- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Is Nova's (NVMI) Inclusion in the PHLX Semiconductor Index Shaping Its Investment Thesis?

Reviewed by Sasha Jovanovic

- Nova Ltd was added to the PHLX Semiconductor Sector Index in September 2025, highlighting its growing profile within the industry.

- This inclusion often boosts investor awareness and can result in heightened demand from index-tracking funds.

- We’ll explore how Nova’s addition to a major semiconductor index could influence its investment thesis, particularly in terms of increased investor demand.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Nova Investment Narrative Recap

To be a shareholder in Nova, you need to believe that demand for advanced semiconductor metrology tools will keep expanding as chip complexity grows worldwide. Although Nova’s inclusion in the PHLX Semiconductor Sector Index may lift its visibility and bring incremental investment from index-tracking funds, it has a limited direct impact on the company’s core short-term catalyst, which remains new product adoption by major semiconductor manufacturers. The biggest immediate risk still centers on large customer CapEx cycles and how quickly Nova’s new platforms gain market traction.

The recent launch of Nova’s WMC optical metrology platform, designed for advanced packaging, reinforces the company’s bid to capture opportunities tied to ongoing capacity expansions and rising device complexity. This supports the thesis that the primary catalyst continues to be the successful commercialization and adoption of Nova’s differentiated solutions as the industry evolves. On the other hand, investors should be mindful if any large customer were to delay or cut spending, as...

Read the full narrative on Nova (it's free!)

Nova's narrative projects $1.1 billion revenue and $293.1 million earnings by 2028. This requires 9.8% yearly revenue growth and a $58.2 million earnings increase from $234.9 million.

Uncover how Nova's forecasts yield a $306.67 fair value, a 5% downside to its current price.

Exploring Other Perspectives

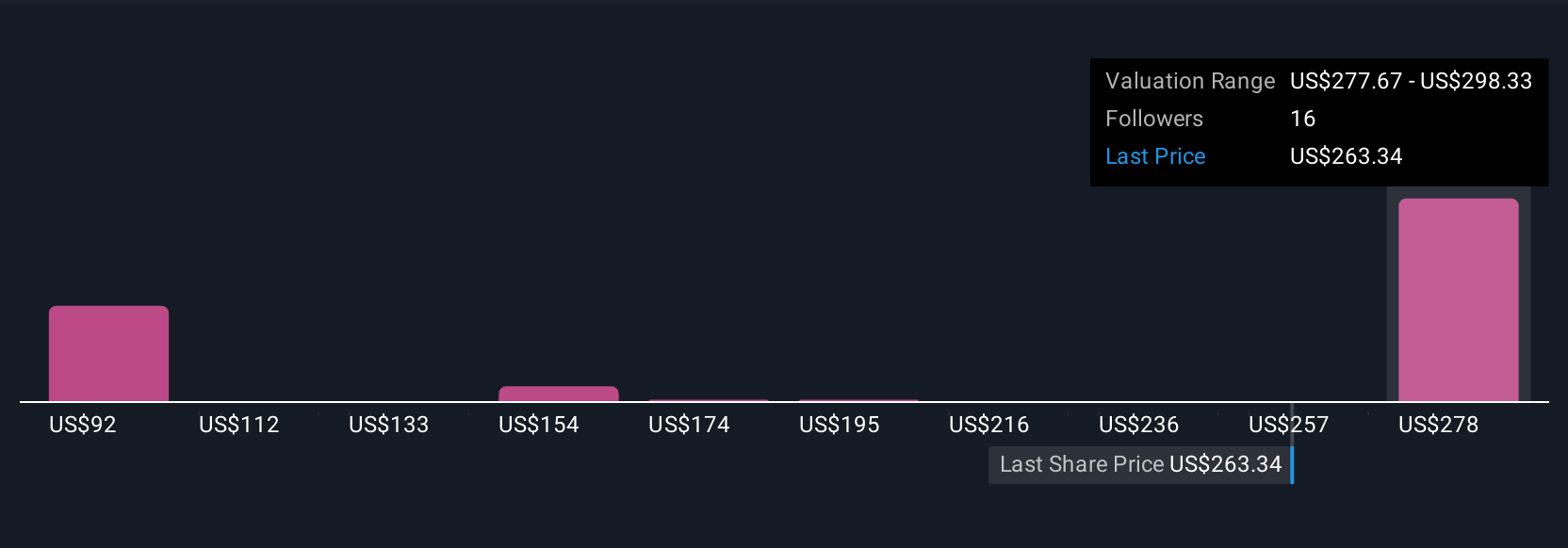

Six private investors in the Simply Wall St Community cited Nova’s fair value estimates, spanning US$91 to US$307 per share. While many see upside on product-driven growth opportunities, others flag concentration risk as major customers’ spending decisions could quickly shift sentiment and results. Explore these differing views for fresh insights.

Explore 6 other fair value estimates on Nova - why the stock might be worth less than half the current price!

Build Your Own Nova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sells of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives