- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

How NVIDIA’s US$2 Billion Synopsys Bet and Deeper AI Integration Will Impact NVIDIA (NVDA) Investors

Reviewed by Sasha Jovanovic

- Earlier this month, NVIDIA and Synopsys expanded their collaboration, with NVIDIA committing a US$2.00 billion equity investment to embed its AI and accelerated computing deeper into Synopsys’ engineering, simulation, and verification software across multiple industries.

- This move not only tightens NVIDIA’s ties to a crucial part of the chip design toolchain but also extends its full-stack AI ecosystem into the workflows that many of its largest customers already rely on.

- We’ll now explore how NVIDIA’s US$2.00 billion Synopsys investment and closer software integration could reshape the company’s AI infrastructure investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NVIDIA Investment Narrative Recap

To own NVIDIA today, you generally need to believe its AI platform can remain the default choice for hyperscalers and enterprises, despite rising custom silicon efforts and export restrictions. The Synopsys partnership and US$2.00 billion equity stake strengthen NVIDIA’s position inside the chip design ecosystem, but do not materially change the near term demand and supply balance in AI accelerators or the key risks around customer vertical integration and geopolitical constraints.

Among the recent announcements, Palantir’s Chain Reaction OS is especially relevant. By positioning NVIDIA as a founding partner in software that tackles AI’s power and grid bottlenecks, it directly addresses the risk that energy and infrastructure constraints could cap long term AI factory buildouts, and reinforces NVIDIA’s narrative that its value is not only in chips but in the broader AI infrastructure stack.

Yet while enthusiasm around AI infrastructure keeps building, investors should also be aware that growing energy and power grid constraints could...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's narrative projects $337.2 billion revenue and $187.9 billion earnings by 2028.

Uncover how NVIDIA's forecasts yield a $250.39 fair value, a 36% upside to its current price.

Exploring Other Perspectives

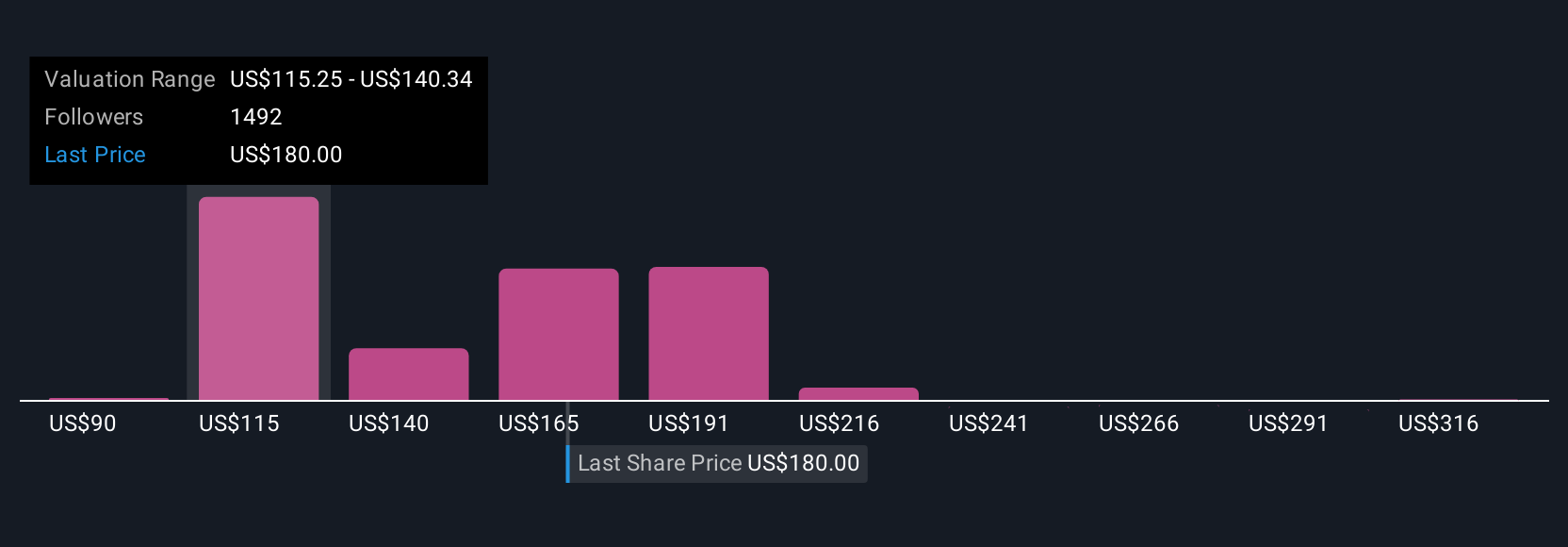

Simply Wall St Community members have posted 411 fair value estimates for NVIDIA, ranging from US$104 to US$341.12 per share, highlighting very different expectations. Against that backdrop, the risk that rising custom ASIC efforts at hyperscalers could erode NVIDIA’s data center dominance is a key consideration for how the company’s long term performance might evolve.

Explore 411 other fair value estimates on NVIDIA - why the stock might be worth as much as 86% more than the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026