- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (ON): Is the Current Valuation Overlooking Long-Term Potential?

Reviewed by Kshitija Bhandaru

ON Semiconductor (ON) shares have moved only slightly in the past week, reflecting a quiet period for the company. Investors continue to watch industry shifts and valuation metrics as they assess the outlook for semiconductor stocks like ON Semiconductor.

See our latest analysis for ON Semiconductor.

After a modest spell this week, ON Semiconductor’s share price reflects a year of fading momentum, with a recent 1-year total shareholder return of -0.31%. That pullback comes after a strong run over the past five years, suggesting that while near-term sentiment is cautious, the longer-term trend highlights the sector’s cyclical nature and continued debate around valuation for semiconductor stocks.

If you’re weighing your next move in the sector, now is an ideal moment to check out the latest opportunities among leading tech and AI stocks with See the full list for free.

With ON Semiconductor's share price lagging despite strong long-term gains and analyst targets sitting above current levels, it raises the question of whether the market is overlooking potential upside or if every catalyst for future growth has already been accounted for.

Most Popular Narrative: 14.4% Undervalued

With ON Semiconductor closing at $49.27, the most widely followed narrative sees the company as trading below its estimated fair value of $57.53. This difference captures optimism around long-term earnings growth, even as near-term momentum lags.

The company's strategic investments in silicon carbide (SiC), wide bandgap technologies, and advanced power management solutions for both automotive and AI data centers position it at the forefront of key structural growth markets. As these high-value products ramp, they are expected to enhance margins and drive long-term earnings growth.

Want to know what financial forecasts power this bold price target? This popular narrative is built on rising profit margins and a valuation multiple lower than today’s. Which future assumptions spark this optimism? Unlock the full story to unmask the key projections behind this discount.

Result: Fair Value of $57.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent manufacturing underutilization or slower adoption of ON Semiconductor’s new products could present challenges for forecasts and limit the expected upside in earnings and margins.

Find out about the key risks to this ON Semiconductor narrative.

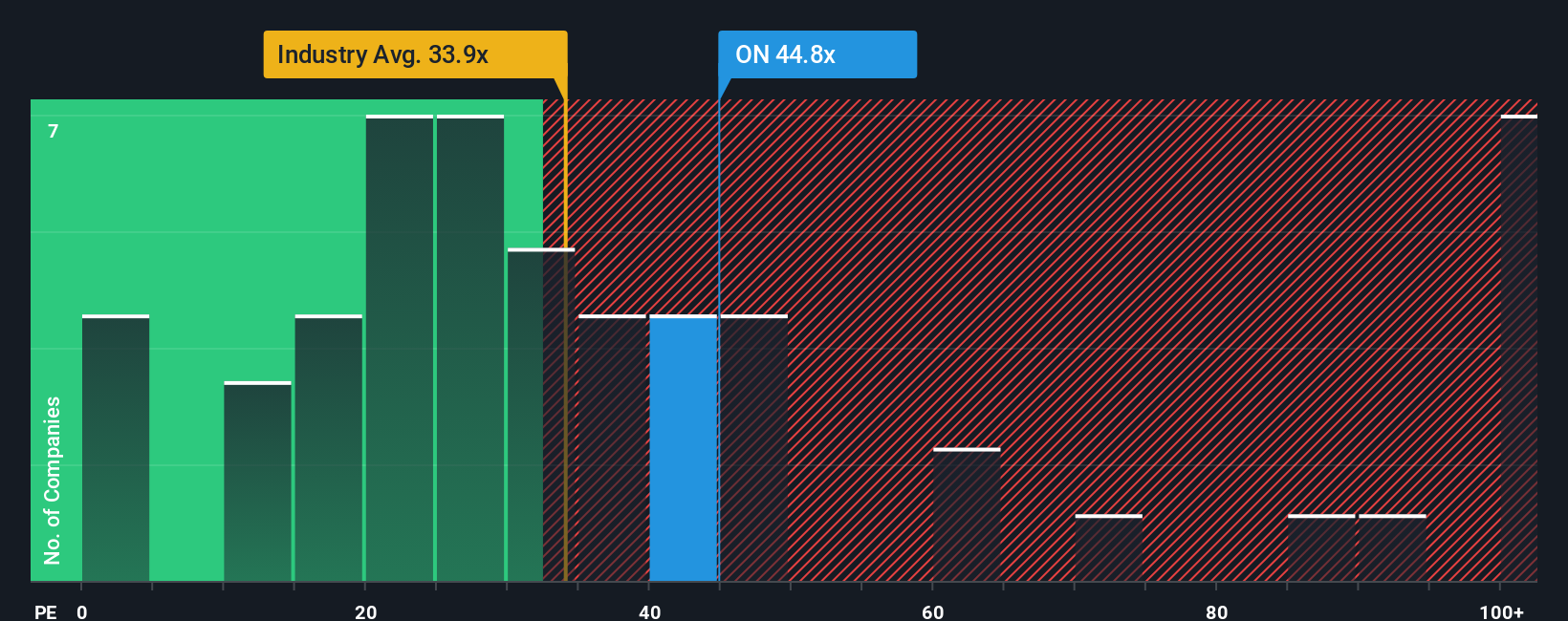

Another View: Market Multiples Raise Questions

Looking at ON Semiconductor from a different angle, the price-to-earnings ratio stands at 43.3x, noticeably higher than both the US semiconductor industry average (37x) and the peer group average (49.3x). While the fair ratio estimate is 48.3x, the current premium hints at potential valuation risk unless future growth accelerates as expected. This gap could signal either opportunity or caution for investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you see things differently or want to dive into the numbers firsthand, you can build your own take in just a few minutes with Do it your way.

A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Uncover new opportunities and stay ahead of market trends with these high-potential ideas from Simply Wall Street:

- Capitalize on game-changing innovations as you assess these 24 AI penny stocks, which are transforming industries with artificial intelligence breakthroughs and rapid adaptation.

- Target reliable income by analyzing these 19 dividend stocks with yields > 3%, which offer strong yields for investors seeking stability and long-term growth.

- Ride the next technology wave by evaluating these 26 quantum computing stocks, which are shaping the future with advanced quantum computing solutions and remarkable growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives