Free Cash Flow positive with US$8.6b in FCF.

View our latest analysis for QUALCOMM

Taking into account the latest results, the current consensus from QUALCOMM's 25 analysts is for revenues of US$39.5b in 2022, which would reflect a solid 18% increase on its sales over the past 12 months. Per-share earnings are expected to ascend 15% to US$9.29.

Stock price growth is deemed to closely follow per share earnings growth, which is why analysts are usually focused on this metric. This is even more reliable when we have a stable company like Qualcomm. In our case, the estimated EPS growth of 15% resembles a potential upside for the stock, but be careful because markets start pricing this in, on the earnings report date - which was Nov.5.2021 for Qualcomm.

The price target average is US$200, and we estimate the company to have an intrinsic value of US$186 per share. Looking at the spread of price target estimates, we see that the most bullish analyst values QUALCOMM at US$225 per share, while the most bearish prices it at US$163. A wide spread like this implies some volatility, but industry trends suggest a steady growth in earnings and revenue.

Qualcomm also pays a small but stable 1.5% dividend yield. This may start increasing as the company optimizes for cash flow generation and investors can slowly start considering the Qualcomm as an income stock.

Conclusion

Qualcomm is a growing company in a developing industry and delivering positive cash flows for investors. The stock seems to be trading around intrinsic value, so there isn't much concern of it being overvalued.

The price may fluctuate, but the growth direction is positive, and the company seems to be optimizing for cash flows for investors.

Considering this, Qualcomm may still be a good stock for investors that want to enter the 5G landscape.

Even so, be aware that QUALCOMM is showing 2 warning signs in our investment analysis , you should know about...

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives