- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI): Valuation Check After Pre–Ex-Dividend Rally and Cyclical Recovery Optimism

Reviewed by Simply Wall St

NXP Semiconductors (NXPI) has been drawing fresh attention as its shares climbed into the ex-dividend date, with management emphasizing a narrative of cyclical recovery despite recent dips in revenue and net income.

See our latest analysis for NXP Semiconductors.

That optimism is already showing up in the tape, with NXP’s share price at $227.95 after a strong recent run, a double digit year to date share price return, and a solid multi year total shareholder return profile suggesting momentum is building rather than fading.

If NXP’s latest move has you rethinking your semiconductor exposure, this could be a good moment to explore other high growth tech opportunities through high growth tech and AI stocks.

With shares already up solidly this year and trading only modestly below analyst targets, the key question now is simple: Is NXP still undervalued, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 11.7% Undervalued

With NXP last closing at $227.95 against a narrative fair value of about $258, this view frames the stock as having meaningful upside still in play.

The analysts have a consensus price target of $258.19 for NXP Semiconductors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $289.0, and the most bearish reporting a price target of just $210.0.

Curious how a moderate growth outlook, rising margins and a lower future earnings multiple can still point to upside from here? Unpack the full logic behind this valuation and see which long term assumptions really move the needle on NXP’s fair value.

Result: Fair Value of $258.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on a fragile recovery. Softer automotive demand or renewed China price pressure could quickly undermine the bullish margin narrative.

Find out about the key risks to this NXP Semiconductors narrative.

Another View: Cash Flows Send a Different Signal

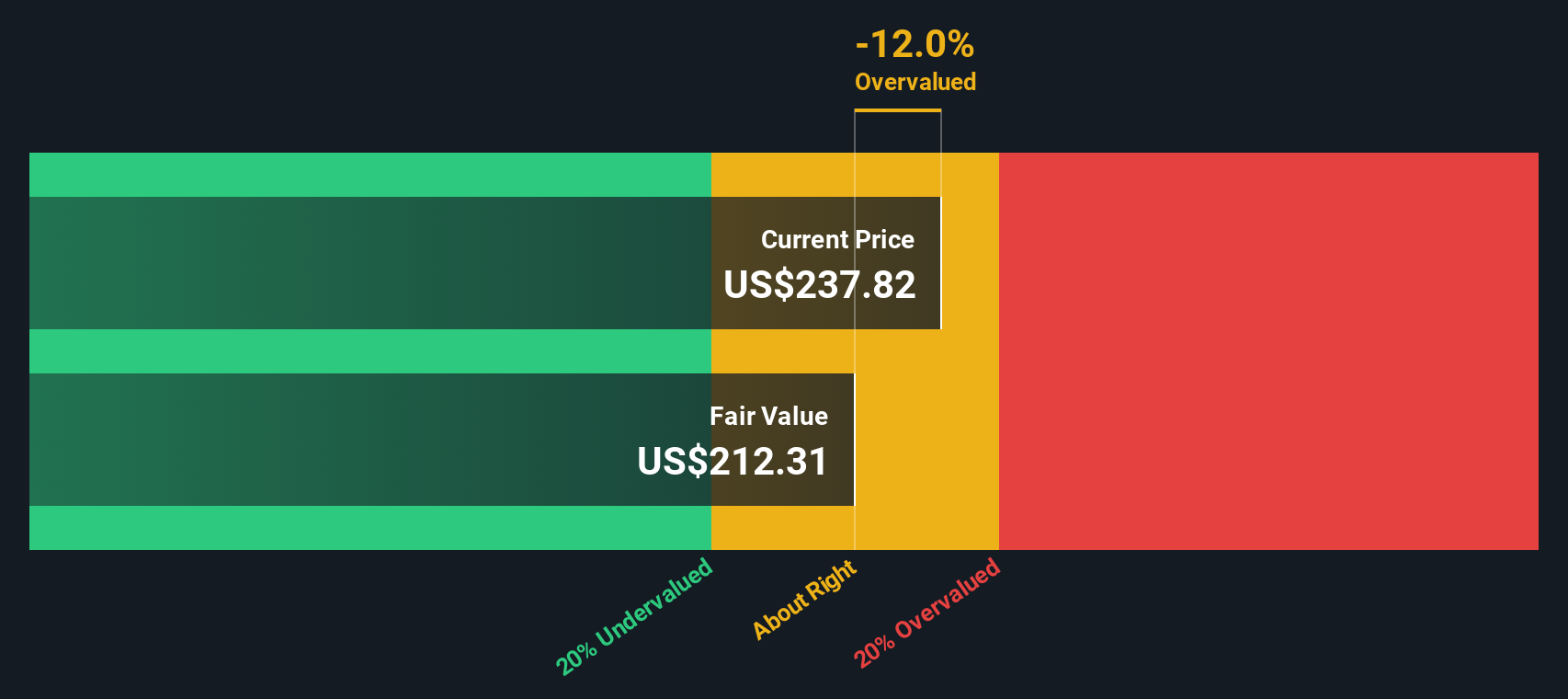

While analyst targets point to upside, our DCF model is more cautious, suggesting NXP is trading around 4.6% above its estimated fair value. That hints at a market already baking in much of the recovery story, so where is the real margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If you are unconvinced by these views or prefer to dive into the numbers yourself, you can build a personalized take in minutes: Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Use the Simply Wall St Screener to pinpoint fresh opportunities that match your strategy so you stay ahead of the crowd, not behind it.

- Capture potential mispricing by targeting quality companies trading below their intrinsic value through these 906 undervalued stocks based on cash flows that could strengthen your long term returns.

- Capitalize on powerful sector trends by focusing on innovators at the intersection of medicine and machine learning using these 30 healthcare AI stocks.

- Position yourself early in the evolving digital asset ecosystem with companies linked to decentralized finance and blockchain via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026