- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Risks Still Elevated At These Prices As Navitas Semiconductor Corporation (NASDAQ:NVTS) Shares Dive 26%

To the annoyance of some shareholders, Navitas Semiconductor Corporation (NASDAQ:NVTS) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

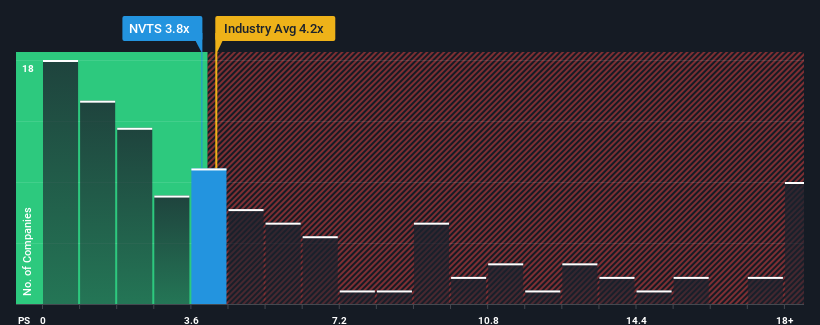

Even after such a large drop in price, it's still not a stretch to say that Navitas Semiconductor's price-to-sales (or "P/S") ratio of 3.8x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in the United States, where the median P/S ratio is around 3.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Navitas Semiconductor

What Does Navitas Semiconductor's Recent Performance Look Like?

Recent times haven't been great for Navitas Semiconductor as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Navitas Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Navitas Semiconductor would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 25% per year growth forecast for the broader industry.

With this information, we find it interesting that Navitas Semiconductor is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Navitas Semiconductor's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Navitas Semiconductor looks to be in line with the rest of the Semiconductor industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Navitas Semiconductor's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 5 warning signs for Navitas Semiconductor (1 makes us a bit uncomfortable!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives