- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Exploring Current Valuation and Growth Assumptions in the Absence of Major News

Reviewed by Simply Wall St

Nvidia (NVDA) has been on the minds of many investors lately, even without a major triggering event driving headlines. Whenever a stock as widely followed as Nvidia sees active trading or nudges in price, it naturally prompts the classic questions: are we witnessing an early signal of something bigger under the surface, or is this simply part of the regular ebb and flow of a market leader?

Looking at the bigger picture, Nvidia remains firmly in the spotlight. The company’s stock climbed nearly 49% over the past year, dramatically outpacing the broader market. Short-term momentum has cooled a bit, especially over the past month, though the past three months have seen a healthy 23% gain. Viewed over the long haul, Nvidia’s returns remain among the most impressive in the sector, up 1,249% over the past three years. These moves, along with steady annual revenue and net income growth, continue to put Nvidia’s valuation front and center for both long-term holders and potential new buyers.

This sets up an intriguing question for investors: at today’s levels, is Nvidia becoming an overlooked value play, or is the market already baking in years of future growth?

Most Popular Narrative: 4.4% Overvalued

According to the most widely followed narrative, Nvidia’s current valuation is seen as slightly overvalued, with the share price just above what the narrative considers to be fair value.

$400b annual revenue assumes Nvidia continues to be dominant in GPU design and AI software stack. Successful competition from AMD, Intel, or a Chinese firm could undermine this.

Uptake of an open-source, cheaper, or better platform than Nvidia's CUDA would heavily undermine Nvidia's moat and enable any sizeable firm to directly engage semiconductor manufacturers, such as TSMC, to produce their own chips. This could take market share from Nvidia's high margin products, similar to what Apple did with its M-Series chips.

Is Nvidia truly on the verge of an unprecedented growth surge, or are bold assumptions about future market dominance hiding in plain sight? One of the most critical beliefs underlying this valuation is a massive leap in future sales, closely tied to Nvidia maintaining a substantial edge in AI hardware and software. What does this narrative expect in terms of revenue expansion, profit margins, and the tech behind it all? The specifics might surprise you.

Result: Fair Value of $170.26 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, fierce competition from other chipmakers or the rise of disruptive AI platforms could quickly alter expectations and challenge Nvidia’s current trajectory.

Find out about the key risks to this NVIDIA narrative.Another View: The SWS DCF Model

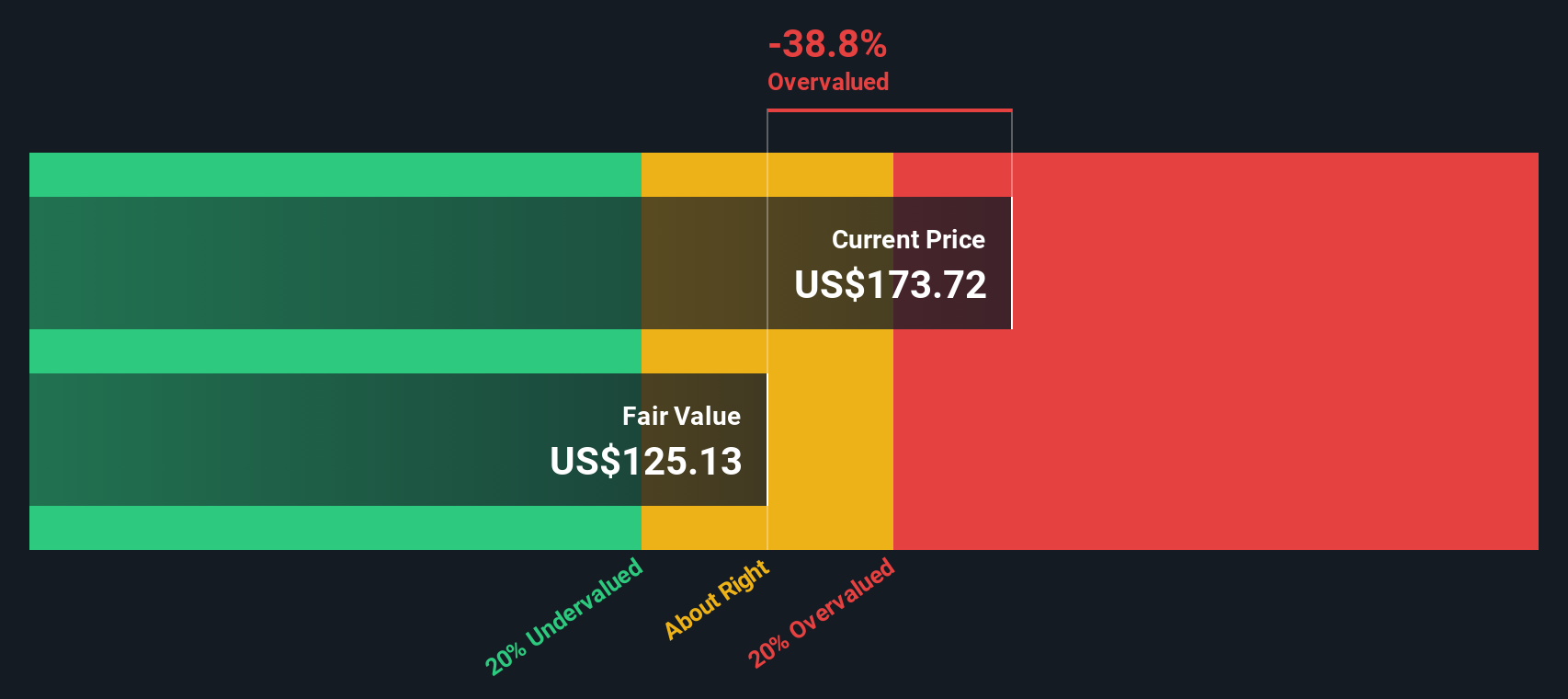

Taking a different approach, our DCF model evaluates Nvidia based on its forecasted cash flows. This method also points to overvaluation, which raises an interesting debate about how future optimism is priced in today. Could both methods be missing hidden risks or upside potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NVIDIA Narrative

If you think there’s more to the story or want to test your own assumptions, you can easily build a personal narrative in just a few minutes. Do it your way.

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that sticking with just one stock means missing out. Broaden your horizons and target emerging trends now, before everyone else catches on.

- Spot fast-rising, under-the-radar opportunities by tracking penny stocks with strong financials on strong fundamentals and agile growth stories.

- Tap into the AI revolution and reshape your portfolio by finding companies powering a new wave of intelligent technology through AI penny stocks.

- Secure better value for every dollar you invest by weighing overlooked gems identified by our undervalued stocks based on cash flows method based on real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026