- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Optimistic Investors Push Navitas Semiconductor Corporation (NASDAQ:NVTS) Shares Up 181% But Growth Is Lacking

Navitas Semiconductor Corporation (NASDAQ:NVTS) shares have had a really impressive month, gaining 181% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 40%.

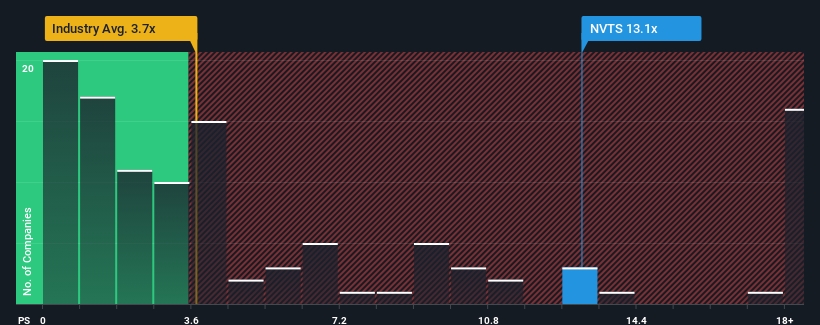

After such a large jump in price, Navitas Semiconductor may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 13.1x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 3.7x and even P/S lower than 1.6x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Navitas Semiconductor

How Navitas Semiconductor Has Been Performing

Navitas Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Navitas Semiconductor will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Navitas Semiconductor's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 195% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.9% as estimated by the eight analysts watching the company. That's not great when the rest of the industry is expected to grow by 35%.

With this in mind, we find it intriguing that Navitas Semiconductor's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Navitas Semiconductor's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Navitas Semiconductor's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Navitas Semiconductor (1 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives