- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Will Photronics' Growth Story Continue After Recent Earnings Beat?

Reviewed by Bailey Pemberton

Thinking about what to do with Photronics stock? You are not alone. Whether you have been watching the semiconductor supply chain surge or just noticed the stock's roller coaster curve, there is plenty to consider if you are weighing whether to buy, hold, or move on. Over the past week, Photronics popped modestly by 1.1%, climbing 4.0% in the last 30 days, even as the year-to-date number is slightly negative at -1.9%. Zoom out, though, and the picture gets interesting: the stock is up an eye-catching 61.2% over three years and a striking 125.4% over five. These moves seem to echo the renewed interest in chip manufacturing as global demand for advanced electronics holds firm, keeping Photronics on the radar for those who look beyond the headlines.

What does all this mean for valuation? Based on six key checks of value, Photronics scores a 3, suggesting it is undervalued in half of these critical areas. It is not often that a stock with this kind of long-term momentum still shows pockets of potential value left to unlock. In the next sections, we will break down how these valuation methods stack up. Plus, reveal a smart way to frame valuation that goes a step further than the usual scorecard.

Why Photronics is lagging behind its peers

Approach 1: Photronics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its expected future cash flows and discounting them back to today’s dollars. This method gives investors a sense of what the company’s business is worth based on fundamental operations rather than current market swings.

Photronics’ most recent free cash flow stands at $81.0 Million. According to the projections, annual free cash flow is expected to fluctuate slightly over the next decade, ranging from an estimated $71.1 Million in 2026 to $66.3 Million by 2035, reflecting modest declines and small rebounds over the period. Analysts commonly provide forecasts up to five years, so projections for later years are extrapolated, offering a long-term lens for potential valuation.

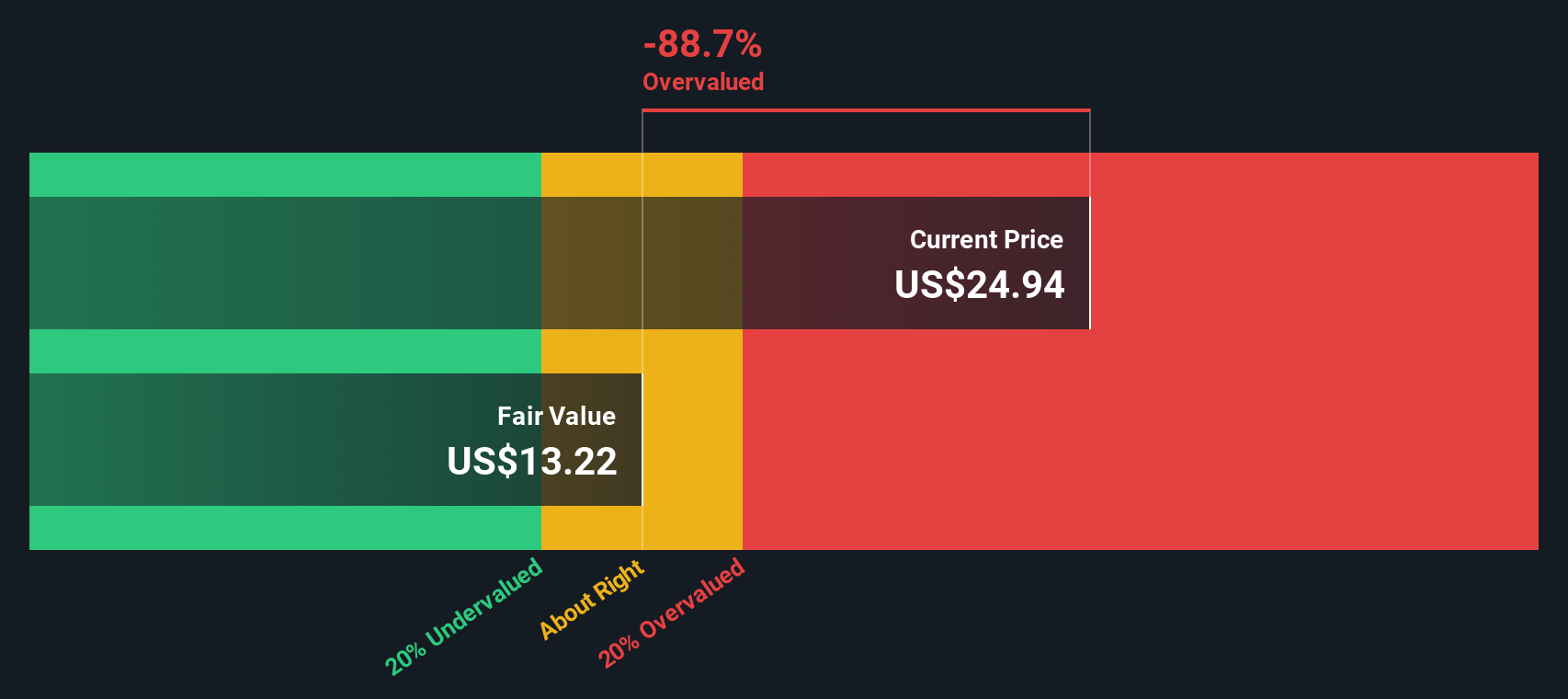

Using these cash flow projections and the two-stage Free Cash Flow to Equity model, the DCF calculation estimates Photronics’ intrinsic value at $13.01 per share. Given that the DCF-implied discount is -80.9%, the stock currently trades at a significant premium to its calculated intrinsic value. This spotlights it as 81.0% overvalued based on this framework.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Photronics may be overvalued by 81.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Photronics Price vs Earnings

For profitable companies like Photronics, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. The PE ratio is a quick way to assess how much investors are willing to pay today for a dollar of the company’s earnings. Generally, a higher PE suggests greater growth expectations or lower perceived risk, while a lower PE can reflect more muted growth prospects or higher risks. This is why “fair” or normal PE ratios can differ widely across industries and individual companies.

Photronics currently trades at a PE ratio of 12.8x. That is significantly below the semiconductor industry average of 38.4x and even further below the peer average of 34.3x. This highlights that investors are paying much less per dollar of Photronics' earnings compared to other names in the space.

To provide a more tailored benchmark, Simply Wall St calculates a proprietary “Fair Ratio.” In this case, the Fair Ratio for Photronics is 19.3x. Unlike simple peer or industry averages, the Fair Ratio incorporates a wider view. It weighs company-specific factors like earnings growth rates, profit margins, risk levels, as well as Photronics' industry and market cap. This delivers an apples-to-apples baseline that better reflects the company's unique financial story.

Comparing the current PE of 12.8x with the Fair Ratio of 19.3x, Photronics appears undervalued on this metric. The company is trading noticeably below what would be expected based on its fundamentals and sector dynamics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Photronics Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, the reasoning and perspective behind your estimates of Photronics’ future revenue, earnings, profit margins, and ultimately, its fair value. By connecting the company’s journey, key industry drivers, and risks directly to your financial expectations, Narratives help turn abstract numbers into a concrete investing thesis.

Narratives are more than just a scorecard; they are an interactive tool available to every investor on Simply Wall St’s Community page, giving millions of users an easy way to spell out their assumptions, reflect on their convictions, and see their fair value calculations in real time. When you create or explore a Narrative, you can immediately check how the fair value it generates compares with today’s share price, making it simple to decide whether you think the stock is a buy, hold, or sell at current levels.

What makes Narratives truly powerful is that they are kept up to date automatically. When new news breaks or earnings arrive, your story and fair value refresh accordingly. For example, some investors using the highest forecast for Photronics see fair value at $33.00 per share due to strong margin and growth assumptions, while others with more conservative views see it as low as $13.01, reflecting different beliefs about future opportunity and risk.

Do you think there's more to the story for Photronics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives