- United States

- /

- Semiconductors

- /

- NasdaqCM:PRSO

The Market Doesn't Like What It Sees From Peraso Inc.'s (NASDAQ:PRSO) Revenues Yet As Shares Tumble 31%

To the annoyance of some shareholders, Peraso Inc. (NASDAQ:PRSO) shares are down a considerable 31% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 93% loss during that time.

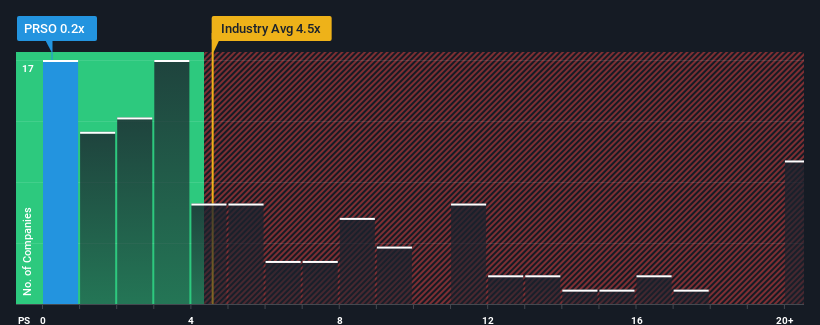

After such a large drop in price, Peraso's price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4.5x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Peraso

What Does Peraso's P/S Mean For Shareholders?

Peraso hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Peraso.How Is Peraso's Revenue Growth Trending?

In order to justify its P/S ratio, Peraso would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's top line. Even so, admirably revenue has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 44% growth forecast for the broader industry.

In light of this, it's understandable that Peraso's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Peraso's P/S

Peraso's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Peraso maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Peraso (3 are a bit concerning) you should be aware of.

If you're unsure about the strength of Peraso's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRSO

Peraso

A fabless semiconductor company, develops, markets, and sells semiconductor devices and antenna modules in North America, Hong Kong, Taiwan, and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives