- United States

- /

- Software

- /

- NYSE:ORCL

Undervalued US Stocks To Watch In October 2024

Reviewed by Simply Wall St

As October 2024 begins, U.S. stock markets are experiencing volatility with major indices retreating from recent record highs due to a decline in technology stocks and rising oil prices amid Middle East tensions. Despite these fluctuations, investors have opportunities to find undervalued stocks that may offer potential for growth. Identifying undervalued stocks involves looking for companies with strong fundamentals that are trading below their intrinsic value, especially in a market influenced by economic uncertainties and sector-specific dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First Solar (NasdaqGS:FSLR) | $240.66 | $472.42 | 49.1% |

| Associated Banc-Corp (NYSE:ASB) | $20.65 | $41.24 | 49.9% |

| California Resources (NYSE:CRC) | $52.78 | $104.52 | 49.5% |

| ChromaDex (NasdaqCM:CDXC) | $3.56 | $7.10 | 49.9% |

| MaxLinear (NasdaqGS:MXL) | $12.73 | $25.35 | 49.8% |

| AeroVironment (NasdaqGS:AVAV) | $211.09 | $417.27 | 49.4% |

| Cytek Biosciences (NasdaqGS:CTKB) | $5.39 | $10.61 | 49.2% |

| Shoals Technologies Group (NasdaqGM:SHLS) | $5.44 | $10.79 | 49.6% |

| Vasta Platform (NasdaqGS:VSTA) | $2.60 | $5.12 | 49.2% |

| SunOpta (NasdaqGS:STKL) | $6.44 | $12.65 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

Micron Technology (NasdaqGS:MU)

Overview: Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide with a market cap of $114.99 billion.

Operations: Micron's revenue segments include DRAM, which generated $16.49 billion, and NAND, which brought in $7.42 billion.

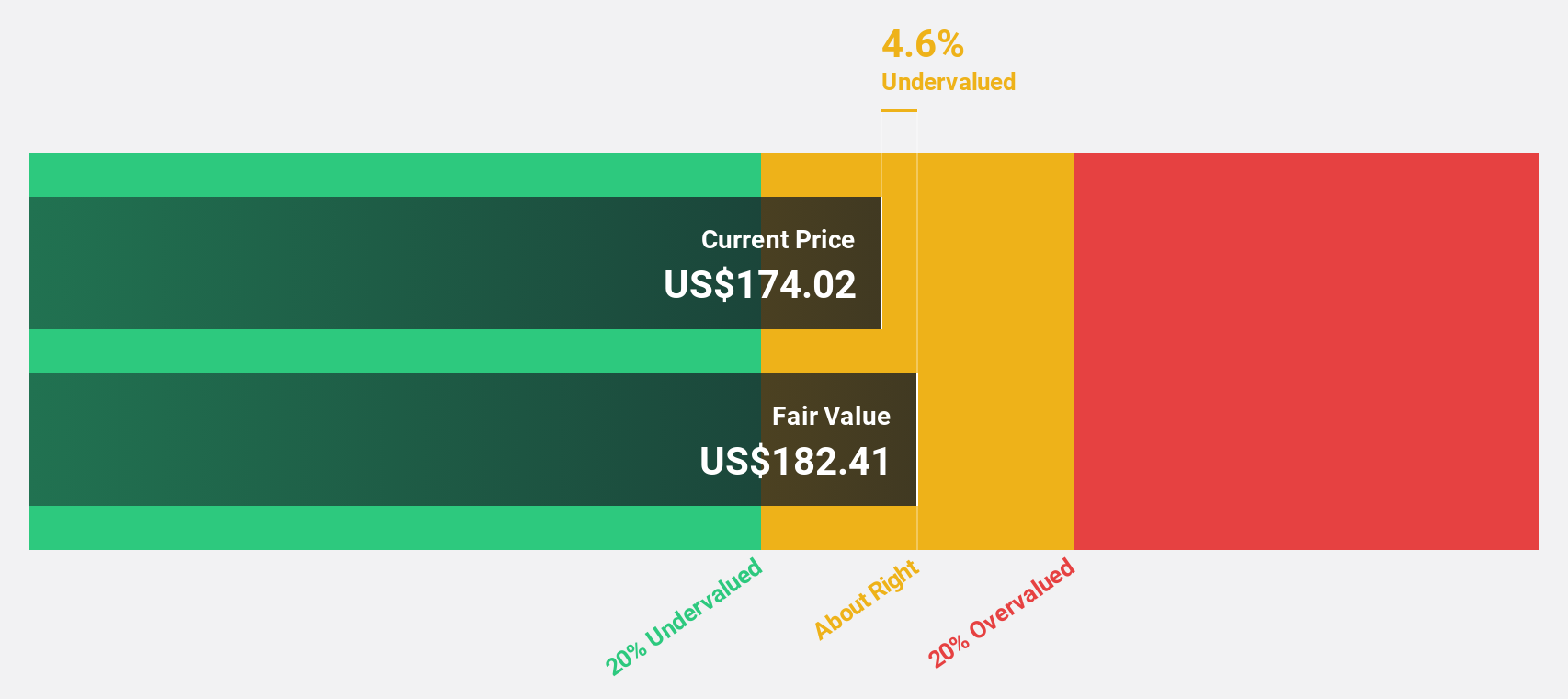

Estimated Discount To Fair Value: 10.3%

Micron Technology reported strong earnings for Q4 2024, with sales of US$7.75 billion and net income of US$887 million, reversing a loss from the previous year. The company expects Q1 2025 revenue of US$8.70 billion ± $200 million and diluted EPS of $1.54 ± $0.08. Trading at around 10% below its estimated fair value, Micron appears undervalued based on discounted cash flow analysis, bolstered by significant profit growth expectations and robust revenue forecasts.

- Our expertly prepared growth report on Micron Technology implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Micron Technology's balance sheet health report.

Leidos Holdings (NYSE:LDOS)

Overview: Leidos Holdings, Inc. provides services and solutions in the defense, intelligence, civil, and health markets both in the United States and internationally, with a market cap of $21.96 billion.

Operations: The company's revenue segments are defense, intelligence, civil, and health markets in the United States and internationally, with total segment adjustments amounting to $16.01 billion.

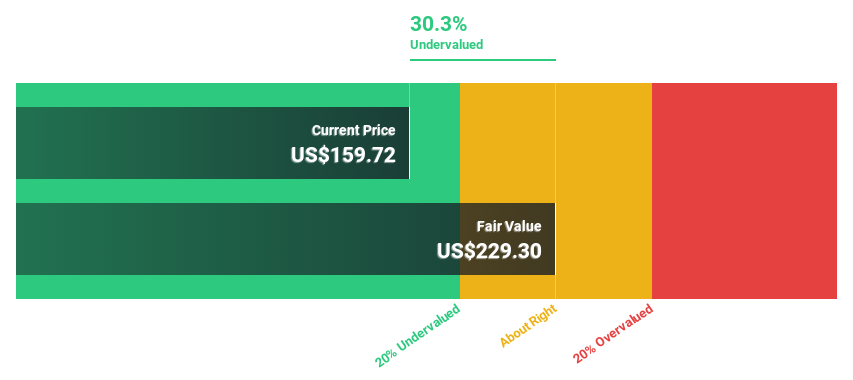

Estimated Discount To Fair Value: 28.1%

Leidos Holdings appears undervalued based on discounted cash flow analysis, trading at US$165.01, significantly below the estimated fair value of US$229.51. Despite high debt levels and lower profit margins than last year, earnings are forecast to grow at 29.5% annually, outpacing the broader U.S. market's growth rate of 15.2%. Recent contract awards and strategic board appointments bolster its financial position and future growth prospects in healthcare safety networks and defense sectors.

- Insights from our recent growth report point to a promising forecast for Leidos Holdings' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Leidos Holdings.

Oracle (NYSE:ORCL)

Overview: Oracle Corporation provides a range of products and services for enterprise information technology environments globally, with a market cap of $472.19 billion.

Operations: Oracle's revenue segments include Hardware ($3.01 billion), Services ($5.31 billion), and Cloud and License ($45.50 billion).

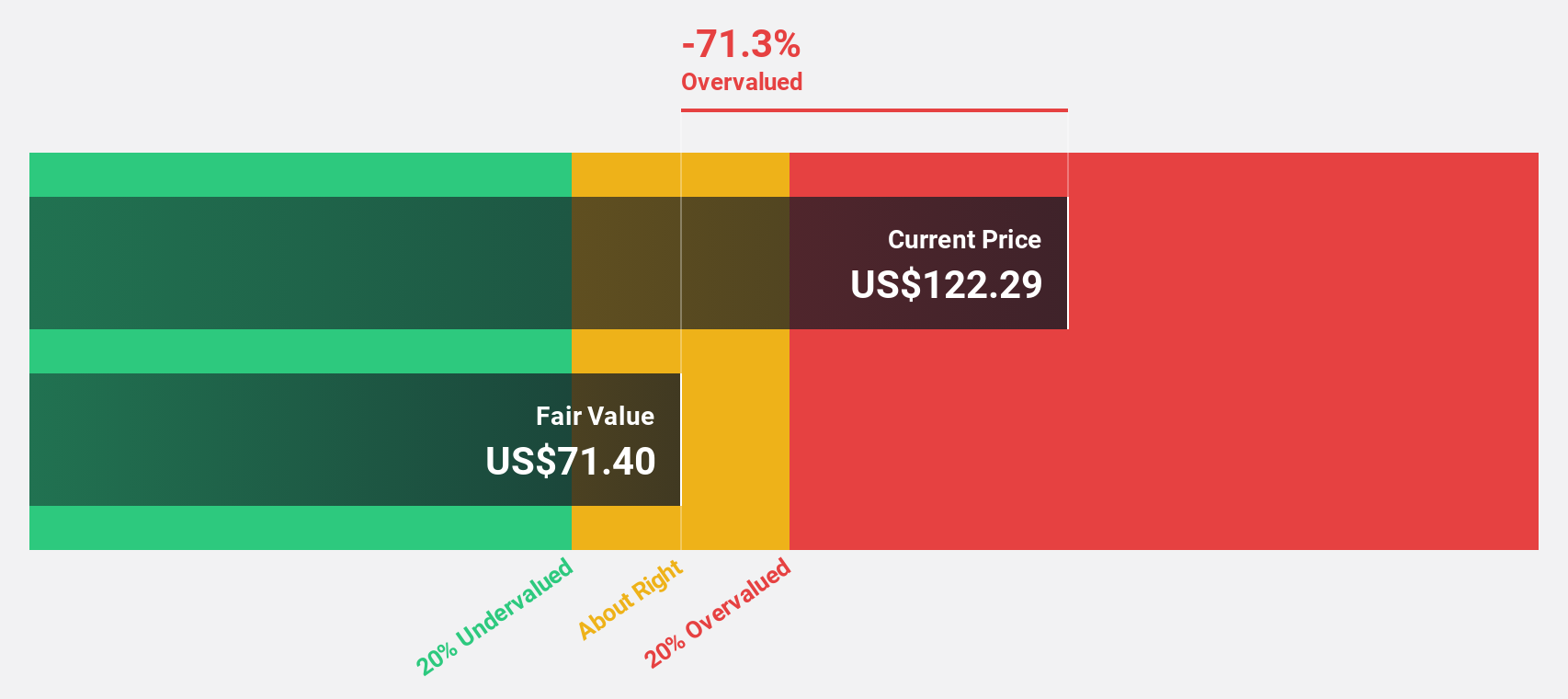

Estimated Discount To Fair Value: 38.3%

Oracle is trading at US$167.16, significantly below its estimated fair value of US$270.82 based on discounted cash flow analysis. Recent investments, including a planned US$6.5 billion public cloud region in Malaysia, bolster its AI and cloud services capabilities, potentially enhancing future cash flows. Despite high debt levels, Oracle's earnings are forecast to grow at 16.2% annually, outpacing the U.S. market's growth rate of 15.2%, with revenue expected to increase by 10.8% per year.

- The growth report we've compiled suggests that Oracle's future prospects could be on the up.

- Take a closer look at Oracle's balance sheet health here in our report.

Make It Happen

- Dive into all 195 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Good value with reasonable growth potential and pays a dividend.