- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NasdaqGS:NXPI) Unveils Powerful S32R47 Radar Processors for Autonomous Driving

Reviewed by Simply Wall St

NXP Semiconductors (NasdaqGS:NXPI) has recently introduced its S32R47 imaging radar processors, enhancing its standing in the autonomous driving sector. This product release, aligned with broader market gains marked by increased optimism around US-UK trade deals, coincides with a notable 14% rise in the company's stock over the past month. Despite mixed earnings and executive changes, the market's bullish sentiment, particularly in response to easing trade restrictions benefiting tech stocks, seems to have supported this upward movement. The innovations in radar technology likely reinforced investor confidence amidst broader economic developments.

We've identified 1 possible red flag for NXP Semiconductors that you should be aware of.

The recent introduction of NXP Semiconductors' S32R47 imaging radar processors aligns with broader positive market sentiment, supporting investor optimism. This innovation potentially enhances NXP's positioning in the autonomous driving sector, possibly contributing to future revenue growth by offsetting challenges in global automotive production. In the longer-term context, NXP's total return has been 118% over five years. Despite recent share price movements, which show a 14% rise due to easing trade restrictions and product innovation, the company underperformed both the US Semiconductor industry and broader US market over the past year.

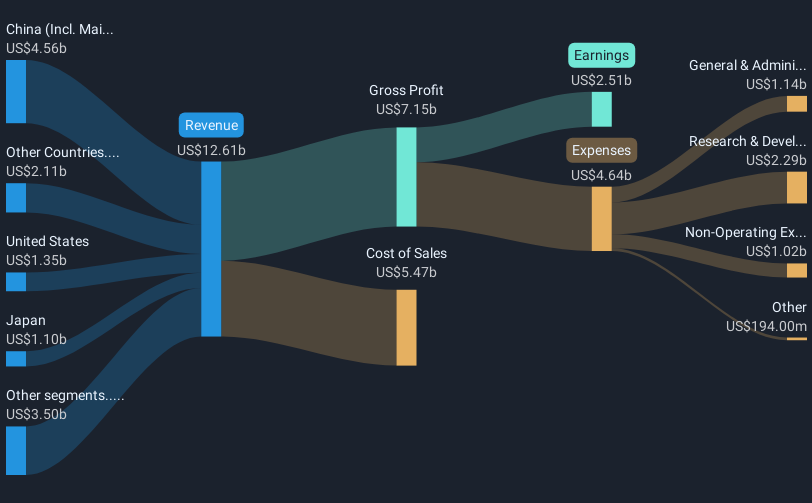

Analysts project NXP's revenue and earnings growth to continue, with revenues expected to increase annually by 5.9% over the next three years and earnings projected to reach $3.3 billion by 2028. These forecasts are contingent on market conditions and execution, particularly regarding acquisitions like Kinara, which aim to boost AI edge computing capabilities. Current valuation insights indicate that while the share price is trading at approximately 22% below the consensus price target of $234.07, there is considerable analyst disagreement. This variability reflects uncertainties related to macroeconomic factors and market performance relative to industry peers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Offers various semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives