- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Assessing ON Semiconductor (ON) Valuation After Recent Share Price Recovery

Reviewed by Simply Wall St

ON Semiconductor (ON) shares ticked up slightly today, closing at $49.64 with a 2.8% gain. Investors have been keeping a close eye on the stock’s recent movement, particularly as the company’s year-to-date return remains in negative territory.

See our latest analysis for ON Semiconductor.

ON Semiconductor’s share price has been on a bit of a rollercoaster lately. After a solid jump over the past week, the stock is still down sharply year-to-date and has delivered a steep 1-year total shareholder return of -30.2%. While momentum has picked up in the very short term, longer-term investors have seen a far rougher ride, with the 3-year total return also firmly in negative territory and only the 5-year horizon showing meaningful gains.

If recent market swings have you rethinking your exposure, it may be worth taking a look at other semiconductor and tech stocks. See the full list for free with See the full list for free..

With shares trading nearly 18% below average analyst price targets and the company showing robust recent profit growth, the big question remains: Is ON Semiconductor undervalued, or is the market correctly pricing in all its future growth?

Most Popular Narrative: 15.4% Undervalued

ON Semiconductor's last close of $49.64 is well below the narrative's fair value estimate, suggesting a notable upside based on forward-looking projections. Market sentiment appears divided; however, narrative followers point to ambitious growth plans driving the bullish case.

ON Semiconductor's expanding partnerships and design wins in EV platforms, notably in China, and its increased penetration into next-generation automotive and hybrid vehicle systems position the company to capitalize on the accelerating shift to electrified and autonomous transportation. These tailwinds are likely to drive higher recurring revenues and improved top-line growth.

Want to discover what bold financial leaps support this valuation? The future price tag relies on a powerful combination of recurring revenue, product mix, and margin expansion. Find out which strategic bets could reshape the company's worth and see if you agree with these aggressive assumptions.

Result: Fair Value of $58.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent manufacturing underutilization and increased competition in key markets could undermine ON Semiconductor's optimistic outlook and growth assumptions.

Find out about the key risks to this ON Semiconductor narrative.

Another View: Multiples Tell a Different Story

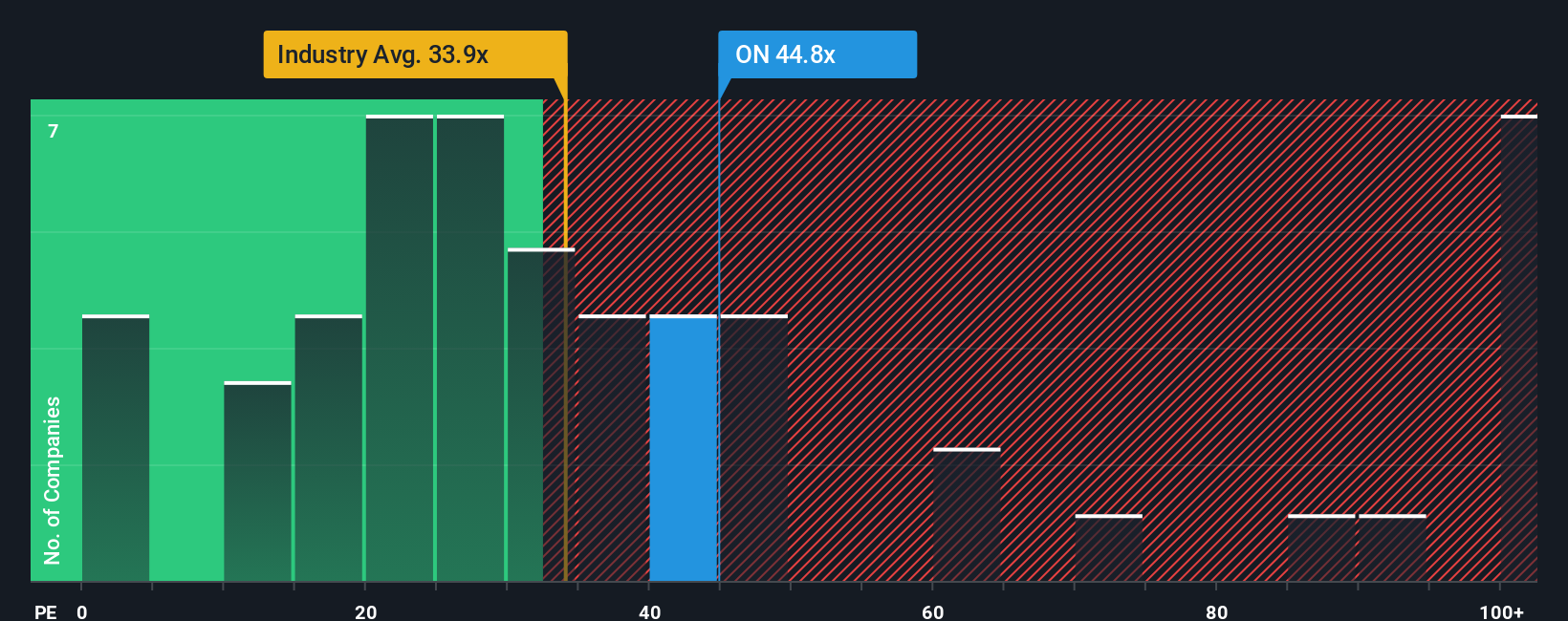

Looking through the lens of price-to-earnings ratios, ON Semiconductor appears expensive. Its P/E comes in at 62.6x, much higher than both the US Semiconductor industry average of 35.8x and the peer average of 34.9x. Even compared to its fair ratio of 54.4x, ON trades at a premium. This could point to elevated valuation risk if fundamentals do not catch up. Are investors overpaying for the future, or could the growth narrative justify the stretch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you have a different take on ON Semiconductor or want a hands-on approach, you can craft your own narrative using live financials and forecasts in just a few minutes. Do it your way

A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Step up your investing strategy with Simply Wall Street’s screeners and uncover unique stock ideas you might be missing. Make your next move count with these standout options:

- Capitalize on rising income streams by starting with these 15 dividend stocks with yields > 3% offering yields above 3% and solid financial foundations.

- Tap into the world of digital transformation by scanning these 25 AI penny stocks to find companies driving innovations in artificial intelligence and automation.

- Access value plays with strong upside potential by reviewing these 927 undervalued stocks based on cash flows that stand out for their attractive cash flow metrics and compelling valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.