- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): Valuation Check After New 64GB DDR5-6400 ECC Module Launch

Reviewed by Simply Wall St

Penguin Solutions (PENG) just expanded its SMART DDR5 lineup with new 64GB DDR5 6400 ECC CSODIMM modules, a targeted move at high performance industrial, edge, telecom, and networking workloads.

See our latest analysis for Penguin Solutions.

The new DDR5 launch comes as Penguin Solutions shares trade at $21.83, with a solid year to date share price return suggesting early momentum, even though the 1 year total shareholder return and the 3 year total shareholder return point to a steadier, longer term compounding story rather than a sudden breakout.

If this kind of infrastructure upgrade has your attention, it might be worth seeing what else is setting up for the next leg higher across high growth tech and AI stocks.

With shares still trading at a discount to analyst targets and intrinsic value estimates despite steady revenue growth, is Penguin Solutions quietly undervalued here, or is the market already baking in the next leg of AI driven demand?

Most Popular Narrative Narrative: 22.7% Undervalued

With Penguin Solutions last closing at $21.83 versus a narrative fair value of $28.25, the spread points to a sizable upside gap in expectations.

Analysts expect earnings to reach $316.1 million (and earnings per share of $5.85) by about September 2028, up from $-14.9 million today. The analysts are largely in agreement about this estimate.

Curious what kind of revenue climb, margin reset, and future earnings multiple are needed to make that price target stack up? The narrative lays out a surprisingly bold financial roadmap.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue lumpiness from large project deals and tariff exposure in its LED segment could quickly undercut those upbeat margin and valuation assumptions.

Find out about the key risks to this Penguin Solutions narrative.

Another View: Rich on Earnings Today

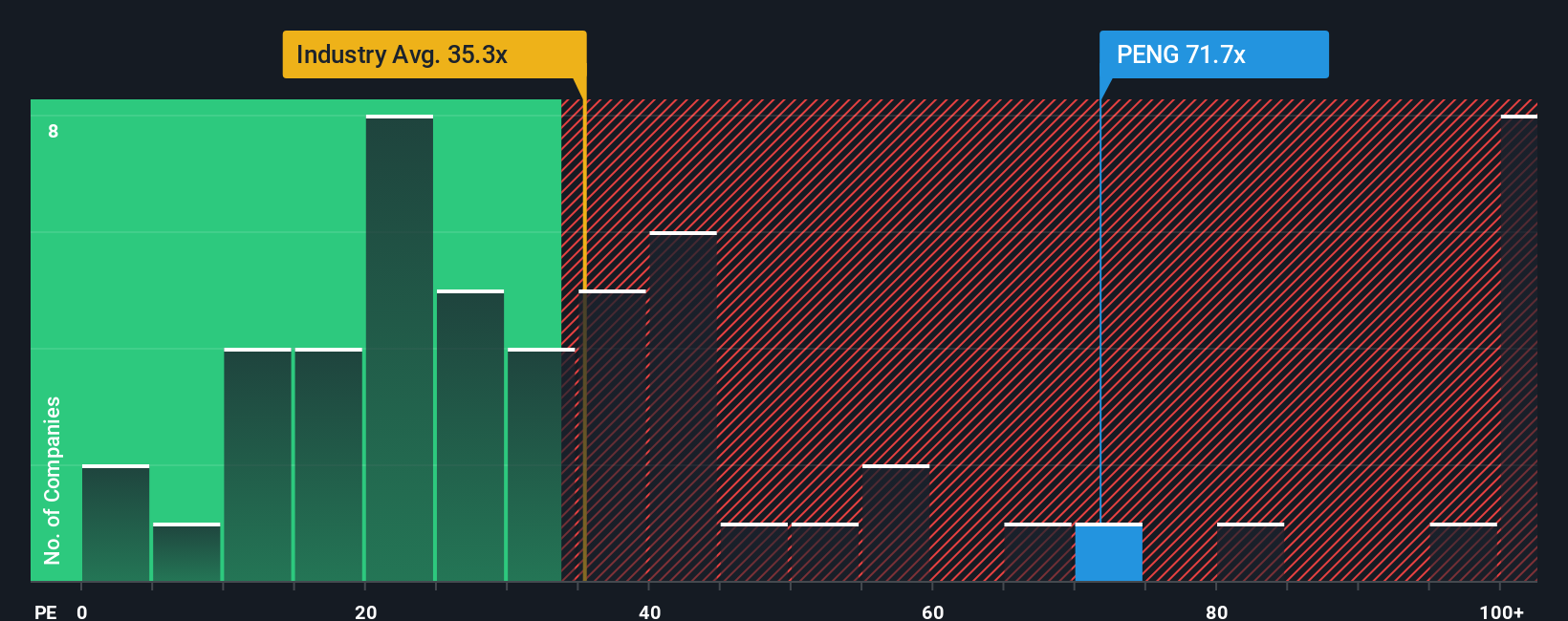

While our fair value work suggests upside, the current 74.6x price to earnings looks steep against the US semiconductor average of 38.1x and even the 63.3x peer average. That premium implies high execution risk, so investors may want to consider whether they are already paying too much for the AI story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If you see the numbers differently or want to stress test your own thesis, you can spin up a customized narrative in just a few minutes: Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction investment ideas?

Before you move on, put Penguin Solutions in context by scanning other opportunities that might compound faster, pay you more income, or reshape entire industries.

- Capture potential mispricings by targeting companies that look overlooked on cash flow metrics through these 905 undervalued stocks based on cash flows.

- Ride structural growth in automation, data, and intelligent software by focusing on innovation centered businesses via these 25 AI penny stocks.

- Boost your portfolio’s income engine with companies that combine yield and staying power using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion