- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

How Investors Are Reacting To QUALCOMM (QCOM) Facing Chinese Antitrust Probe Over Autotalks Deal

Reviewed by Sasha Jovanovic

- In recent days, Chinese regulators launched an antitrust investigation into Qualcomm’s acquisition of Autotalks, citing suspected violations of anti-monopoly law amid incomplete disclosure of deal details. This regulatory action comes during escalating US-China trade tensions, presenting new challenges for international semiconductors operating in the region.

- The probe underscores the growing impact of geopolitical and regulatory risks on U.S. technology firms with substantial exposure to China.

- We’ll explore how this heightened regulatory scrutiny may influence Qualcomm’s future growth prospects and risk factors within its investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

QUALCOMM Investment Narrative Recap

To be a Qualcomm shareholder today, it’s essential to believe in the company’s ability to expand beyond smartphones into AI-powered devices, automotive, and IoT, while managing risks from regulatory scrutiny and volatile global trade. The recent Chinese antitrust probe adds uncertainty around Qualcomm’s deal-making and ongoing access to the Chinese market, but it does not drastically alter the primary short-term catalyst: accelerating adoption of AI and connected automotive solutions. However, regulatory risk has become more acute in the near term as a result.

Among recent announcements, Qualcomm’s legal victory against Arm Ltd. stands out as most relevant. This outcome bolsters Qualcomm’s position to defend its intellectual property and reinforces confidence during a period marked by both legal and regulatory scrutiny, now heightened by the Chinese investigation, and plays directly into risks associated with global rule changes affecting patent licensing, a cornerstone of Qualcomm’s business.

By contrast, investors should also keep in mind emerging headwinds related to escalating global trade tensions and new regulatory hurdles that may…

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's narrative projects $46.9 billion revenue and $12.2 billion earnings by 2028. This requires 2.7% yearly revenue growth and a $0.6 billion earnings increase from $11.6 billion today.

Uncover how QUALCOMM's forecasts yield a $177.71 fair value, a 10% upside to its current price.

Exploring Other Perspectives

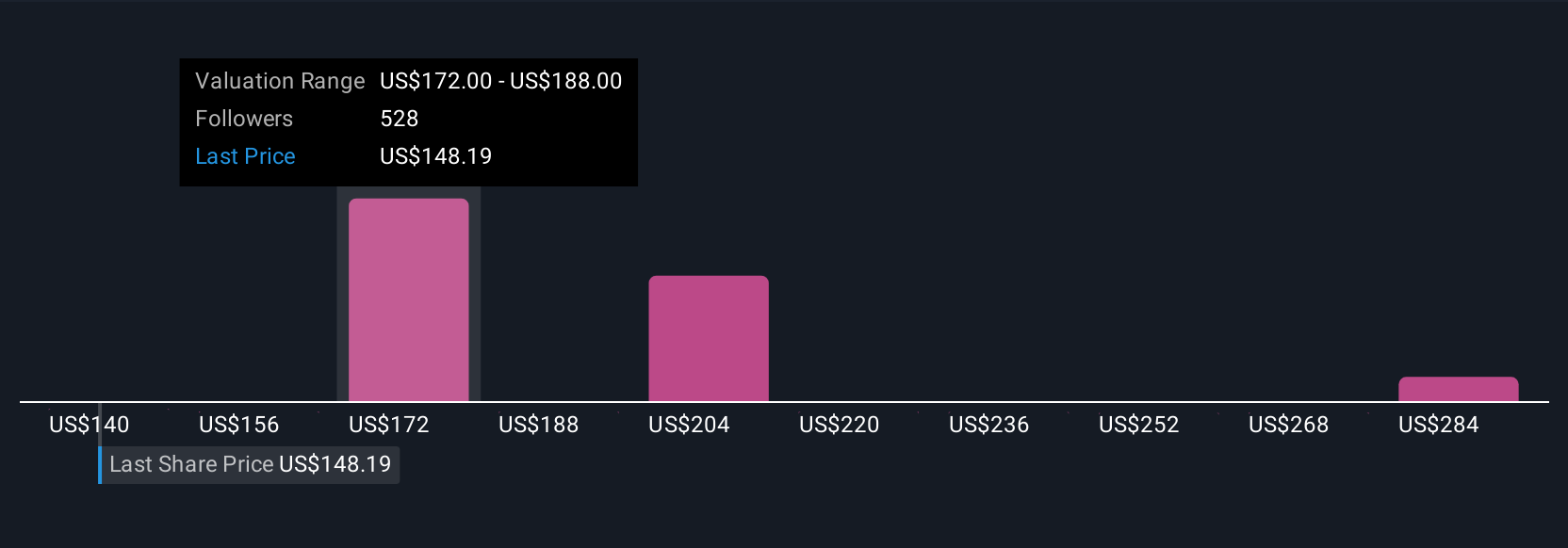

Thirty-eight members of the Simply Wall St Community placed Qualcomm’s fair value between US$140 and US$300, showing broad disagreement in outlook. While the community anticipates multiple scenarios, recent regulatory challenges highlight why broader market access remains a key concern for the company’s future growth.

Explore 38 other fair value estimates on QUALCOMM - why the stock might be worth 13% less than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

No Opportunity In QUALCOMM?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026