- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Expands AI Horizons With Saudi Arabia Partnerships And Governance Changes

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) recently announced a significant partnership with Saudi Arabia to advance AI capabilities, which coincides with the company's strategic focus on developing global collaborations. This move aligns with the broader market trend where tech stocks, including NVIDIA, Tesla, and AMD, experienced notable gains, reflecting the tech sector's ongoing rally. While NVIDIA's price move of 17% over the last month is substantial, it's consistent with the general tech stock momentum driven by new partnerships and broader market positivity. These strategic initiatives enhance investor confidence, aligning with the sector's positive trajectory as evidenced by the recent market rally.

We've spotted 2 warning signs for NVIDIA you should be aware of, and 1 of them shouldn't be ignored.

The recent partnership announcement between NVIDIA and Saudi Arabia to enhance AI capabilities could strengthen NVIDIA's positioning in AI and data center sectors, potentially driving long-term revenue and earnings growth. While the immediate share price increase of 17% aligns with the positive market sentiment, the company's long-term total shareholder return over the past five years was very large, reaching 1380.99%. This performance underscores investor confidence in NVIDIA's strategic advancements and expansion efforts in the tech industry.

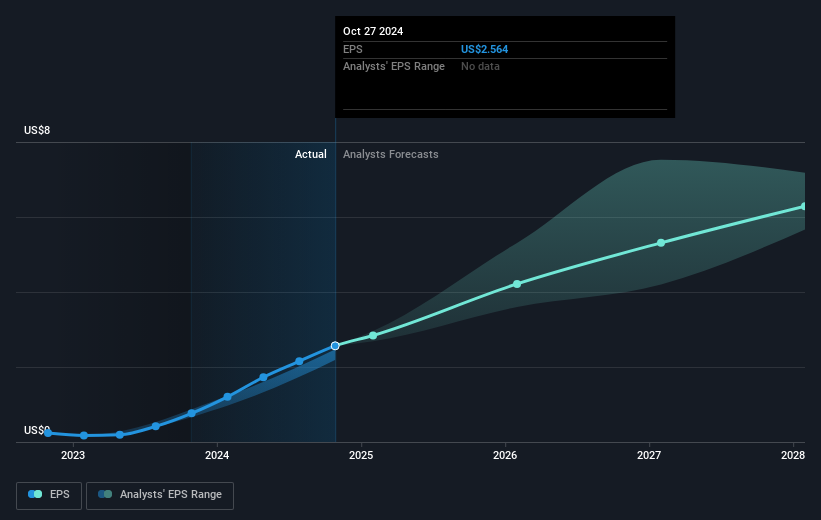

In the past year, NVIDIA's performance outpaced the US Semiconductor industry, which returned 21.6%. The positive momentum, fueled by partnerships like those with Toyota and Uber, is expected to bolster NVIDIA's AI presence, impacting both revenue and earnings positively in the future. Analysts estimate revenues could grow by 30.3% annually, with potential earnings reaching US$158.2 billion in three years. The current share price movement towards the consensus price target of US$163.12—a 30.4% potential increase from its current level—reflects overarching market confidence in NVIDIA's strategic direction and growth capability.

Assess NVIDIA's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives