- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Does U.S. Approval of UAE AI Chip Exports Reshape the Growth Story for NVIDIA (NVDA)?

Reviewed by Sasha Jovanovic

- In recent days, the U.S. government approved Nvidia to export billions of dollars' worth of AI chips to the United Arab Emirates, opening a significant new revenue channel for the company and further advancing its presence in Middle Eastern AI infrastructure.

- This development occurs as Nvidia deepens major partnerships and investments, including collaborations with Intel, OpenAI, RealSense, and Hitachi, expanding its reach across global AI, robotics, and data center markets amid heightened industry demand.

- We'll now examine how this key UAE export approval strengthens Nvidia's investment narrative and broadens its international growth prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

NVIDIA Investment Narrative Recap

NVIDIA's investment narrative centers on the sustained, global expansion of AI infrastructure and accelerated computing, underpinned by industry-wide demand for its GPUs and full-stack solutions. The recent U.S. government approval of multibillion-dollar AI chip exports to the United Arab Emirates represents a significant milestone, opening new near-term revenue streams and expanding international growth opportunities. While this may not fully offset ongoing risks from potential U.S.-China tensions, it serves as a meaningful short-term catalyst by capturing sovereign-scale demand. One recent announcement with particular relevance is NVIDIA's direct investment of up to $2 billion in Elon Musk's xAI, helping fund major GPU purchases and seeding a large-scale data center deployment. This reinforces NVIDIA's broadening role as both technology supplier and capital partner for new AI ventures, deepening its presence in critical infrastructure buildouts. Announcements like this link directly to short-term revenue catalysts, but also highlight concentration risk and the evolving customer partnership model. However, investors should be aware that despite new export approvals, the risk of further supply chain or regulatory headwinds remains front of mind...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's narrative projects $337.2 billion revenue and $187.9 billion earnings by 2028. This requires 26.8% yearly revenue growth and a $101.3 billion increase in earnings from $86.6 billion today.

Uncover how NVIDIA's forecasts yield a $213.99 fair value, a 11% upside to its current price.

Exploring Other Perspectives

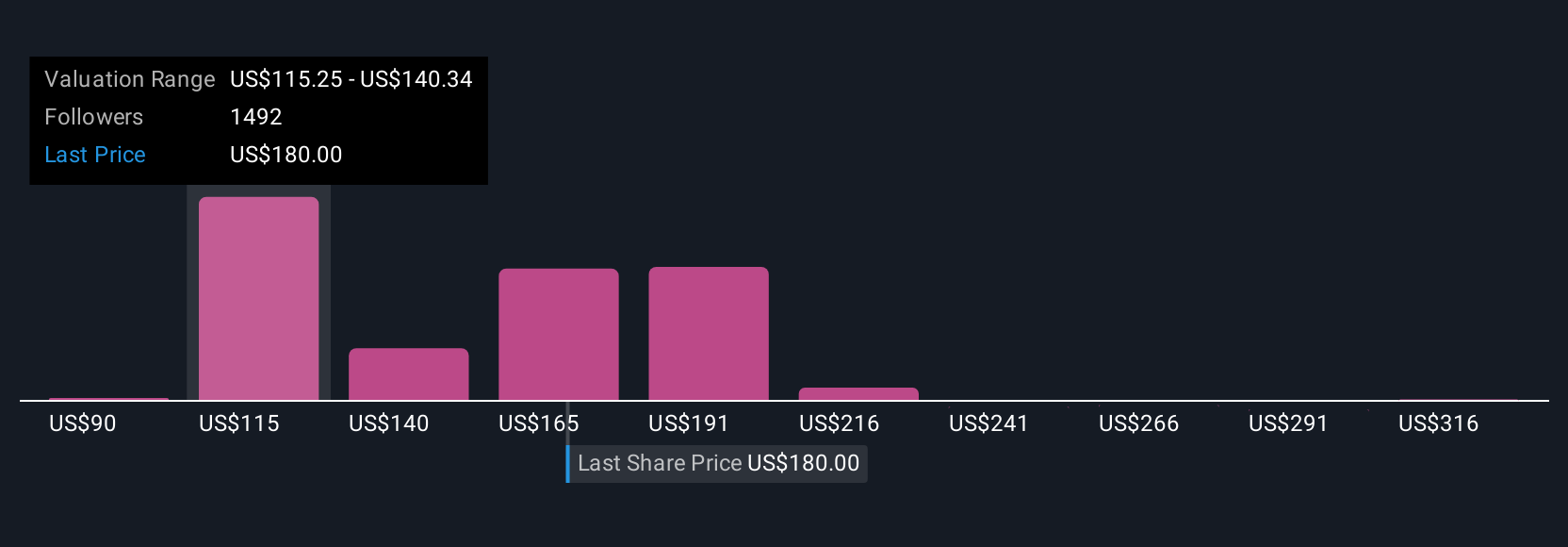

Fair value estimates from 445 Simply Wall St Community members range widely, from US$90.15 up to US$341.12 per share. With so many views, consider how ongoing U.S.-China tensions could affect NVIDIA’s addressable market in the years ahead.

Explore 445 other fair value estimates on NVIDIA - why the stock might be worth as much as 77% more than the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026