- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

A Fresh Look at ON Semiconductor (ON) Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

ON Semiconductor (ON) shares edged up after a week in which the stock gained roughly 11%. While there was no single headline driving the move, investors appear to be reassessing the company's recent performance and future prospects.

See our latest analysis for ON Semiconductor.

ON Semiconductor’s recent 11% rally over the past week highlights just how quickly market sentiment can shift, especially after several months of lackluster returns. While the 1-day share price return of 4.5% and a solid 7-day gain signal that short-term momentum is building, long-term total shareholder returns still trail at -18% over the past year and remain below water for the three-year period. This suggests the company continues to work through broader industry headwinds despite this latest bounce.

If rapid gains like these have you curious about new investing angles, now's the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

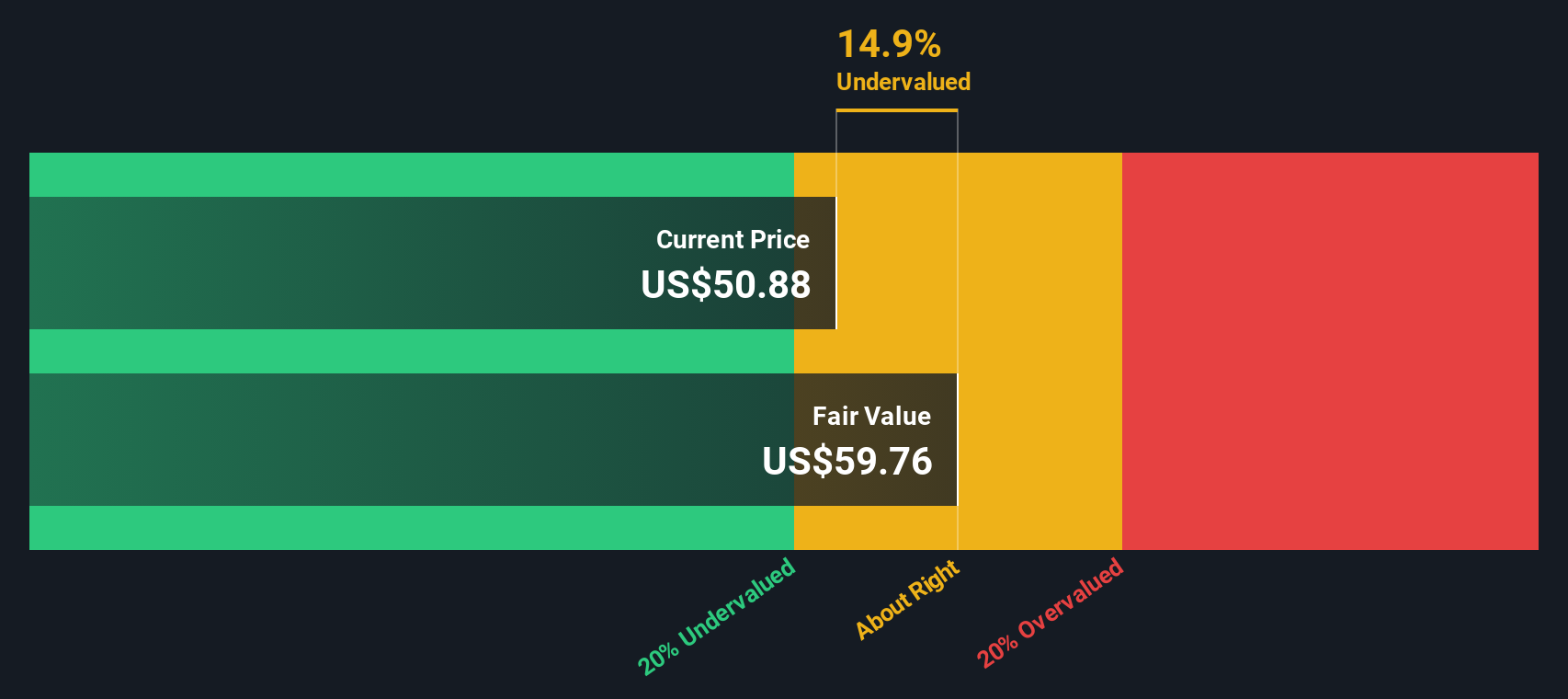

This recent surge raises a key question: Is ON Semiconductor truly trading below its inherent value, or have the market's latest moves already priced in the company's next stage of growth potential?

Most Popular Narrative: 4.6% Undervalued

ON Semiconductor’s most-followed narrative places fair value just above the last close, hinting at modest undervaluation baked into today’s price. With strong attention on the company’s shifting business mix and strategic investments, some notable assumptions are driving this view.

Ongoing portfolio rationalization, phasing out legacy and non-core products, and reallocating resources towards higher-margin, differentiated offerings (such as ADAS image sensing and machine vision) should improve product mix and boost average margins, positively impacting net profitability and earnings leverage.

Curious which future profit margins and growth metrics power this bullish view? The story centers on a fundamental business transformation and expectations for massive earnings acceleration. Can the company achieve the scale and efficiency needed for such a leap? Read on for the exact numbers behind this valuation.

Result: Fair Value of $57.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underutilization of manufacturing capacity and weak demand in key automotive markets could stall ON Semiconductor's margin recovery and top-line growth.

Find out about the key risks to this ON Semiconductor narrative.

Another View: What Does Our DCF Model Say?

Looking at ON Semiconductor through the lens of our DCF model reveals an even more optimistic picture. The SWS DCF fair value estimate comes in at $60.71, higher than both the market price and analyst consensus. This suggests the market may still be conservative about ON’s longer-term earnings potential. Is there hidden value others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ON Semiconductor Narrative

If you see the numbers differently, or would rather investigate ON Semiconductor from your own perspective, you can craft a personalized analysis in just a few minutes. Do it your way

A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh sectors and trends. Accelerate your growth strategy by checking out these powerful opportunities for your next portfolio move:

- Generate consistent income by tapping into these 17 dividend stocks with yields > 3%, which offers robust yields and strong financial foundations.

- Unleash your potential in the fast-moving AI sector with these 24 AI penny stocks, which are poised for disruptive breakthroughs and significant upside.

- Position yourself ahead of the curve by seizing these 3587 penny stocks with strong financials, which deliver impressive financials at accessible entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives