- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (ON): Exploring Today’s Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

ON Semiconductor (ON) has quietly climbed around 9% over the past month, even as its year to date return remains negative. That mix of short term momentum and longer term drag creates an interesting potential entry point for investors to evaluate.

See our latest analysis for ON Semiconductor.

That recent 30 day share price return of about 9% sits against a still negative year to date share price return and a 12 month total shareholder return of roughly minus 18%. This suggests early momentum as sentiment cautiously improves.

If ON Semiconductor’s rebound has caught your eye, this could be a good moment to compare it with other chip names and explore high growth tech and AI stocks for fresh semiconductor and AI opportunities.

So with shares still down over the past year despite solid profit growth and only a small discount to analyst targets, is ON Semiconductor quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 6.7% Undervalued

With ON Semiconductor last closing at $54.79, the most followed narrative pegs fair value modestly higher at $58.70, implying a small upside that hinges on aggressive profit expansion.

The company's strategic investments in silicon carbide (SiC), wide bandgap technologies, and advanced power management solutions for both automotive and AI data centers position it at the forefront of key structural growth markets; as these high-value products ramp, they are expected to enhance margins and drive long-term earnings growth.

Curious how moderate revenue growth can still back a higher price tag? The narrative leans on a profit surge and a compressed future earnings multiple. Want to see how those moving parts fit together? Unlock the full roadmap behind this valuation call and the numbers it quietly depends on.

Result: Fair Value of $58.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could unravel if automotive demand stays weak, or if underutilized fabs delay the hoped for margin and cash flow recovery.

Find out about the key risks to this ON Semiconductor narrative.

Another Lens on Valuation

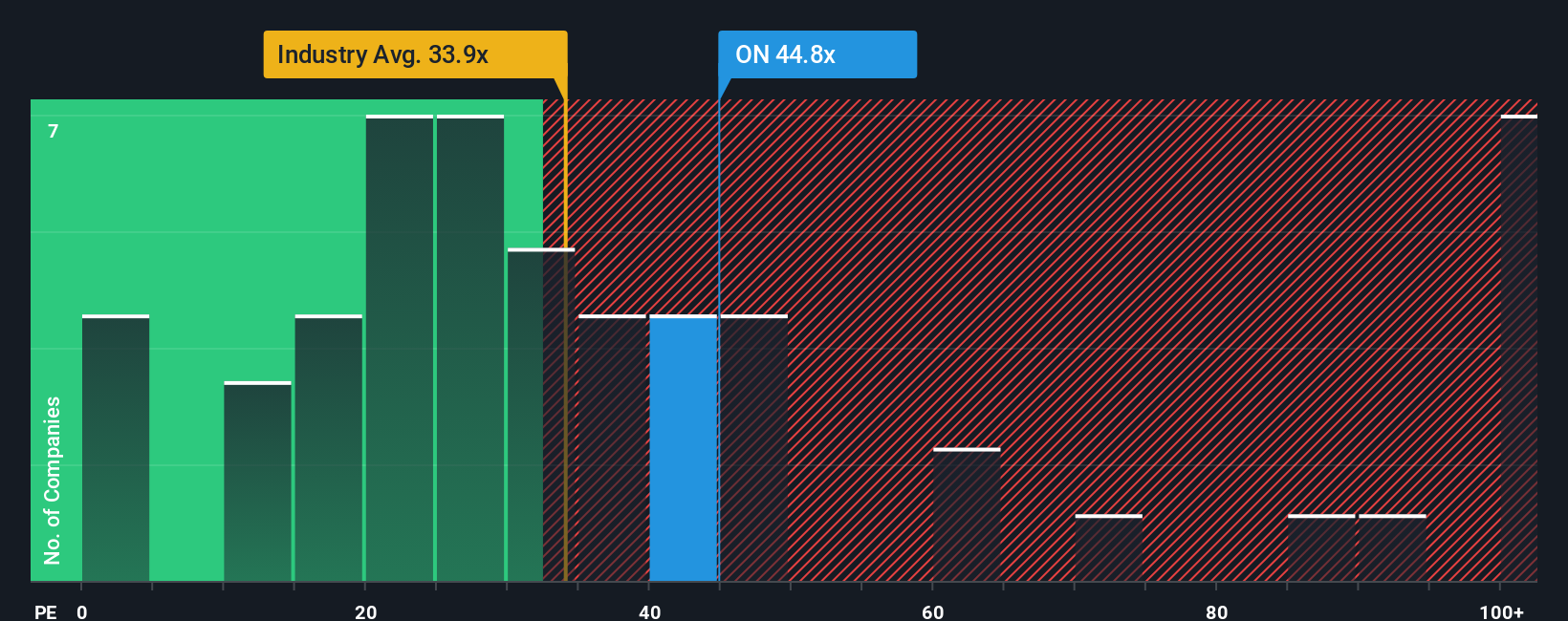

Step away from the narrative assumptions and the picture looks harsher. ON trades on a price to earnings ratio of 69.1 times, versus 37.5 times for the US semiconductor industry, 33.7 times for peers, and a fair ratio of 58 times. This points to meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you are unconvinced by this view or prefer to dig into the numbers yourself, you can craft a personalized narrative in just minutes: Do it your way.

A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more compelling opportunities?

Before you move on, lock in your next potential winners with targeted ideas from the Simply Wall Street Screener, built to surface what others might miss.

- Capture early stage potential by scanning these 3572 penny stocks with strong financials that balance tiny share prices with surprisingly solid business foundations.

- Ride powerful structural trends by zeroing in on these 26 AI penny stocks poised to benefit from surging demand for automation and intelligent software.

- Strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that aim to deliver reliable cash returns alongside long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026