- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (NasdaqGS:ON) Reports Q1 Loss of US$486 Million as Sales Fall

Reviewed by Simply Wall St

ON Semiconductor (NasdaqGS:ON) reported a substantial net loss for the first quarter, with revenue declining significantly compared to the prior year. Surprisingly, despite this challenging performance, the company's stock price surged by 24% over the last month. This sharp rise occurred against the backdrop of a mixed stock market, where the S&P 500 and Dow were striving to maintain their winning streaks. The company's negative earnings announcement and the market's bullish trend likely affected investor sentiment in conflicting ways, yet ON Semiconductor's stock outperformed, indicating unique factors at play beyond the broader market trends.

The recent 24% surge in ON Semiconductor's stock, despite reporting a significant net loss, highlights transient dynamics that could influence the company's continuing focus on automotive, industrial, and AI investments. Over a five-year period, the company's total shareholder return, including both share price and dividends, was a substantial 167.62%. This indicates strong long-term performance, even though it recorded a decline in earnings and revenue in the past year.

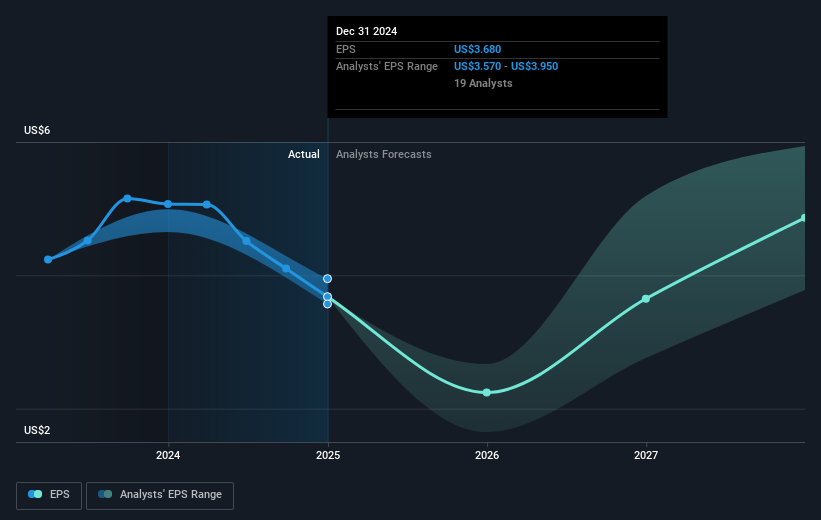

In comparison to the wider industry, ON Semiconductor's stock underperformed over the last year, with the US Semiconductor industry delivering a return of 11.3% during the same timeframe. This short-term underperformance might cast temporary doubts on its strategic direction. However, analysts forecast that the company's revenue growth driven by emerging markets and innovation in EV technology could bolster future earnings, potentially aligning with the longer-term growth trajectory seen so far.

Current share price movement brings it to a significant discount compared to the consensus analyst price target of $54.19, which is a little more than 28% higher than the current price. Such a gap underscores market skepticism about revenue and earnings forecasts, especially in light of recent geopolitical and sector challenges. If ON Semiconductor can effectively navigate these risks, aligning future growth with analyst projections, the recent news might still resonate positively across its financial forecasts.

Assess ON Semiconductor's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives