- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors N.V.'s (NASDAQ:NXPI) Business Is Yet to Catch Up With Its Share Price

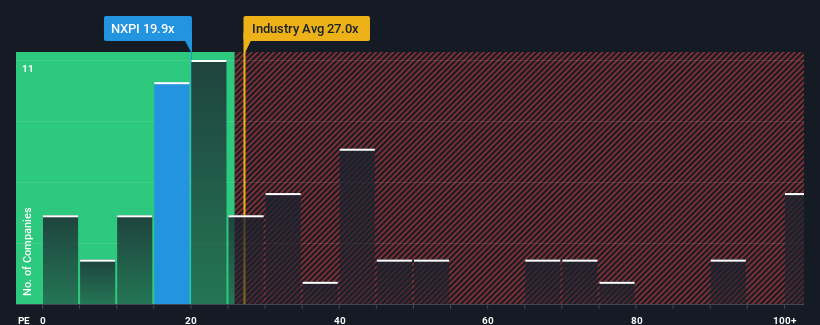

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider NXP Semiconductors N.V. (NASDAQ:NXPI) as a stock to potentially avoid with its 19.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

NXP Semiconductors certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for NXP Semiconductors

How Is NXP Semiconductors' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as NXP Semiconductors' is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.7% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 9.9% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 13% each year growth forecast for the broader market.

With this information, we find it concerning that NXP Semiconductors is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of NXP Semiconductors' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for NXP Semiconductors you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NXPI

NXP Semiconductors

Offers various semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives