- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

A Look at NXP Semiconductors (NXPI) Valuation Following Strong Earnings and Upbeat Outlook

Reviewed by Simply Wall St

There’s plenty for NXP Semiconductors (NasdaqGS:NXPI) investors to unpack after the company posted quarterly results that topped expectations and followed up with a bright outlook for next quarter. Management’s guidance came in strong, reiterating confidence in the business despite the shifting global semiconductor landscape. It is not every day you see a company outperform on both sales and earnings, while also indicating potential for more upside in the near term.

The stock has seen its share of movement. After a modest climb over the past month, shares have lagged the Nasdaq Composite overall during the past quarter and year. But even with a long-term return just under flat for the past year, NXP’s three- and five-year performance stand out with steady multi-bagger gains, powered by growing relevance in automotive chips, AI, and secure connectivity. Investors seem cautiously optimistic, weighing the company’s momentum against year-over-year volatility in the sector.

So do these upbeat results and guidance mark a chance to get ahead of the curve, or are shares already fully pricing in the expected growth ahead?

Most Popular Narrative: 12.4% Undervalued

According to the most widely followed narrative, NXP Semiconductors appears undervalued by just over 12%. This suggests that analysts believe there is notable upside potential compared to its current share price.

Robust demand growth in automotive semiconductors continues, supported by increasing electrification (xEVs), adoption of ADAS/radar, and accelerating interest in software-defined vehicles globally. NXP's strong design win momentum, especially with content-rich solutions like S32 processors and radar, positions the company to realize above-market revenue growth and expanding gross margins as auto content per vehicle rises.

Want to know what’s fueling this bullish outlook? The main factor guiding this valuation is a bold set of financial assumptions involving future profitability trending toward new highs and a valuation multiple that sets an ambitious benchmark. Ready to uncover the details driving this calculation? The key numbers in this narrative could surprise you.

Result: Fair Value of $257.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing revenue declines and fierce competition in China could challenge NXP’s growth trajectory. These factors serve as key risks for investors to watch.

Find out about the key risks to this NXP Semiconductors narrative.Another View: Our DCF Model Paints a Different Picture

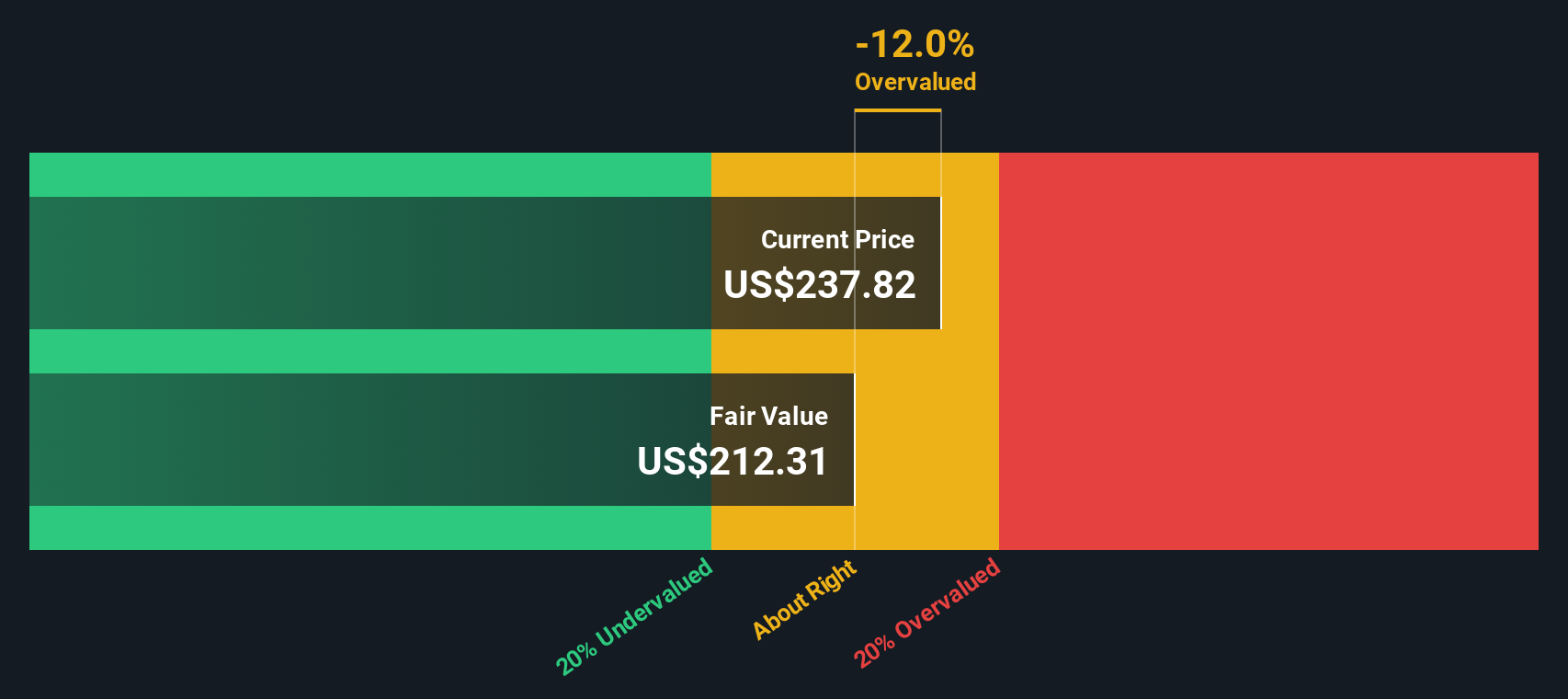

Looking at NXP Semiconductors through the lens of our DCF model presents a more cautious result, suggesting the shares may actually be trading above their estimated fair value. This may prompt some to reconsider the prevailing analyst optimism.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NXP Semiconductors Narrative

If you think the numbers tell a different story, or simply want to dig into the fundamentals yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about making the smartest moves with your money, now's the time to act. There are powerful opportunities beyond NXP Semiconductors that you do not want to overlook.

- Target tomorrow’s breakthrough opportunities by scanning markets for innovation, all while tapping into AI penny stocks to fuel your portfolio with next-generation AI leaders.

- Earn consistent cash flow for your investments by reviewing dividend stocks with yields > 3% with yields above 3% that can strengthen your passive income stream.

- Capture value where the market has yet to catch up using undervalued stocks based on cash flows, allowing you to pinpoint stocks with strong fundamentals trading below their fair price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion