- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): Evaluating Valuation After Strong Earnings, $75M Buyback, and Cautious 2026 Outlook

Reviewed by Kshitija Bhandaru

Penguin Solutions (PENG) is in the spotlight after releasing its latest quarterly results and announcing a new $75 million stock buyback plan. Investors are weighing the company’s solid 2025 earnings in comparison with concerns about future growth and profit margins.

See our latest analysis for Penguin Solutions.

It’s been a dramatic period for Penguin Solutions. While management announced upbeat long-term partnerships and rolled out a sizable new buyback, the market has focused on softer sales guidance and narrower margins. That has led to a steep 19.7% seven-day share price decline, even though long-term investors are still sitting on an 8.8% one-year total shareholder return and a robust 65% total return over three years. Momentum has clearly faded in the short run as the outlook grows more cautious, but the bigger story remains about Penguin’s shift toward AI infrastructure and future profitability.

If you’re curious about what other companies are showing strong momentum and insider confidence, this is the perfect time to discover fast growing stocks with high insider ownership

With shares retreating despite solid results and a generous buyback plan, investors are now asking whether Penguin Solutions trades at a discount given its recent pullback, or if the weaker sales outlook is already factored in. Is this the setup for a buying opportunity, or is the market wisely pricing in a slower growth phase?

Most Popular Narrative: 22% Undervalued

Penguin Solutions’ most-followed narrative assigns a fair value of $28.25 per share, meaning the last close at $22.04 looks comparatively attractive. Analysts and investors are weighing robust forecasts against recent price weakness and are setting the stage for a bullish case if the company delivers.

“Ongoing digital transformation is expanding the addressable IT infrastructure market, with Penguin's expertise in large-scale, complex deployments and growing channel partnerships (including recent wins and new distribution agreements) positioning the company to capture additional market share and drive topline growth.”

What is fueling this valuation? The key is a set of aggressive growth assumptions—specifically, future profits are expected to rise significantly and improved margins could outpace sector norms. Want a full breakdown of the data and projections driving Penguin’s bullish price estimate? Uncover the surprising details inside the most popular narrative.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue lumpiness or sudden weakness in memory demand could quickly challenge the bullish thesis and drive fresh volatility in Penguin’s share price.

Find out about the key risks to this Penguin Solutions narrative.

Another View: The Risk in Current Market Multiples

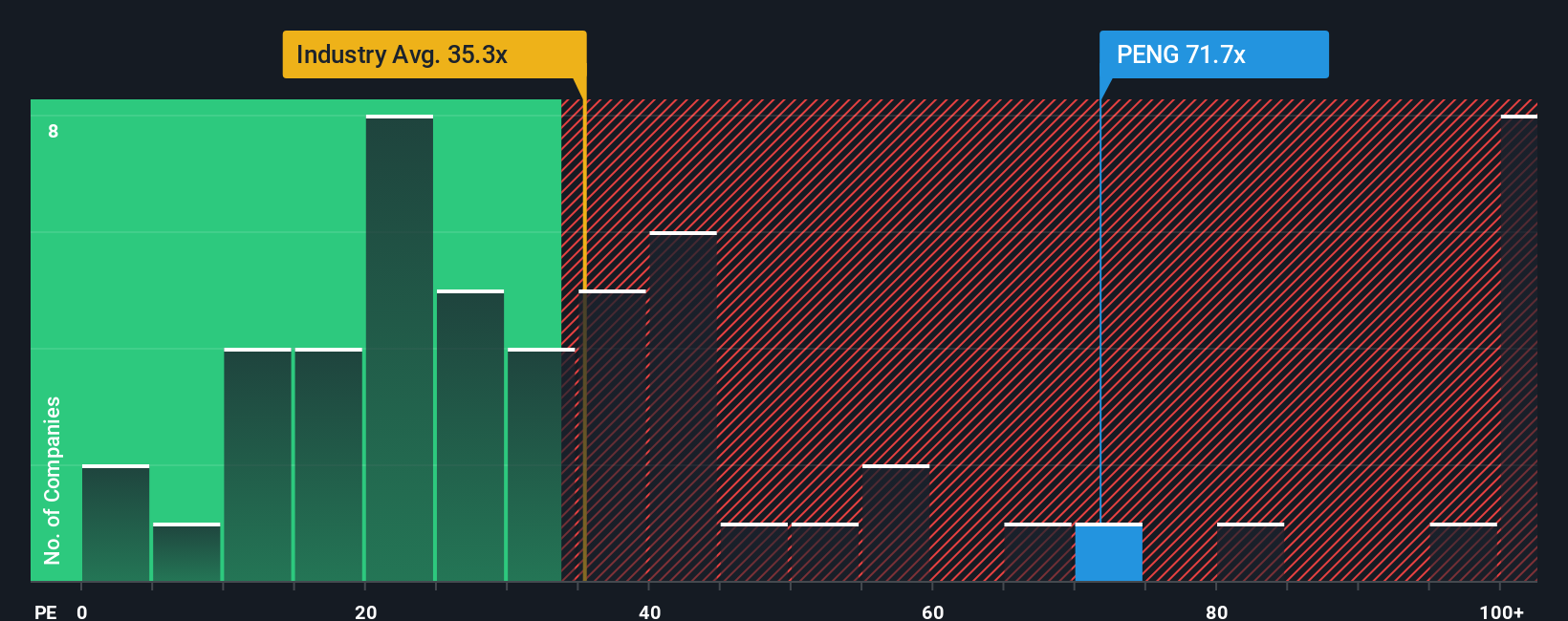

While the analyst-driven fair value looks optimistic, the market tells a different story. Penguin Solutions trades at a much higher price-to-earnings ratio than both its U.S. industry peers and the sector average. This raises red flags about valuation risk. Could this premium signal overenthusiasm or hidden growth potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If you have a different perspective or want to dive into the data yourself, you can craft your own Penguin Solutions story in just minutes. Do it your way

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to stay ahead of the market? Don’t wait while others seize fresh opportunities. Tap into handpicked stocks primed for different trends and strategies right now.

- Capture reliable income by scanning these 18 dividend stocks with yields > 3% offering attractive yields and a history of steady payouts.

- Ride the tech wave with these 25 AI penny stocks that are revolutionizing everything from automation to data analysis.

- Jump on breakthroughs in computing power by targeting these 26 quantum computing stocks pushing the boundaries of what’s possible in the digital age.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Engages in the designing and development of enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives