- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

A Look at Penguin Solutions (PENG) Valuation Following $148.9 Million Shelf Registration Filing

Reviewed by Simply Wall St

Penguin Solutions (PENG) just filed a shelf registration for $148.9 million in common stock, setting the stage for a potential capital raise. If you are following the stock, moves like this do not go unnoticed. Shelf registrations often trigger debates: some investors worry about future dilution, while others see these filings as signals of expansion plans or fiscal maneuvering to fuel growth. Whatever your take, these are the types of events that can quickly reshape expectations.

This filing comes after a stretch of solid price momentum. Over the past year, Penguin Solutions has delivered a return of 36%, building on a steady climb that has carried over from prior years and has gained 29% year-to-date. While there have been a few ups and downs in the sector, the company’s three-year and five-year returns are also impressive, suggesting that investor sentiment has grown more positive even as management pursues aggressive growth strategies. It is in this context that this new shelf filing adds another layer to the story.

The big question now is whether this new development creates a real buying opportunity or if the market has already factored in all the growth ahead for Penguin Solutions.

Most Popular Narrative: 8.3% Undervalued

The prevalent narrative suggests that Penguin Solutions is trading at a discount to its fair value, implying room for upside if the company can execute its ambitious growth plan.

Ongoing digital transformation is expanding the addressable IT infrastructure market. Penguin's expertise in large-scale, complex deployments and growing channel partnerships, including recent wins and new distribution agreements, is positioning the company to capture additional market share and drive topline growth.

Curious about why analysts think Penguin’s upside is still in play? The engine behind that price target is a mix of notable sales growth, shifting profit margins, and a forward-looking earnings multiple drawn from the technology sector. Ready to see the financial projections that justify this narrative’s fair value? The full story might surprise you.

Result: Fair Value of $27.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue lumpiness and tariff exposure could quickly test investor patience if growth does not occur as expected.

Find out about the key risks to this Penguin Solutions narrative.Another View: A Deeper Dive into Valuation

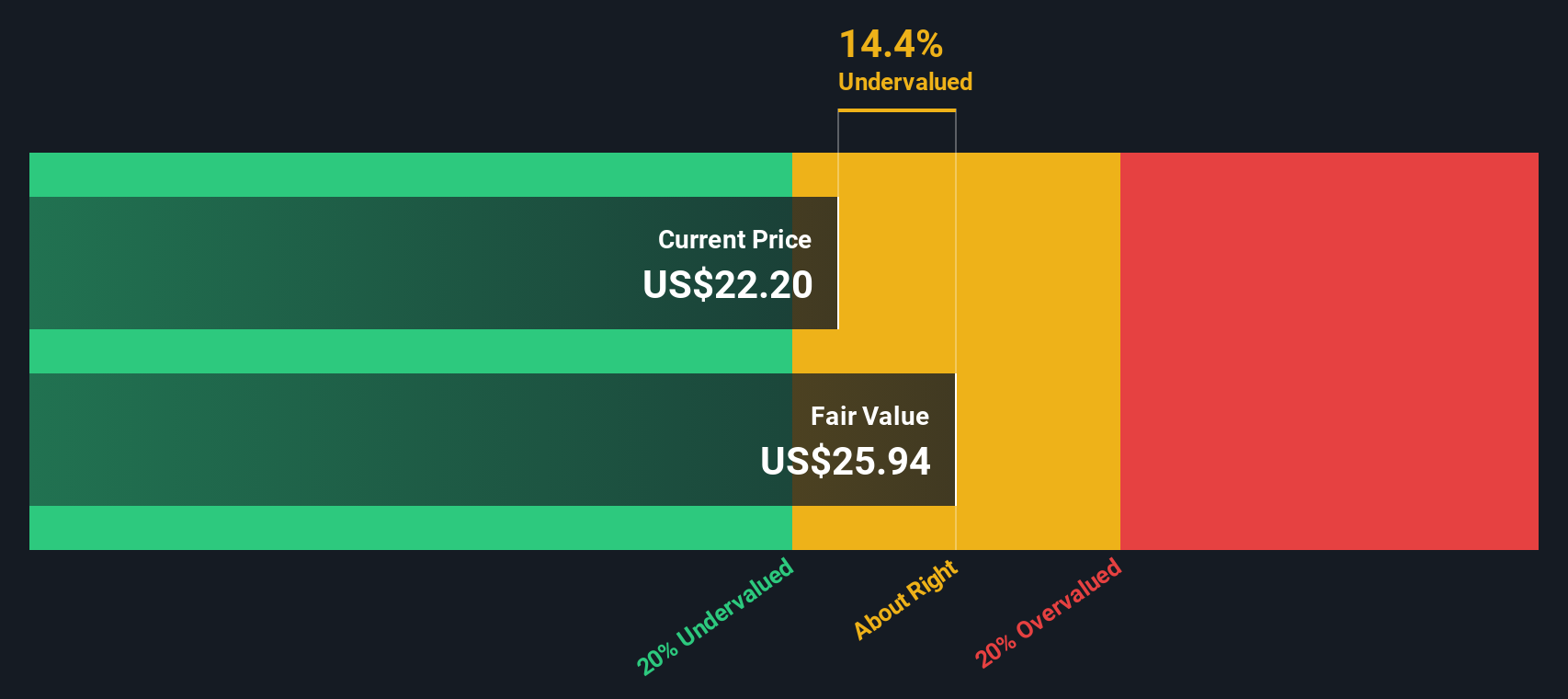

Taking a step back, our DCF model provides a different perspective. It suggests the stock is also trading below its intrinsic value. However, does this method capture all the risks and opportunities ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Penguin Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Penguin Solutions Narrative

If you want to question these conclusions or test your own theories, you can easily build your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Penguin Solutions.

Looking for more investment ideas?

Why settle for just one opportunity when you could be tracking tomorrow’s winners today? Level up your research and catch standout stocks before the crowd does.

- Capture the next wave of undervalued companies positioned for a comeback by using our undervalued stocks based on cash flows.

- Turn your interest toward cutting-edge breakthroughs with quantum computing stocks powering advancements in tomorrow’s technology.

- Pursue reliable income streams by targeting dividend stocks with yields > 3% that deliver consistent yields above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)