- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Is Universal Display Corporation's (NASDAQ:OLED) Stock's Recent Performance A Reflection Of Its Financial Health?

Universal Display's (NASDAQ:OLED) stock up by 4.9% over the past three months. Since the market usually pay for a company’s long-term financial health, we decided to study the company’s fundamentals to see if they could be influencing the market. Particularly, we will be paying attention to Universal Display's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Universal Display

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Universal Display is:

15% = US$200m ÷ US$1.3b (Based on the trailing twelve months to March 2023).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.15 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Universal Display's Earnings Growth And 15% ROE

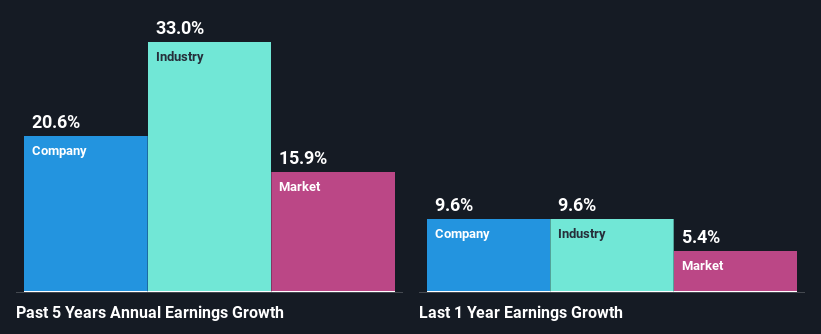

At first glance, Universal Display seems to have a decent ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 16%. This probably goes some way in explaining Universal Display's significant 21% net income growth over the past five years amongst other factors. We reckon that there could also be other factors at play here. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Universal Display's reported growth was lower than the industry growth of 33% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Universal Display fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Universal Display Making Efficient Use Of Its Profits?

Universal Display's three-year median payout ratio to shareholders is 23%, which is quite low. This implies that the company is retaining 77% of its profits. So it looks like Universal Display is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Besides, Universal Display has been paying dividends over a period of six years. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 25% of its profits over the next three years. Accordingly, forecasts suggest that Universal Display's future ROE will be 17% which is again, similar to the current ROE.

Summary

Overall, we are quite pleased with Universal Display's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a respectable growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you're looking to trade Universal Display, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives