- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA) Valuation in Focus as Meta Eyes Google’s AI Chips for Data Centers

Reviewed by Simply Wall St

Shares of Nvidia (NVDA) experienced a sharp decline after reports revealed that Meta Platforms may adopt Google’s AI chips for future data centers. This change could potentially begin as soon as next year through Google Cloud. Investors reacted quickly, since Meta is one of Nvidia’s largest customers and a shift of this scale introduces direct competition at the very heart of Nvidia’s AI chip business.

See our latest analysis for NVIDIA.

This latest twist comes after an already eventful year for NVIDIA, with the company reporting record Q3 revenue, launching major AI infrastructure partnerships, and beating expectations on both top and bottom lines. Despite the sharp 2.6% share price dip today, momentum has cooled compared to the remarkable 28.6% gain year to date. Total shareholder return still stands at a standout 29.9% for the past year. Long-term holders continue to see exceptional returns, but recent volatility highlights how quickly sentiment can shift as new risks and opportunities emerge in the fast-moving AI market.

Curious to see what other tech leaders might be next in line for major momentum shifts? Explore the latest opportunities in the sector with our See the full list for free.

With competitive threats increasing and recent volatility reducing some optimism, investors are left asking a crucial question: is Nvidia trading at a compelling valuation after the pullback, or is the market fully accounting for future growth already?

Most Popular Narrative: 24.3% Undervalued

According to restinglion, the estimated fair value for NVIDIA shares sits notably above the latest closing price. The narrative draws attention to the foundational drivers that could help the company maintain its leadership in AI as competitive tensions rise.

High revenue and gross margins (insane profits): NVIDIA has profited 72 billion, some publicly traded companies will never reach 72 billion in revenue. And this number is only expected to grow as AI will continue to grow, innovating under the fingertips of NVIDIA.

Want to uncover what fuels such a confident valuation? The secret lies in bold assumptions around financial momentum and product dominance. Are you ready to see the numbers that this narrative believes could redefine tech investing? Click through for the full story and surprising projections now.

Result: Fair Value of $235.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower revenue growth and intensifying chip competition could quickly challenge these optimistic projections if upcoming quarters disappoint investors' expectations.

Find out about the key risks to this NVIDIA narrative.

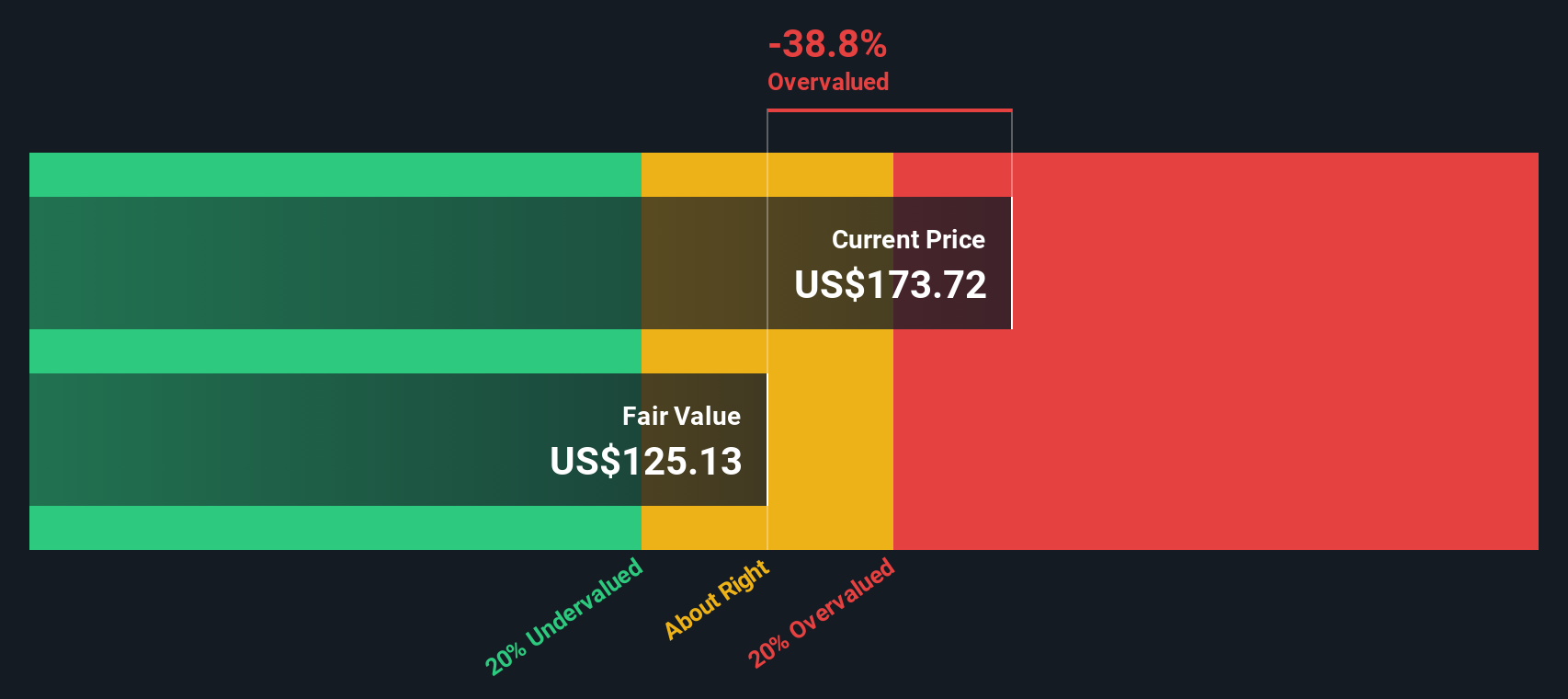

Another View: Discounted Cash Flow Model Suggests Overvaluation

Looking at our SWS DCF model, the estimated fair value stands at $163.79. This is below Nvidia’s recent share price of $177.82, suggesting the market may now be pricing in more growth than the underlying business can justify. Does this mean enthusiasm has run ahead of fundamentals, or is the DCF model missing future surprises?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVIDIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVIDIA Narrative

If you see things differently or want to dig into the data firsthand, crafting a personal narrative takes less than three minutes. Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Don’t let this moment slip by. There are even more standout opportunities on the horizon for sharp investors willing to look beyond the headlines. Make your next smart move by checking out these handpicked ideas:

- Grow your wealth steadily by tapping into attractive yields found among these 14 dividend stocks with yields > 3% with consistently strong payouts and robust financial health.

- Ride the wave of technological innovation by spotting next-gen companies with the most promise using these 26 AI penny stocks in rapidly expanding artificial intelligence markets.

- Capitalize on hidden gems the market has overlooked and load up on value with these 925 undervalued stocks based on cash flows, perfect for those seeking untapped potential at compelling prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026