- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

3 Stocks That May Be Undervalued By The Market In November 2025

Reviewed by Simply Wall St

In November 2025, the United States stock market has experienced significant volatility, with major indices like the Nasdaq and S&P 500 posting losses despite initial gains driven by strong earnings from companies such as Nvidia. Amidst this turbulence, investors may find opportunities in stocks that appear undervalued by the market; these stocks often possess solid fundamentals that could be overlooked during broader market downturns.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.33 | $62.85 | 48.6% |

| Northwest Bancshares (NWBI) | $11.30 | $22.10 | 48.9% |

| Mobileye Global (MBLY) | $10.77 | $20.98 | 48.7% |

| Li Auto (LI) | $17.65 | $34.84 | 49.3% |

| Horizon Bancorp (HBNC) | $15.72 | $30.82 | 49% |

| Hasbro (HAS) | $76.76 | $150.45 | 49% |

| Griffon (GFF) | $68.00 | $133.45 | 49% |

| First Solar (FSLR) | $245.84 | $480.58 | 48.8% |

| Crocs (CROX) | $78.51 | $156.32 | 49.8% |

| BCB Bancorp (BCBP) | $7.53 | $14.65 | 48.6% |

Let's review some notable picks from our screened stocks.

Veracyte (VCYT)

Overview: Veracyte, Inc. is a diagnostics company operating both in the United States and internationally, with a market cap of $3.16 billion.

Operations: The company's revenue is derived from its Diagnostic Products and Biopharmaceutical Services segment, which generated $495.14 million.

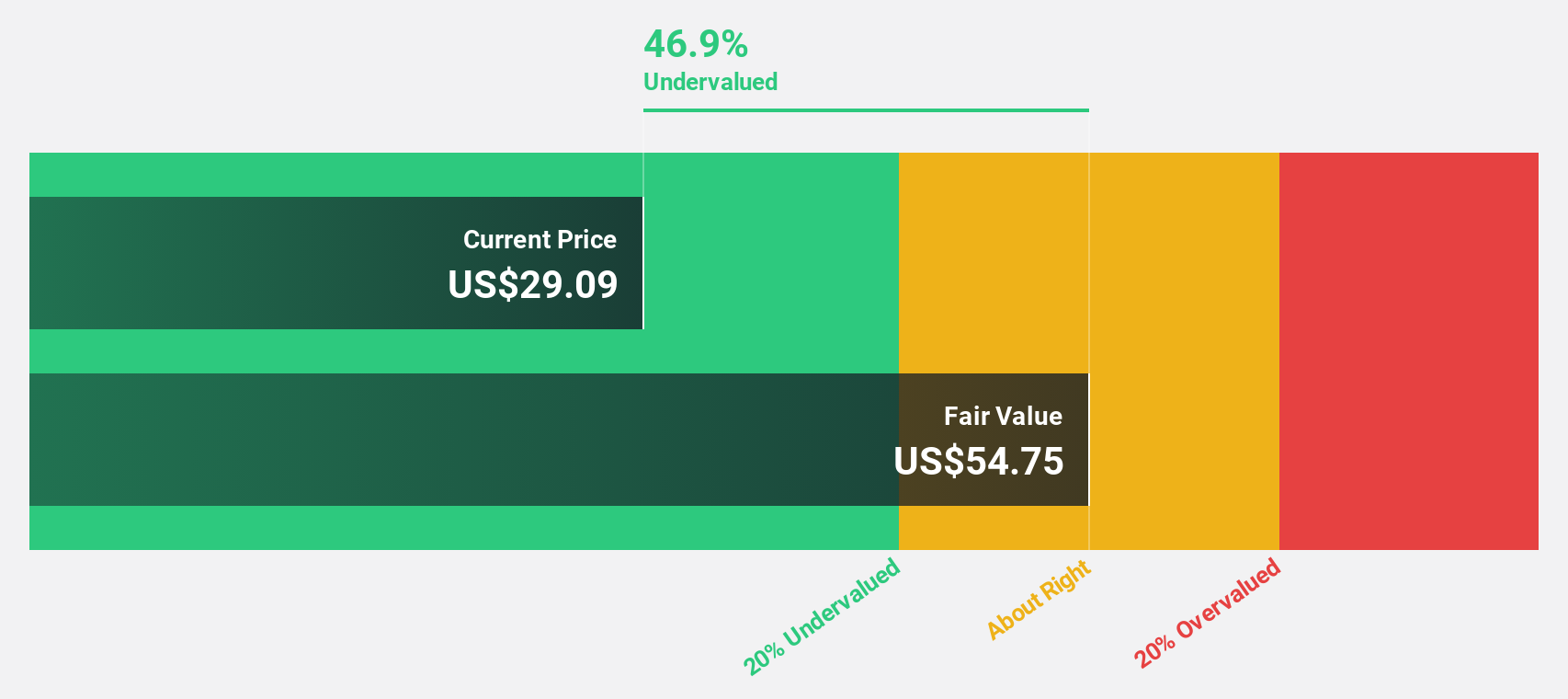

Estimated Discount To Fair Value: 32.6%

Veracyte is trading at US$40.85, below its estimated fair value of US$60.65, suggesting potential undervaluation based on cash flows. Recent earnings show a net income increase to US$19.14 million for Q3 2025, with revenue rising to US$131.87 million year-over-year. The company revised its 2025 revenue guidance upwards to between US$506 million and US$510 million, indicating solid financial health and growth prospects supported by innovative research tools like Afirma GRID and Decipher GRID.

- Our expertly prepared growth report on Veracyte implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Veracyte.

Impinj (PI)

Overview: Impinj, Inc. operates a cloud connectivity platform across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of $4.49 billion.

Operations: The company's revenue is primarily derived from the development and sale of its RAIN products and services, totaling $359.80 million.

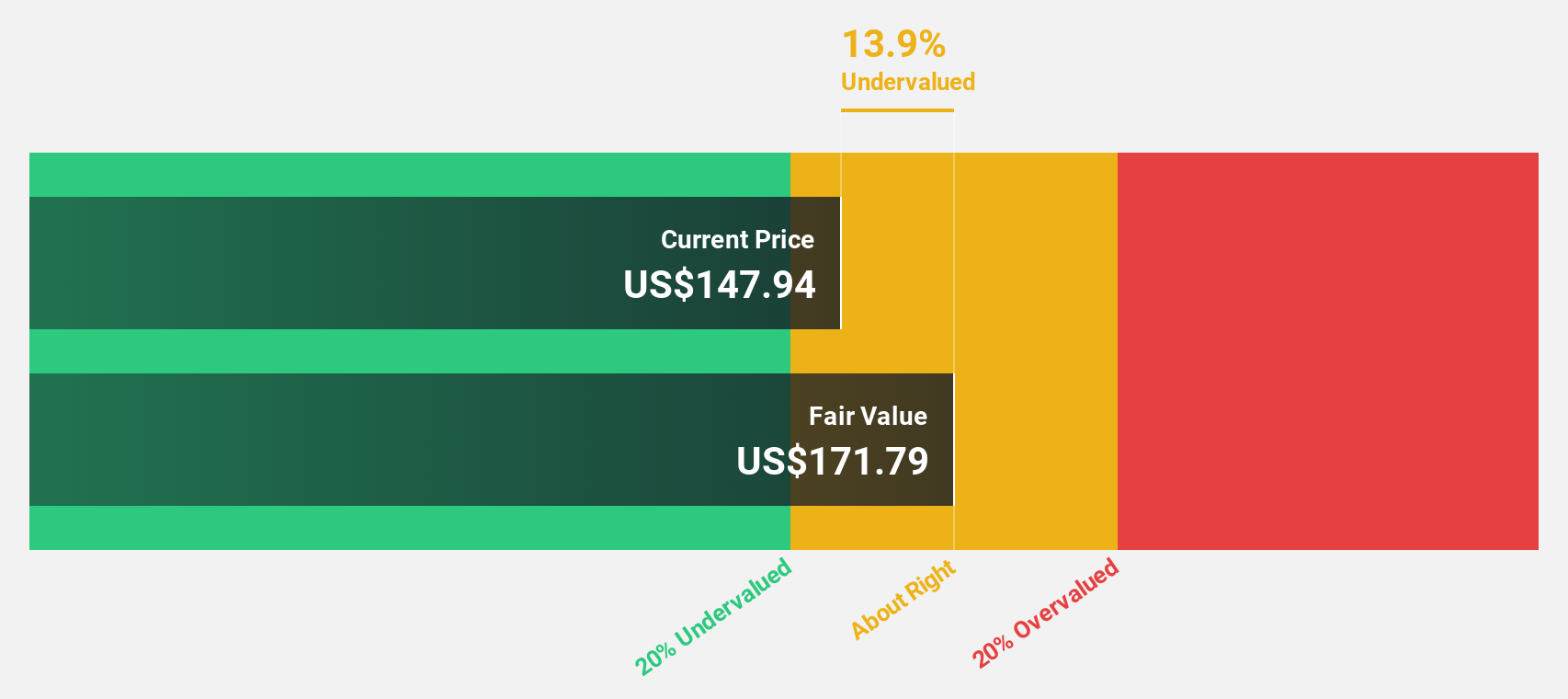

Estimated Discount To Fair Value: 13.9%

Impinj, trading at US$147.94, is below its fair value estimate of US$171.79. The company forecasts a significant annual earnings growth rate of 122.3%, with revenue expected to grow faster than the US market average. Despite recent quarterly losses, Impinj's innovative Gen2X technology and expanded office space signal strategic growth initiatives. Analysts anticipate a 63% stock price rise, reflecting confidence in future profitability and cash flow potential amidst current undervaluation concerns.

- According our earnings growth report, there's an indication that Impinj might be ready to expand.

- Take a closer look at Impinj's balance sheet health here in our report.

CareTrust REIT (CTRE)

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing skilled nursing, senior housing and other healthcare-related properties in the United States and the United Kingdom, with a market cap of approximately $8.16 billion.

Operations: The company's revenue is primarily derived from investments in healthcare-related real estate assets, totaling $428.48 million.

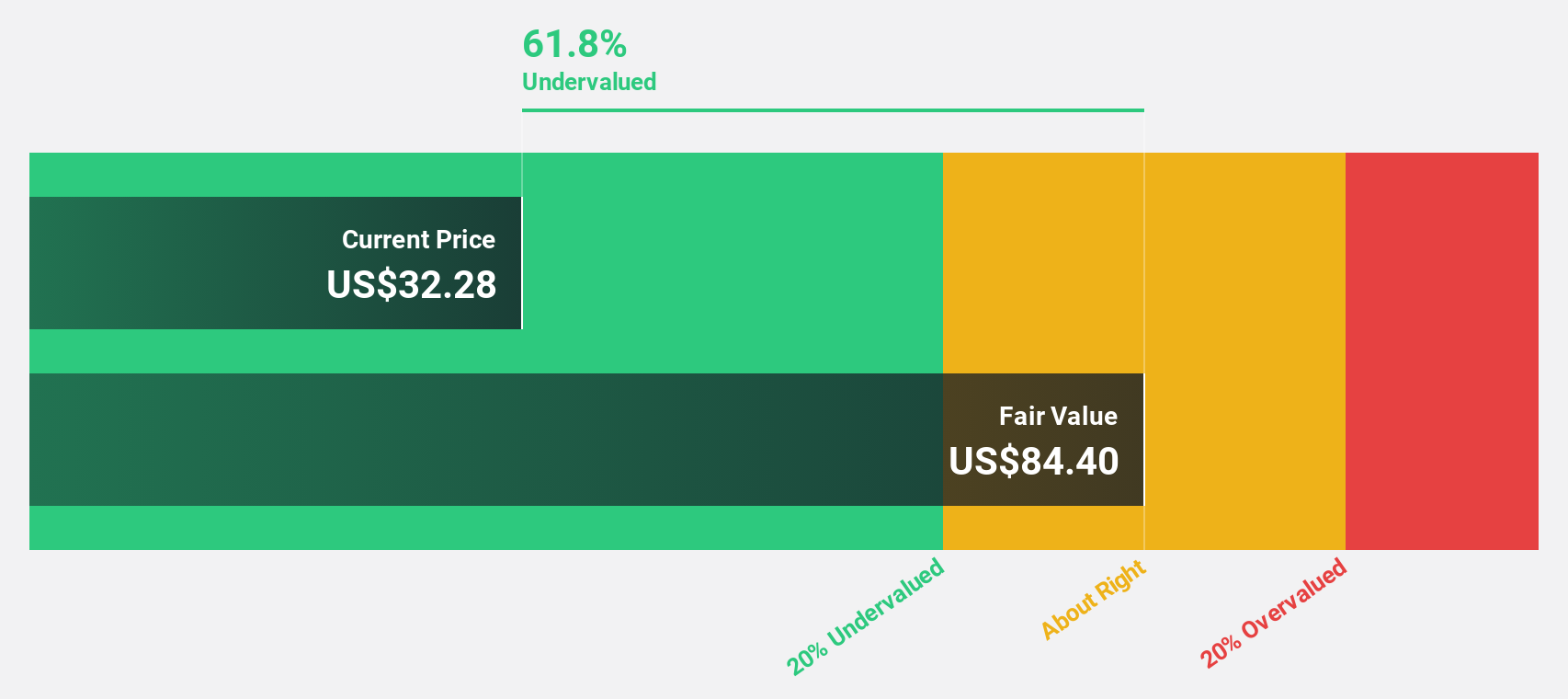

Estimated Discount To Fair Value: 37.3%

CareTrust REIT, trading at US$36.21, is significantly undervalued compared to its fair value estimate of US$57.76. Despite a low forecasted return on equity and recent shareholder dilution, its earnings are expected to grow substantially at 20.9% annually, outpacing the broader market's growth rate. Recent acquisitions in the UK and strong quarterly performance highlight strategic expansion and robust cash flow potential, although dividend coverage remains a concern for investors focused on sustainability.

- In light of our recent growth report, it seems possible that CareTrust REIT's financial performance will exceed current levels.

- Navigate through the intricacies of CareTrust REIT with our comprehensive financial health report here.

Turning Ideas Into Actions

- Reveal the 215 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives