- United States

- /

- Healthcare Services

- /

- NasdaqCM:TALK

US Exchange Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As of November 2024, the United States stock market has been experiencing positive momentum, with the S&P 500 extending its winning streak and Bitcoin reaching new record highs. Amidst this backdrop, investors are increasingly exploring diverse investment opportunities beyond traditional large-cap stocks. Penny stocks, often representing smaller or emerging companies, remain an intriguing area for those seeking affordability coupled with growth potential. Despite their historical connotations as high-risk investments, penny stocks can still present worthwhile opportunities when they possess strong financial fundamentals and a promising outlook.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8368 | $5.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.63M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.7017 | $3.25M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.78 | $2.31B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $7.6M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.30 | $547.49M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.90 | $139.41M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8694 | $76.61M | ★★★★★☆ |

Click here to see the full list of 740 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Talkspace (NasdaqCM:TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company operating in the United States with a market cap of $533.80 million.

Operations: The company generates revenue from its Pharmacy Services segment, which amounts to $181.29 million.

Market Cap: $533.8M

Talkspace, Inc., with a market cap of US$533.80 million, has shown promising revenue growth, reporting US$47.4 million in Q3 2024 compared to US$38.65 million the previous year. Despite being unprofitable with negative return on equity, Talkspace benefits from being debt-free and having sufficient cash runway for over three years due to positive free cash flow. The company's strategic partnerships with entities like Espresa and Wisdo Health enhance its accessibility and service offerings in mental health care across various demographics, including workplace wellness and senior support initiatives. These collaborations align with rising demand for accessible mental health services.

- Click here and access our complete financial health analysis report to understand the dynamics of Talkspace.

- Assess Talkspace's future earnings estimates with our detailed growth reports.

Navitas Semiconductor (NasdaqGM:NVTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits and related technologies for power conversion and charging, with a market cap of approximately $341.84 million.

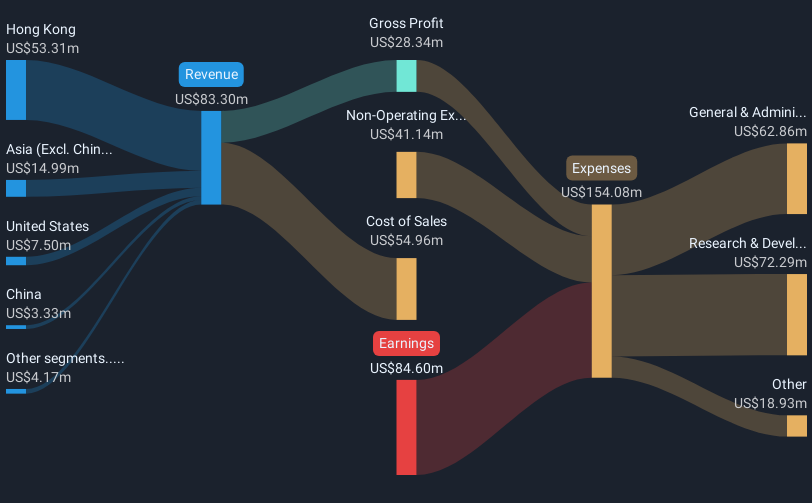

Operations: The company generates revenue of $91.38 million from its semiconductors segment.

Market Cap: $341.84M

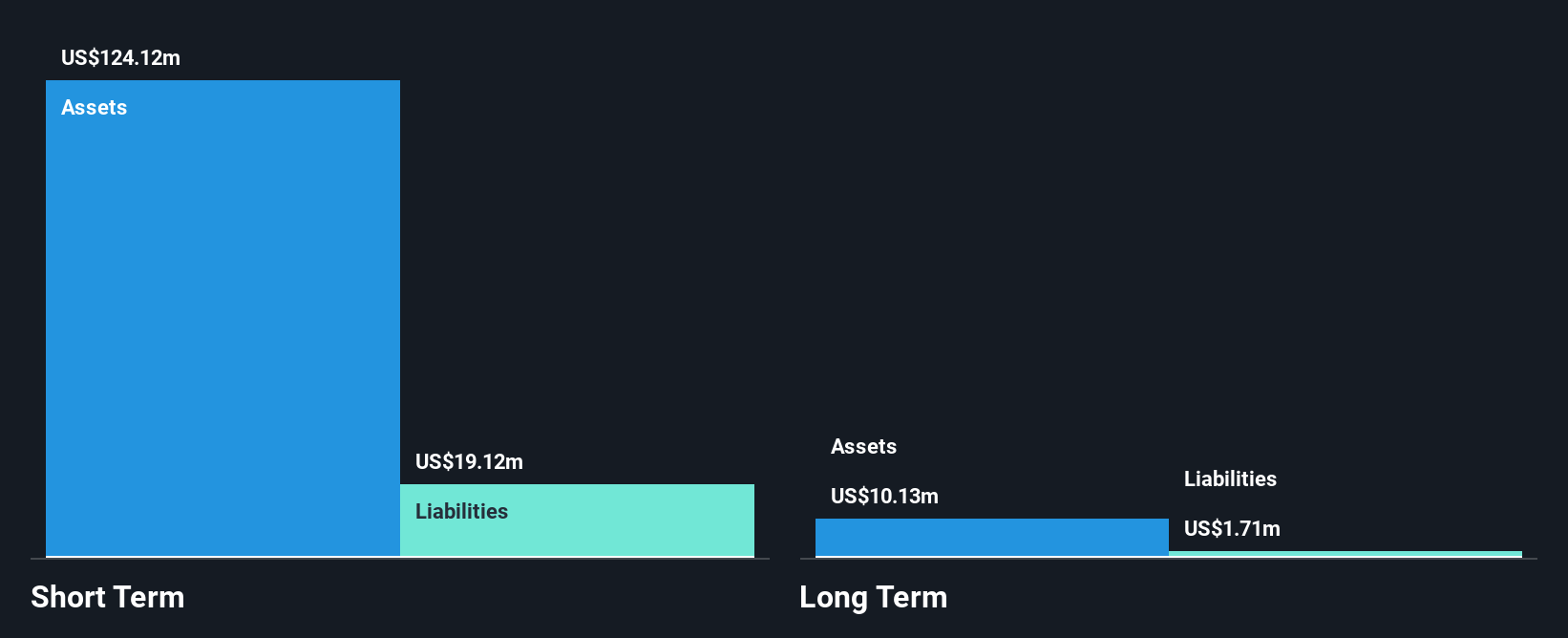

Navitas Semiconductor, with a market cap of US$341.84 million, is navigating the penny stock landscape by leveraging its innovative GaN and SiC technologies. Despite reporting a net loss of US$18.73 million in Q3 2024, the company maintains strong liquidity with short-term assets exceeding liabilities and no debt burden. Recent product announcements highlight advancements in AI data centers and EV markets, potentially driving future revenue growth. However, the company's high volatility and ongoing unprofitability pose risks for investors seeking stability. Navitas's participation in industry conferences underscores its commitment to innovation and market presence expansion.

- Unlock comprehensive insights into our analysis of Navitas Semiconductor stock in this financial health report.

- Gain insights into Navitas Semiconductor's outlook and expected performance with our report on the company's earnings estimates.

Exscientia (NasdaqGS:EXAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Exscientia plc is an AI-driven Pharma-tech company focused on designing and developing differentiated medicines for diseases with high unmet patient needs, with a market cap of $633.50 million.

Operations: The company's revenue is primarily derived from the discovery and development of small molecule drug candidates, amounting to £17.07 million.

Market Cap: $633.5M

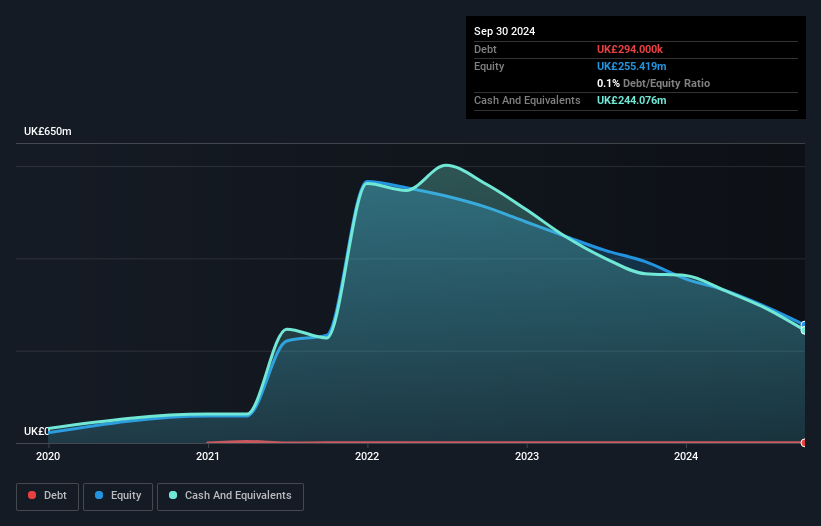

Exscientia, with a market cap of $633.50 million, is currently navigating significant changes following its acquisition by Recursion Pharmaceuticals for approximately $650 million. The company has been unprofitable, with increasing losses over the past five years and a negative return on equity of -58.93%. Despite this, Exscientia's short-term assets significantly exceed both its short-term and long-term liabilities, providing some financial stability. Recent index drops highlight potential challenges in maintaining market visibility. However, the merger could offer strategic synergies and an extended cash runway into 2027 for the combined entity.

- Dive into the specifics of Exscientia here with our thorough balance sheet health report.

- Examine Exscientia's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 740 US Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talkspace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TALK

Talkspace

Operates as a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States.

Flawless balance sheet with reasonable growth potential.