- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Has the Recent 12% Pullback Opened a Valuation Opportunity?

Reviewed by Simply Wall St

Nvidia (NVDA) has cooled off after a strong multi year run, with the stock down about 12% over the past month even as its three year total return still tops 1,000%.

See our latest analysis for NVIDIA.

That pullback has cooled some of the near term excitement, with a 30 day share price return of minus 12.36 percent. However, it comes on top of a powerful multi year total shareholder return story that still signals strong, if more volatile, momentum around its 181.31 dollar share price.

If Nvidia’s swingier phase has you thinking about where else growth and innovation might show up next, it could be worth exploring high growth tech and AI stocks as a broader hunting ground.

With Nvidia still growing revenue and profits at mid twenties percentages and trading nearly 38 percent below the average analyst target, investors face a pivotal question: is this a rare mispricing, or has the market already baked in its next leg of growth?

Most Popular Narrative Narrative: 22.8% Undervalued

Compared with NVIDIA's recent 181.31 dollar close, the narrative's 235 dollar fair value points to a sizable upside that hinges on durability of its AI dominance.

While its monumental past illustrates a historic run that may never be recreated, the company stands in a position to continue historic growth; although this growth may not meet standards set in the past 5 years, the company will still maintain a chokehold on the high tech ai market for these 3 reasons: • High switching costs: companies like google, apple, microsoft, meta can't afford to compete with lower tech chips and software... NVIDIA sizably leads the market.

Want to see why this narrative still backs aggressive upside even after trimming growth expectations, and how rich margins and future earnings multiples power that 235 dollar target? Dive into the full breakdown.

Result: Fair Value of $235 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competition in AI accelerators and any slowdown in data center spending could pressure Nvidia’s margins and challenge this underappreciated upside thesis.

Find out about the key risks to this NVIDIA narrative.

Another View: Market Ratio Sends A Different Signal

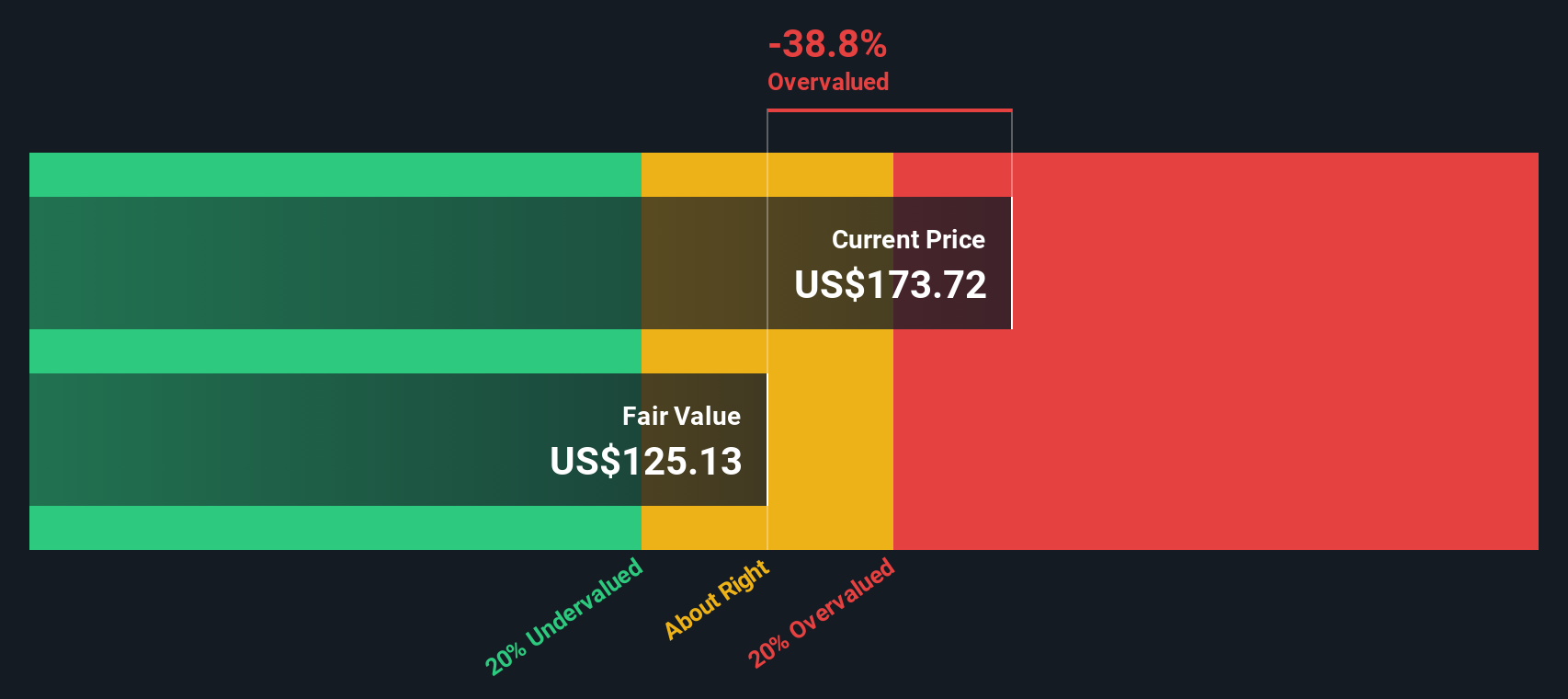

While the narrative pegs NVIDIA as 22.8 percent undervalued, the SWS DCF model paints a tougher picture, with fair value at 164.59 dollars versus today’s 181.31 dollars, suggesting the stock might be around 10 percent overvalued. Which story will the market ultimately follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVIDIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVIDIA Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock when the market is full of opportunities. Use Simply Wall Street’s screener to pinpoint ideas most investors overlook.

- Lock in reliable cash flow potential by targeting income opportunities through these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s foundation.

- Ride the next wave of innovation by zeroing in on cutting edge opportunities with these 24 AI penny stocks shaping tomorrow’s digital infrastructure.

- Sharpen your value edge by hunting for mispriced opportunities using these 932 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026